Suffolk New York Agreement For Payment on Casinghead Gas Between Gas Purchaser and Lease Operator

Description

How to fill out Agreement For Payment On Casinghead Gas Between Gas Purchaser And Lease Operator?

Generating legal documents is essential in the modern era. Nevertheless, you don't necessarily need to seek expert help to draft some of them from scratch, such as the Suffolk Agreement For Payment on Casinghead Gas Between Gas Purchaser and Lease Operator, using a service like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from across different categories ranging from living wills to real estate documents to divorce paperwork. All forms are categorized by their legitimate state, simplifying the searching experience.

You can also access comprehensive resources and guides on the website to simplify any tasks related to document processing.

If you are already a member of US Legal Forms, you can locate the necessary Suffolk Agreement For Payment on Casinghead Gas Between Gas Purchaser and Lease Operator, Log In to your account, and download it. Certainly, our website cannot entirely substitute for a legal expert. If you must handle an especially complex issue, we suggest consulting an attorney to review your form prior to execution and submission.

With more than 25 years in business, US Legal Forms has become a preferred source for a variety of legal forms for countless users. Join them today and easily acquire your state-specific documents!

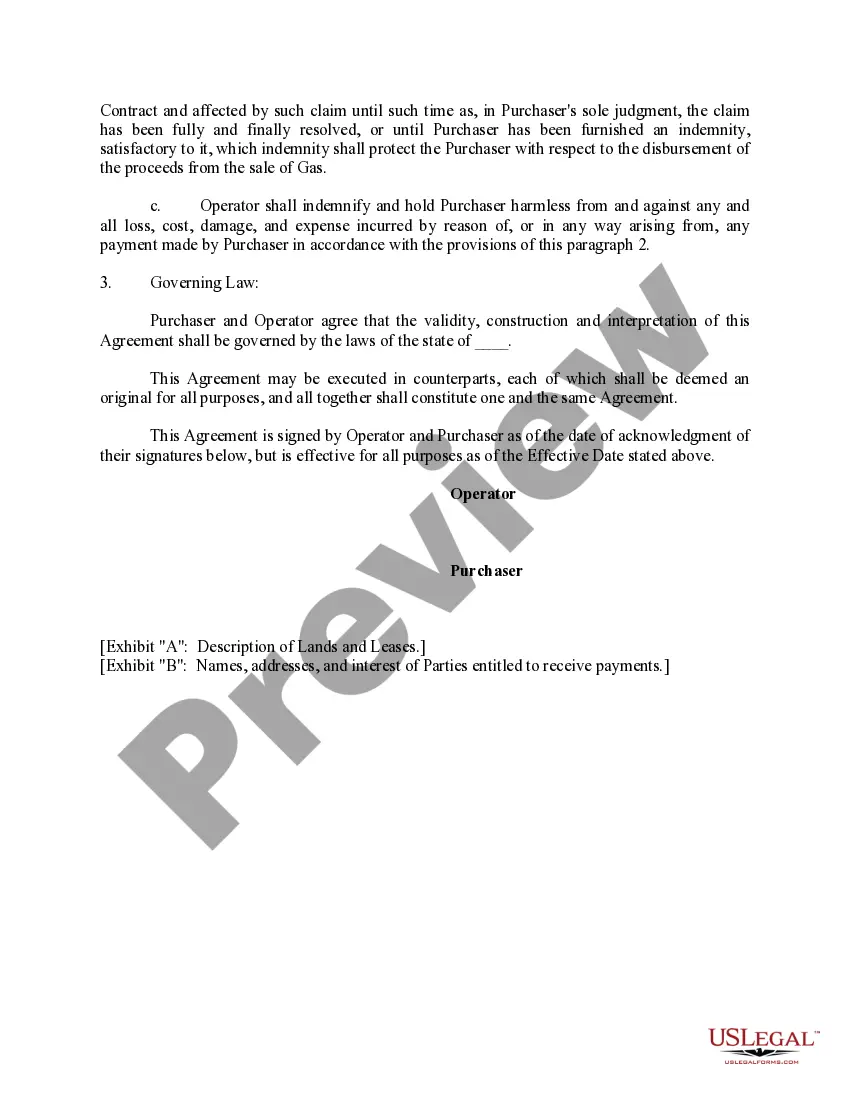

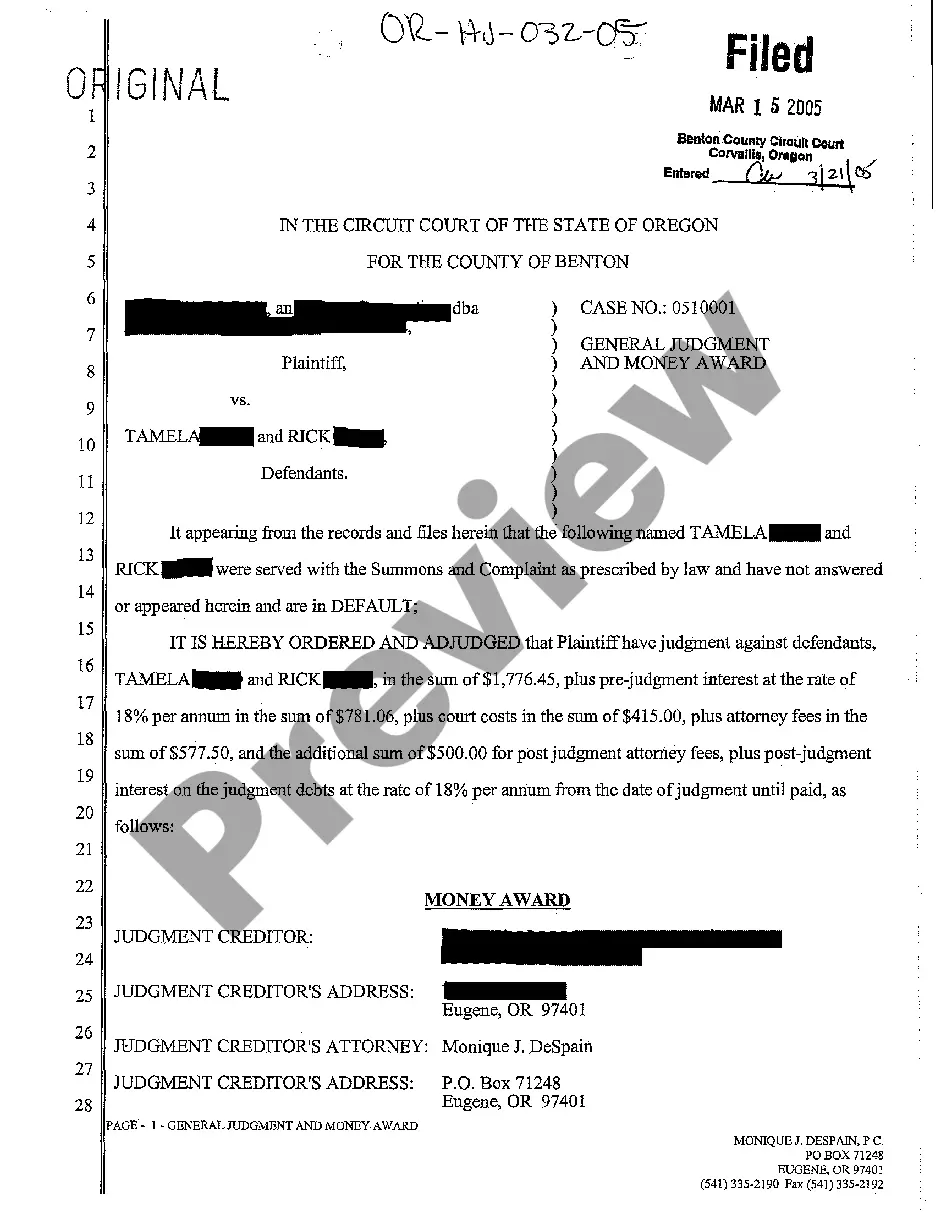

- Review the document’s preview and description (if available) for a general overview of what you will receive after acquiring the document.

- Confirm that the document selected is tailored to your state/county/region as state regulations may affect the legality of certain records.

- Explore similar forms or restart the search to find the right document.

- Click Buy now and create your account. If you already have an account, choose to Log In.

- Select the pricing plan, then a convenient payment method, and purchase the Suffolk Agreement For Payment on Casinghead Gas Between Gas Purchaser and Lease Operator.

- Choose to save the form template in any available format.

- Visit the My documents tab to re-download the document.

Form popularity

FAQ

Generally, the typical private oil and gas lease provides for the lessee to obtain the rights incidental to exploration, drilling, developing, producing, and disposing of the oil, gas, and associated hydrocarbons underlying the leased premises.

Gathering agreements set the contractual framework for the rendering of gathering services by midstream oil & gas companies to upstream producers. They are highly specialized agreements involving complex technical, commercial, and legal issues.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

A spacing unit is a legally described boundary designated by a governmental agency (the Oklahoma Corporation Commission (OCC) in the case of Oklahoma)) as a ?common source of supply? of oil and gas for purposes of dividing fairly, among the various owners, production from a particular well or wells.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

DEFENSIVE CLAUSES. Defensive clauses include dry hole clauses, operations clauses, pooling and unitization clauses, and cessation of production clauses. These clauses will extend the period of the lease without the necessity of production.

A landowner can also insert a clause in the lease to take royalty either ?in kind? or ?in value.? Taking royalty ?in kind? means that the Lessor can take physical possession of the oil, gas or liquids once they leave the ground, and he may market the production himself.

In general terms, the Pugh Clause provides that production from a unitized or pooled area located on or including a portion of the leased lands will not be sufficient to extend the primary term for the entire leasehold.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.