Fairfax Virginia Assignment and Conveyance of Overriding Royalty Interest refers to the legal process by which the ownership and rights associated with overriding royalty interests in oil and gas leases are transferred or assigned in Fairfax, Virginia. This type of arrangement allows certain individuals or entities to receive a percentage of the production revenues generated from an oil or gas well, without having any rights or responsibilities related to the operation or costs of drilling and producing the resources. Assigning and conveying overriding royalty interests involves creating a legal document, often known as an assignment or conveyance instrument, that outlines the specific terms and conditions of the transfer. This instrument typically includes details such as the names of the assignor (current owner) and assignee (new owner), the description of the overriding royalty interest being conveyed, the property or lease to which it pertains, and the consideration or payment being exchanged for the transfer. In Fairfax, Virginia, there may be different types of Assignment and Conveyance of Overriding Royalty Interest. These can include: 1. Full Assignment: This type of conveyance involves the complete transfer of the overriding royalty interest from the assignor to the assignee. The assignee becomes the new owner and is entitled to collect all future royalty payments associated with the interest. 2. Partial Assignment: In this case, only a portion of the overriding royalty interest is transferred to the assignee. The assignor retains some portion of the interest, continuing to receive corresponding percentage of the royalties, while the assignee acquires the remaining portion. 3. Temporary Assignment: Sometimes, overriding royalty interests may be assigned for a specific period, typically for a defined term or until certain conditions are met. This arrangement allows for temporary ownership of the interest, after which it reverts to the assignor. 4. Assignment with Re completion Provision: Occasionally, an overriding royalty interest may be assigned with a recompletion provision. This provision enables the assignee to maintain the interest only if the well is recompleted or brought into production within a specified timeframe. Overall, Fairfax Virginia Assignment and Conveyance of Overriding Royalty Interest involves the transfer of ownership rights to receive oil and gas royalties. It is crucial for all parties involved to carefully review and understand the terms and conditions outlined in the assignment instrument to ensure a smooth and legally compliant transfer of overriding royalty interests.

Fairfax Virginia Assignment and Conveyance of Overriding Royalty Interest

Description

How to fill out Fairfax Virginia Assignment And Conveyance Of Overriding Royalty Interest?

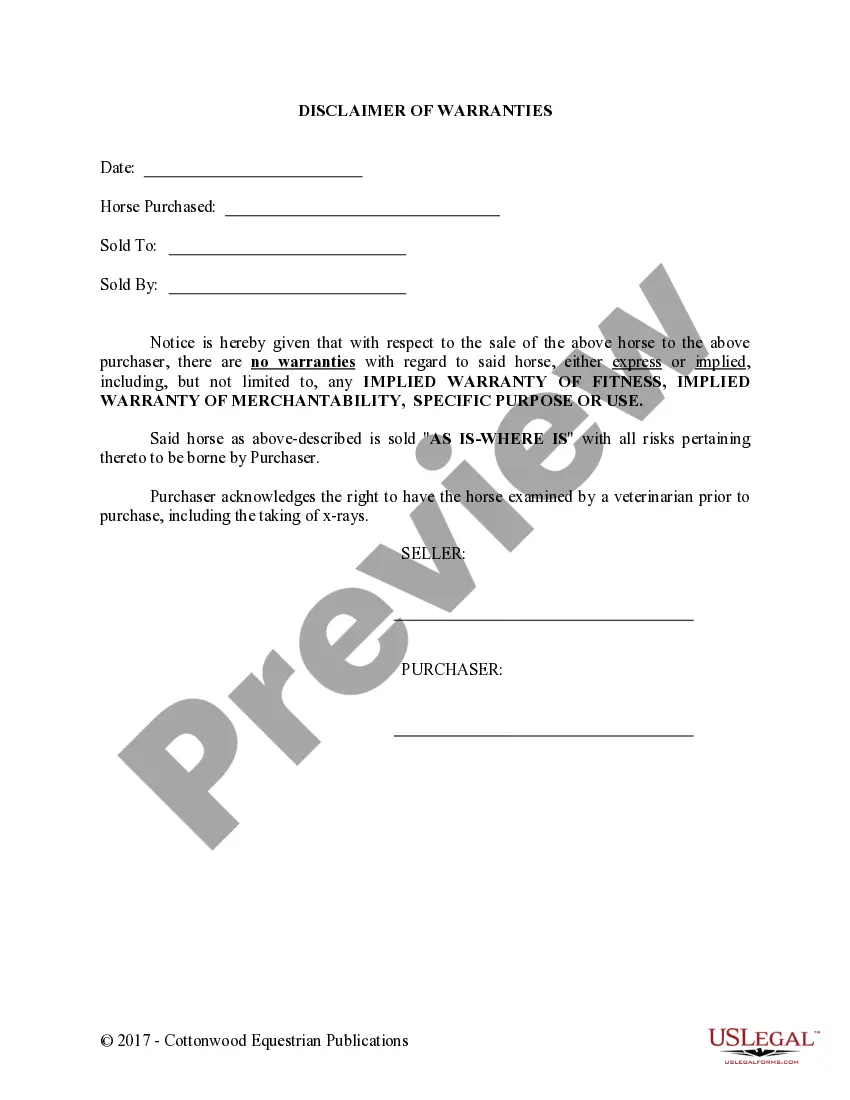

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Fairfax Assignment and Conveyance of Overriding Royalty Interest, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Fairfax Assignment and Conveyance of Overriding Royalty Interest from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Fairfax Assignment and Conveyance of Overriding Royalty Interest:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

More info

A statement of interest in the parcels of land. The price of each parcel of land, as determined by reference to the appraised price of the parcels as reported to the Commission in the annual land survey. The sum of all consideration, other than any sale price, payable under the agreement or an easement or the residue. 2 See note 1 1 A statement of each Party's interest under a certain Working Interest under a certain Project Agreement. The amount of the Working Interest and any other nature or form of interest. The terms and condition of any Interest and the sum of the consideration payable. The sum of such consideration, other than any sale price, payable. It is the duty of the court to determine the terms and condition and the price paid hereof, including, if necessary, any consideration for certain expenses that are included in the value of the real estate conveyed.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.