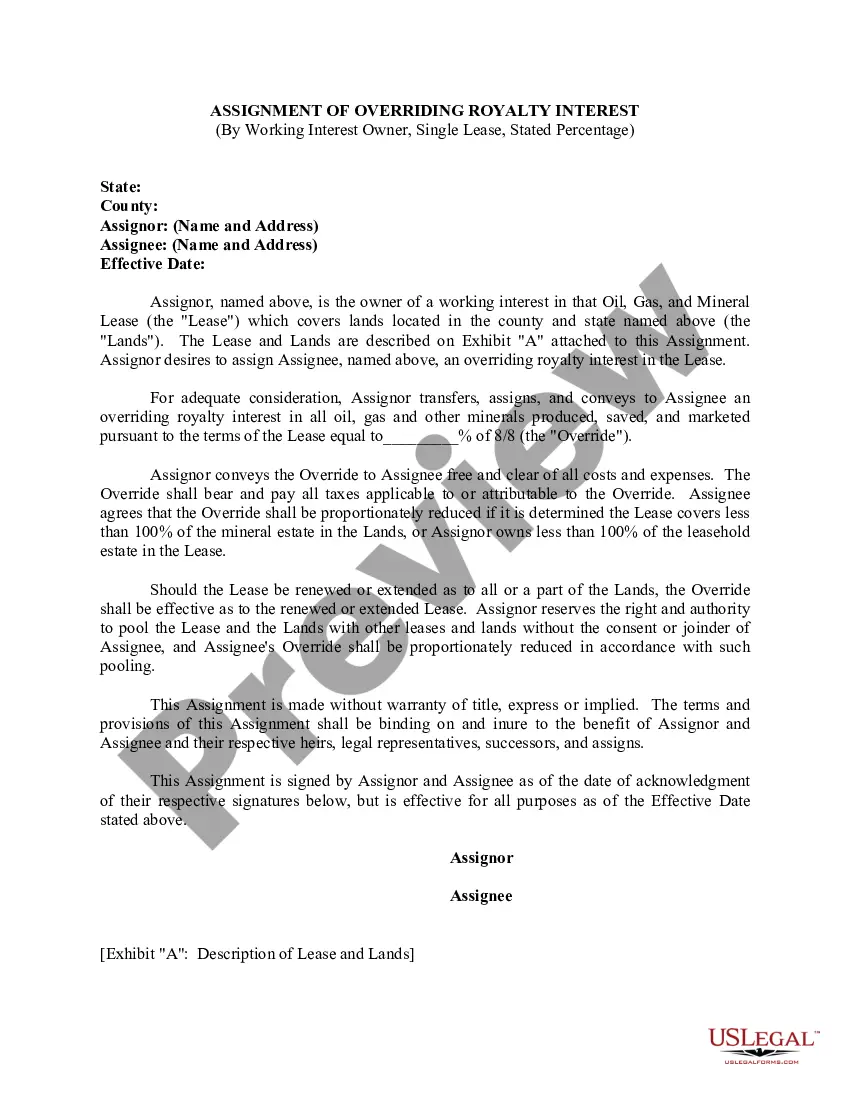

Alameda, California Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage When it comes to the oil and gas industry, an Alameda County, California Assignment of Overriding Royalty Interest in Working Interest Owner on a Single Lease, Stated Percentage is a crucial agreement that deserves attention. This article will delve into the specifics of this assignment, providing a detailed description of its purpose and function. First, let's understand what an overriding royalty interest (ORRIS) is. In oil and gas exploration, an ORRIS allows the interest owner to receive a percentage of the revenue generated from the lease, even if they don't directly hold an operating working interest. It provides the holder with a share of the profits without shouldering the expenses and risks associated with the operation. As the name suggests, an Alameda, California Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage refers to a situation where the working interest owner transfers a portion of their overriding royalty interest to another party. This transfer could occur due to various reasons, such as financial needs, divestment strategies, or simply to leverage the expertise of the transferee in managing the royalty interest. Key elements involved in this assignment include the working interest owner, the assignor (the working interest owner transferring the ORRIS), and the assignee (the recipient of the ORRIS). The assignment agreement will detail the specific terms and conditions of this transfer, including the stated percentage of the ORRIS being assigned and the corresponding terms of payment. It should be noted that there might be variations of this assignment type depending on the terms specified in the agreement. Some possible variations could include assignment of overriding royalty interests on multiple leases or assignment of ORRIS by multiple working interest owners on a single lease. To ensure a smooth transaction, parties involved in an Alameda, California Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage must follow legal procedures and comply with the relevant regulations. Consulting knowledgeable attorneys specializing in oil and gas law in Alameda, California is advisable to ensure the assignment is correctly executed and all parties are adequately protected. In conclusion, an Alameda, California Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage represents a significant financial agreement within the oil and gas industry. By transferring a portion of their overriding royalty interest, the working interest owner aims to benefit from the expertise or financial gains offered by the assignee. Understanding the intricacies of this assignment type is crucial for all parties involved to make informed decisions and protect their interests.

Alameda California Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

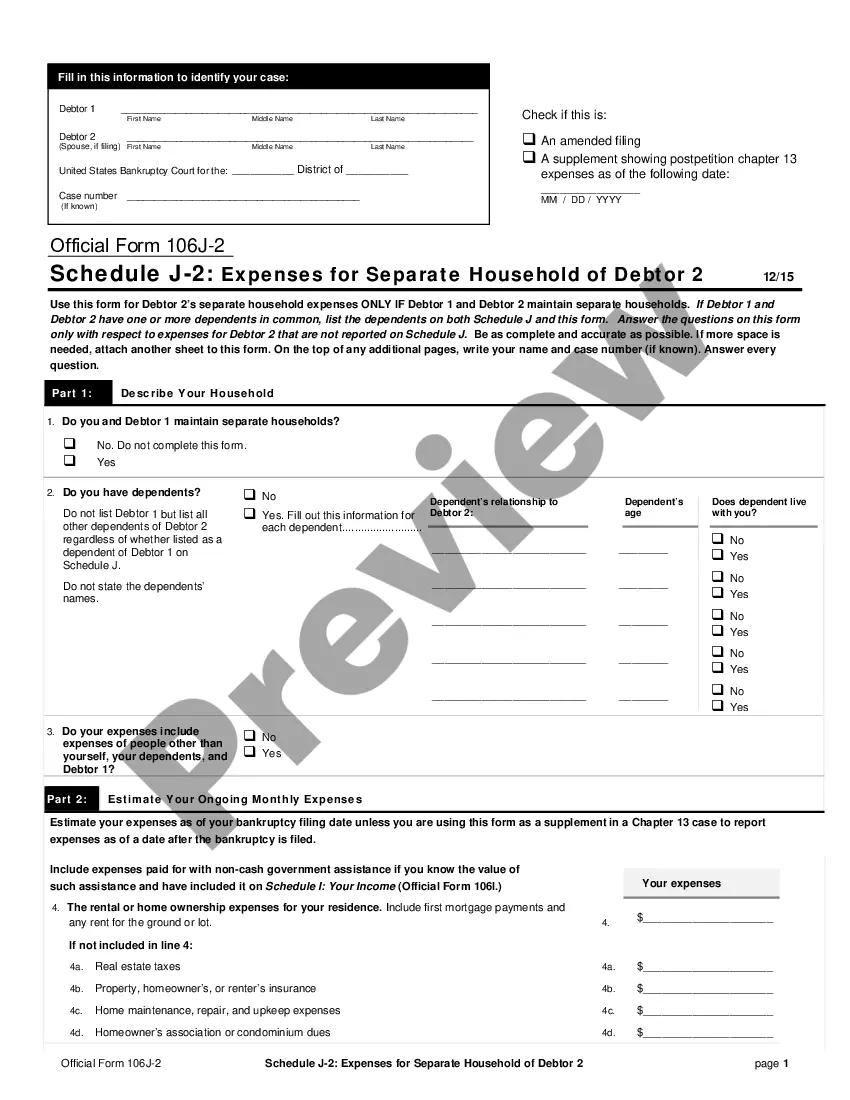

How to fill out Alameda California Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Alameda Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Alameda Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Alameda Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Alameda Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage and download it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

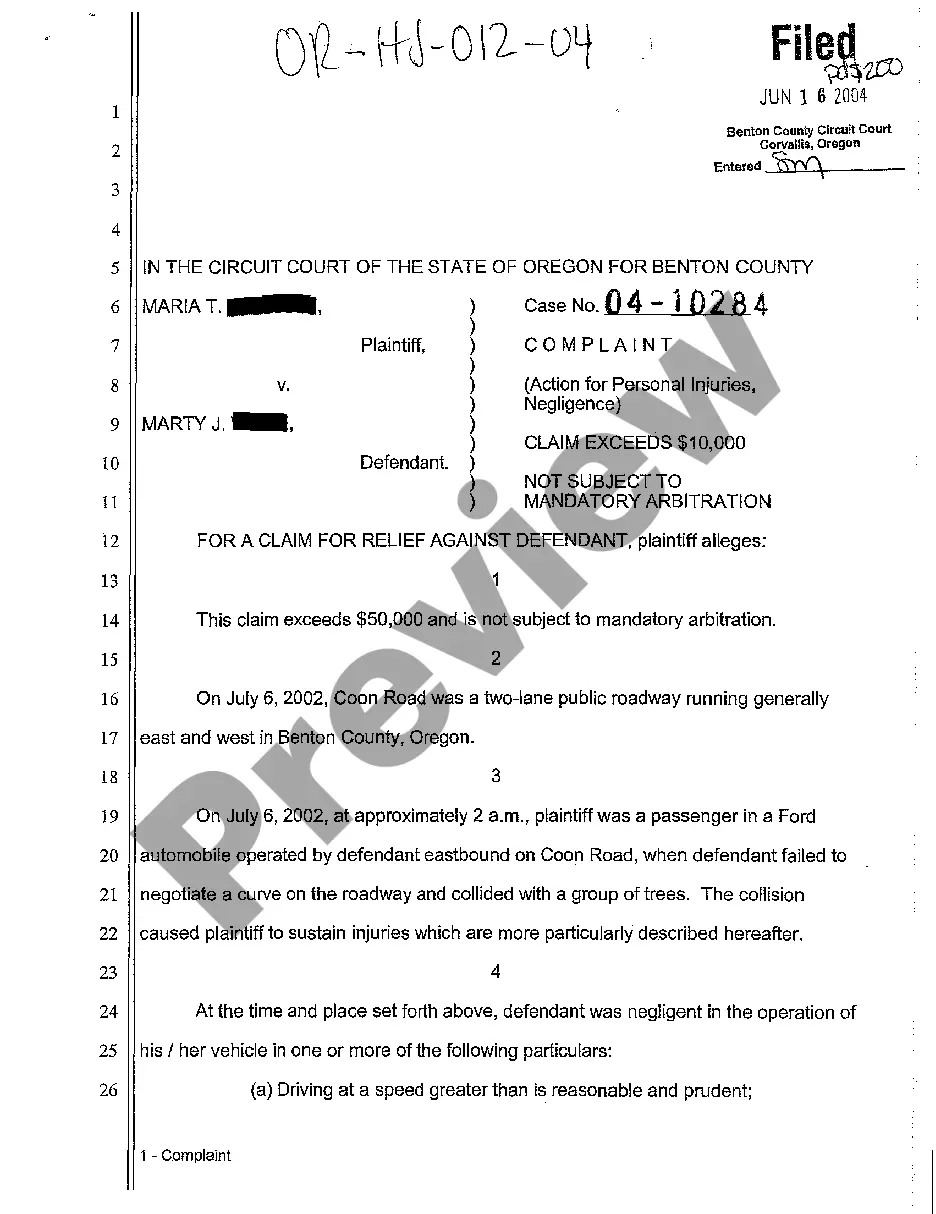

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR RI = NPRI.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

Legal Definition of overriding royalty : an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.