Fulton Georgia Checklist of Information to Obtain For Producing Properties Evaluation

Description

How to fill out Fulton Georgia Checklist Of Information To Obtain For Producing Properties Evaluation?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Fulton Checklist of Information to Obtain For Producing Properties Evaluation, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Fulton Checklist of Information to Obtain For Producing Properties Evaluation from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fulton Checklist of Information to Obtain For Producing Properties Evaluation:

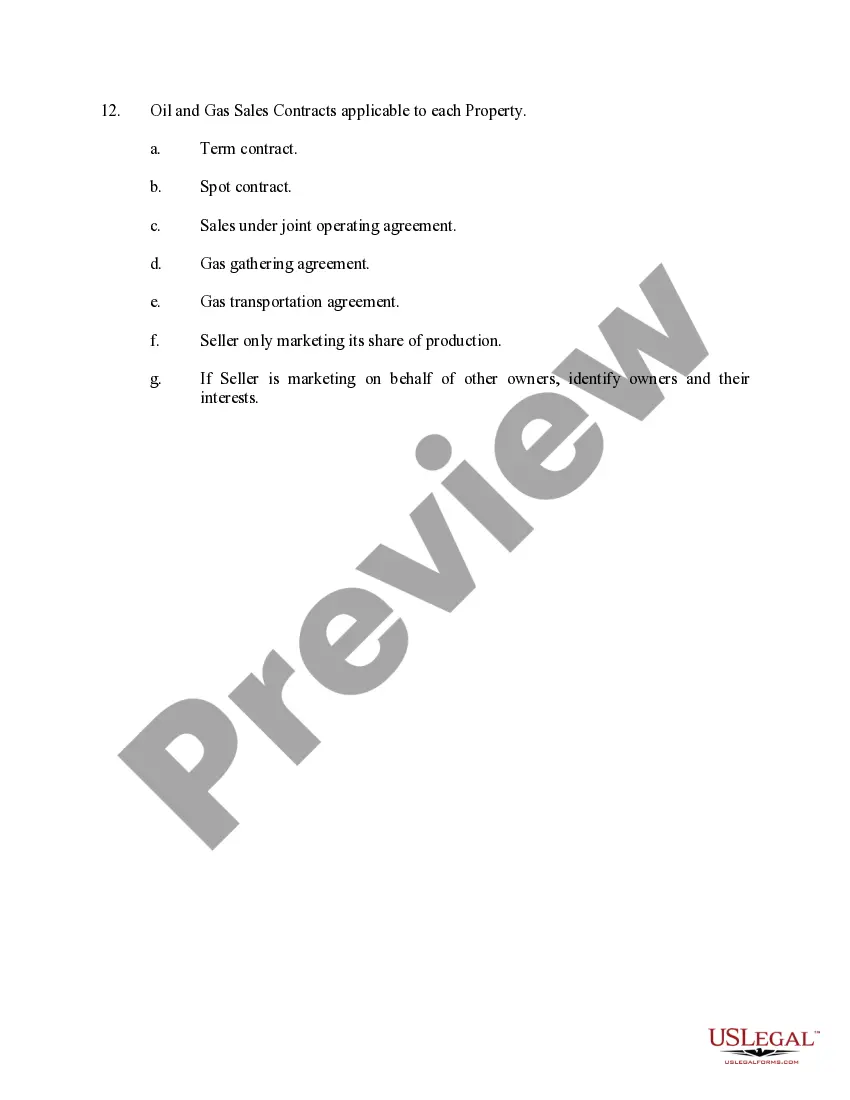

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

It is known today for its economic vitality and upscale living in the incorporated cities of Alpharetta, Mountain Park, Roswell, and Sandy Springs. In July 2006 two new cities, Johns Creek and Milton, were incorporated in north Fulton County.

According to the IRS, your letter should include the following: Taxpayer's name, address, and contact information. A statement expressing your desire to appeal IRS's findings to the Office of Appeals. The tax period in question. A list of the items you do not agree with and the corresponding reasons.

You can file your appeal online at in person at any of the five Fulton County Tax Assessor locations listed below, or by mail.

To protect your appeal rights, you must file your property tax appeal with the County Board of Tax Assessors within 45 days of the date the Assessment Notice was mailed. Do not send your appeal form to the Department of Revenue.

Court services Administrative Services. Estates and Wills. Evictions. Court and Justice Agencies. Garnishments. Jury Duty. Law Library. Open Records.

The Georgia Department of Economic Development markets Georgia to the world by encouraging business investment and trade, attracting tourists to Georgia, and promoting the state as a go-to location for film, music, digital entertainment, and the arts.

The Fulton County effective property tax rate is 1.16%. A 2020 Tax Foundation analysis found the average Fulton County resident pays $2,901 in property taxes every year, the highest among all Georgia counties.

You must be 65 years old or older. You must be living in the home to which the exemption applies on January 1 of the year for which the exemption applies. Your net income, or the combined net income of you and your spouse must not be greater than $10,000 for the preceding year.

It's the mission of the Development Authority of Fulton County (DAFC) to stimulate quality economic development, expand and diversify the tax base, provide quality jobs, retain existing businesses and sustain quality of life for residents throughout Fulton County.