Kings New York Amendment to Oil and Gas Lease With Amendments to Be inserted in Form

Description

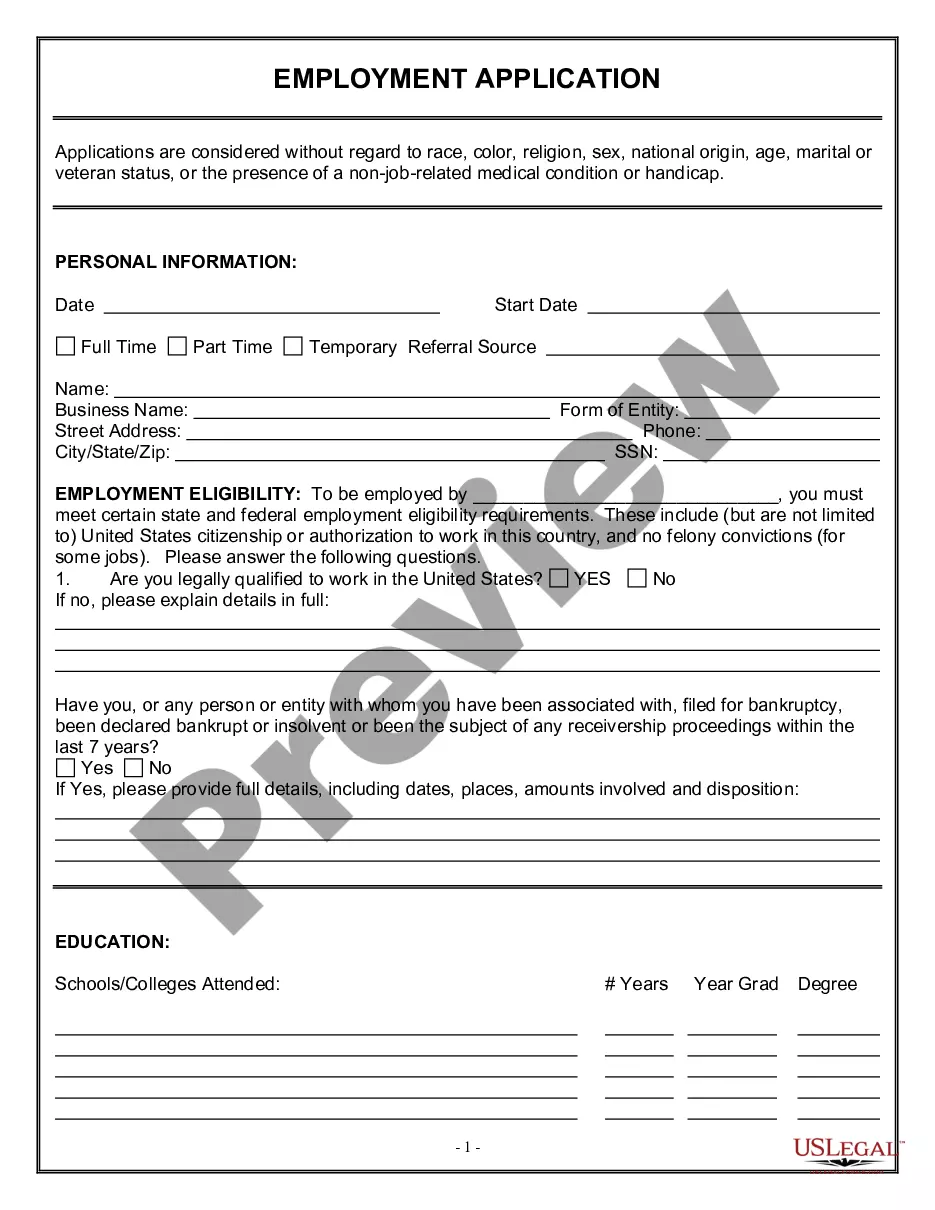

How to fill out Kings New York Amendment To Oil And Gas Lease With Amendments To Be Inserted In Form?

Preparing papers for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Kings Amendment to Oil and Gas Lease With Amendments to Be inserted in Form without professional assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Kings Amendment to Oil and Gas Lease With Amendments to Be inserted in Form by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Kings Amendment to Oil and Gas Lease With Amendments to Be inserted in Form:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

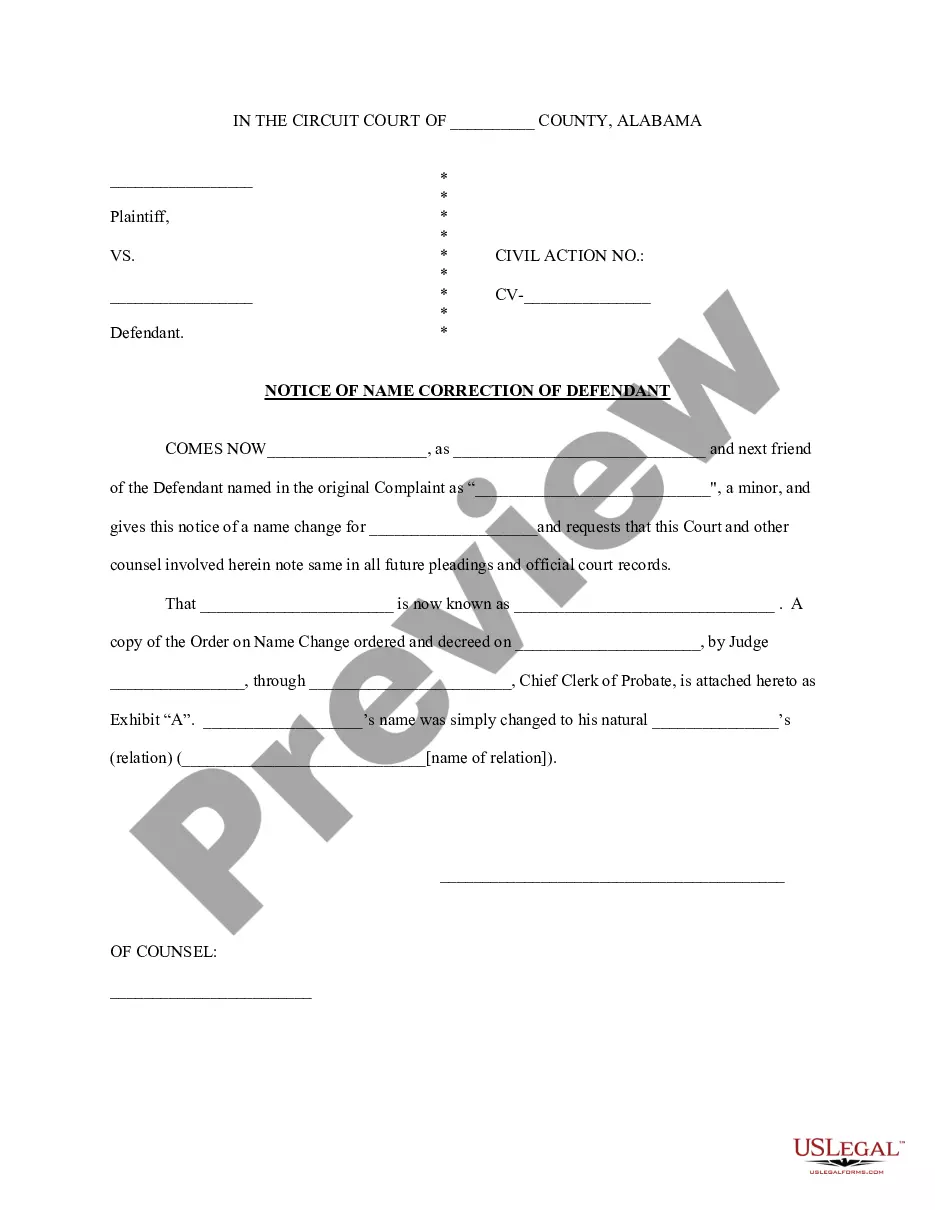

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

The primary term of a federal oil and gas lease is 10 years. The term is extended as long as the lease has at least one well capable of production. Leases do not authorize ground disturbance.

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.

In terms of the oil and gas industry, ratification of a lease is the term for requesting acceptance of an existing lease agreement, with or without changes, from landowners who have purchased parcels to which the original leaseholder gave permission to drill and produce. Leases can last for decades.

Most landowners choose to receive the royalty in cash at the posted price of the oil. A Lessor deciding to receive the oil as the royalty payment can market the oil royalty back to the Lessee for marketing and receive cash through that arrangement.

(a) (1) Any lease of oil or natural gas rights or any other conveyance of any kind separating such rights from the freehold estate of land shall expire at the end of ten (10) years from the date executed, unless, at the end of such ten (10) years, natural gas or oil is being produced from such land for commercial

The federal government charges oil and gas companies a royalty on hydrocarbon resources extracted from public lands. The standard Federal royalty payment was 12.5%, or a 1/8th royalty.

The annual rentals required under all oil and gas leases issued since December 22, 1987 is $1.50 per acre (or partial acre) for the first five lease years and $2.00 per acre (or partial acre) thereafter.

In times of a low natural gas prices and reduced drilling, Lease Amendments, Modifications and Ratifications may become common. Gas companies may attempt to revive or restore a expired lease by presenting the royalty owner with a Lease Modification and Amendment.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, according to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.