Wake North Carolina Disclaimer of All Rights Under Operating Agreement by Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Party To Agreement?

A documentation procedure consistently accompanies any legal action you undertake.

Initiating a business, submitting or accepting a job offer, transferring ownership, and numerous other life events necessitate you prepare official paperwork that varies from state to state.

This is why having everything gathered in one location is incredibly beneficial.

US Legal Forms is the largest online collection of current federal and state-specific legal templates.

Utilize it as required: print it or fill it out digitally, sign it, and send wherever necessary. This is the simplest and most dependable method to obtain legal documentation. All templates in our library are professionally created and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters effectively with US Legal Forms!

- Here, you can conveniently search for and download a document for any personal or business purpose used in your area, including the Wake Disclaimer of All Rights Under Operating Agreement by Party to Agreement.

- Finding templates on the platform is exceptionally straightforward.

- If you already have a membership to our library, Log In to your account, locate the sample using the search box, and click Download to save it to your device.

- After that, the Wake Disclaimer of All Rights Under Operating Agreement by Party to Agreement will be available for further use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this simple guide to acquire the Wake Disclaimer of All Rights Under Operating Agreement by Party to Agreement.

- Make sure you have accessed the correct page with your localized form.

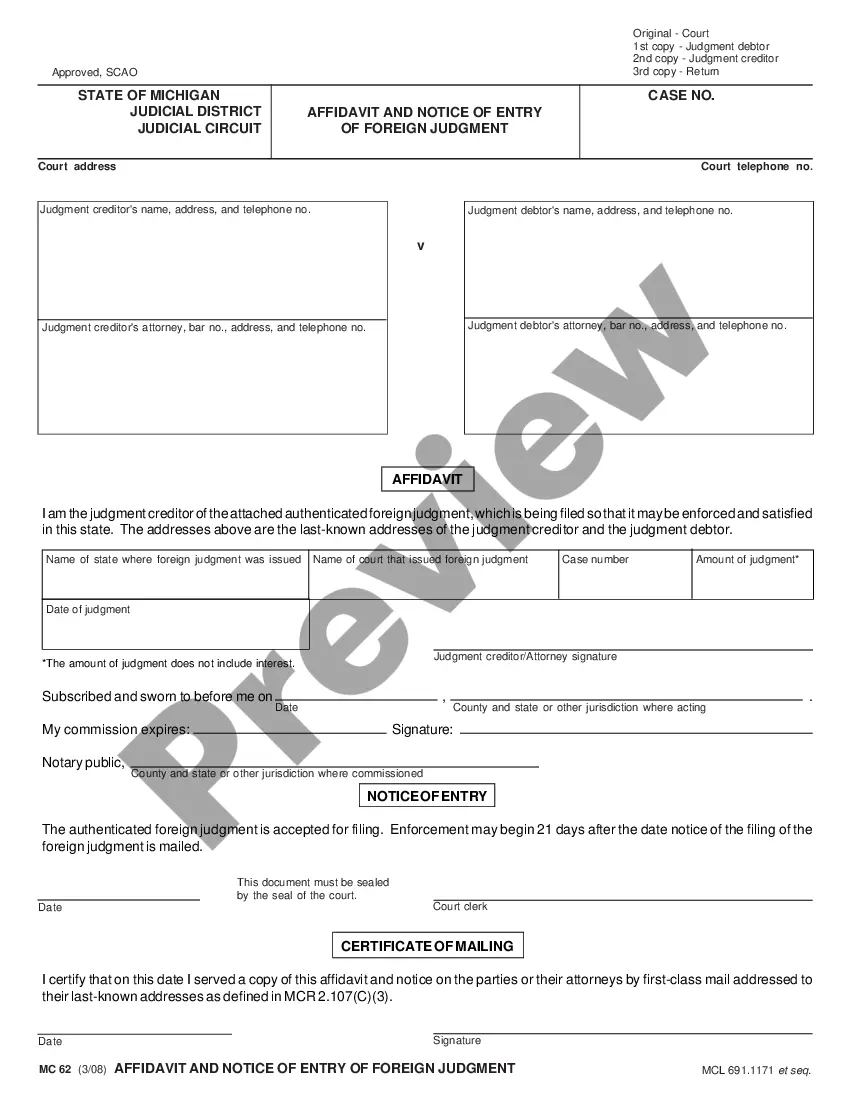

- Utilize the Preview mode (if available) and review the template.

- Read the description (if any) to confirm the template meets your needs.

- Look for an alternative document using the search option if the sample does not suit you.

- Click Buy Now when you find the necessary template.

- Choose the appropriate subscription plan, then Log In or create an account.

- Select the preferred payment method (via credit card or PayPal) to continue.

- Choose file format and download the Wake Disclaimer of All Rights Under Operating Agreement by Party to Agreement to your device.

Form popularity

FAQ

The LLC operating agreement, also known as an LLC agreement, establishes the rules and structure for the LLC and can help address any issues that arise during business operations. Most states have default provisions that address many of these difficulties, but the operating agreement can override these presumptions.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

What should an LLC operating agreement include? Basic company information. Member and manager information. Additional provisions. Protect your LLC status. Customize the division of business profits. Prevent conflicts among owners. Customize your governing rules. Clarify the business's future.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

An LLC Operating Agreement is a legal document that outlines the ownership and member duties of your Limited Liability Company. This agreement allows you to set out the financial and working relations among business owners ("members") and between members and managers.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

Who signs an operating agreement? Every member of the LLC and the manager or managers (if there are any) need to sign the operating agreement. Each signatory should sign a separate signature page. Be sure to sign the document in the proper way to best protect your corporate veil.

An Operating Agreement is a contract document which is considered as a key document used by a limited liability company (LLC) as it provides an outline of the financial and functional decisions of the business which includes its regulations, provisions and rules.

Most LLC operating agreements are short and sweet, and they typically address the following five points: Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.

United States: LLC Operating Agreements Can Be Binding Even If Not Signed By The Parties.