Pima Arizona Affidavit of Heirship for the Owner of the Property

Description

How to fill out Affidavit Of Heirship For The Owner Of The Property?

Statutes and guidelines in every domain vary from jurisdiction to jurisdiction.

If you are not a legal professional, it can be challenging to navigate through the diverse standards involved in creating legal documents.

To bypass expensive legal fees when preparing the Pima Affidavit of Heirship for the Property Owner, you need a certified template valid for your area.

This is the easiest and most cost-effective method to obtain current templates for any legal needs. Discover them all in just a few clicks and maintain your paperwork in order with US Legal Forms!

- That's when utilizing the US Legal Forms platform becomes incredibly beneficial.

- US Legal Forms is an online repository trusted by millions, offering over 85,000 state-specific legal templates.

- It serves as a fantastic resource for both professionals and individuals seeking do-it-yourself templates for various personal and business needs.

- All templates can be utilized multiple times: once you acquire a sample, it remains available in your profile for future use.

- Thus, when you have an account with an active subscription, you can simply Log In and re-download the Pima Affidavit of Heirship for the Property Owner from the My documents section.

- For new users, several additional steps are required to acquire the Pima Affidavit of Heirship for the Property Owner.

- Review the page details to confirm you have located the correct sample.

- Utilize the Preview feature or examine the form description if available.

Form popularity

FAQ

The deeds don't transfer ownership of a property until death, meaning an owner can sell a property, refinance it or take other actions while still living. The deeds aren't as versatile as living trusts but are less expensive. For many Arizona homeowners, a beneficiary deed might be all they need.

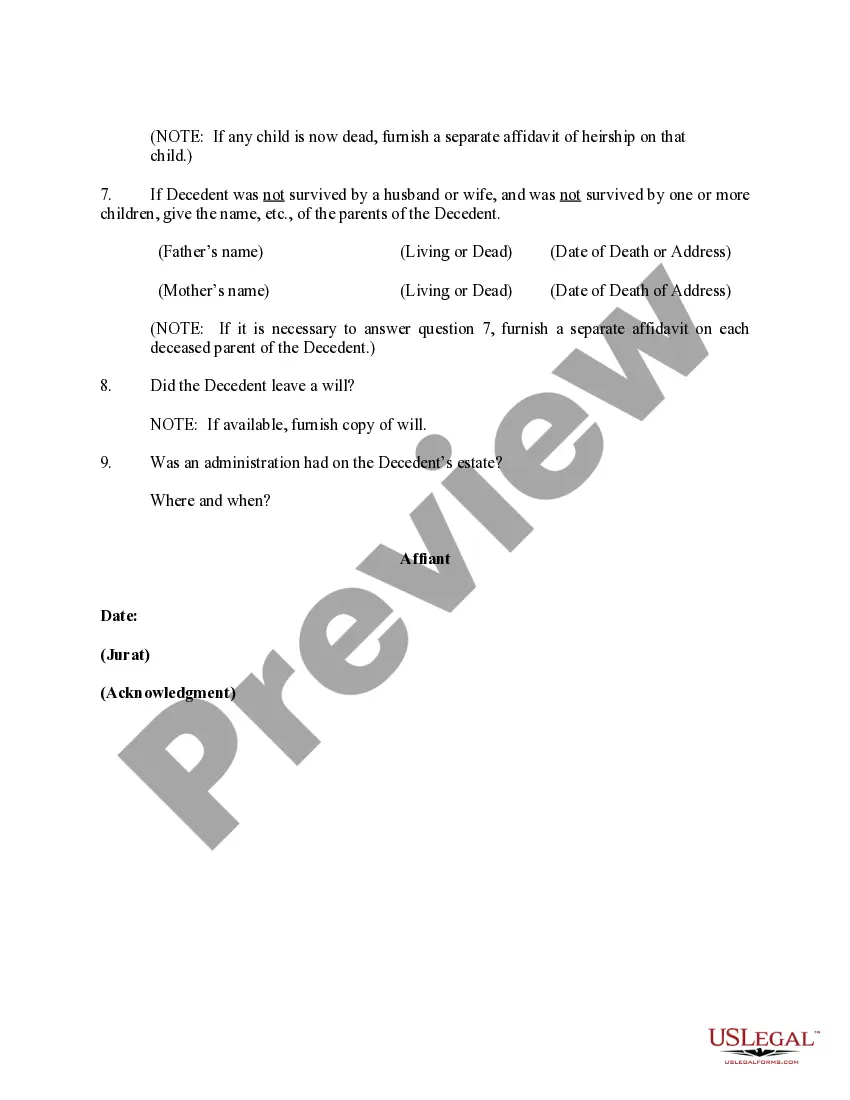

A loved one or heir of the decedent must file an affidavit of heirship with the county clerk of the counties in which the decedent owned property or resided at the time of death. The Affidavit of Heirship form you file must contain: The decedent's date of death. The names and addresses of all witnesses.

Two documents are recommended for the transfer of property after death without a Will. An Affidavit of Heirship. The Affidavit of Heirship is a sworn statement that identifies the heirs. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased.

Small Estate Affidavits are used in Arizona to transfer assets from a deceased person to the heirs when the total value of the assets is below the minimum value requiring a probate.

First, you'll need to initiate probate. File a petition with the county court where the decedent lived or owned property, and include a list all of the potential heirs to the estate. If there is a family member or trusted advisor who would like to serve as the estate's administrator, indicate that in the petition.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

Documents Required to transfer property from father to son Will/ testament. Certified copy of death certificate of the father. Succession Certificate. No-obligation certificate from the other successors/heirs along with the affidavit. Lineage list certificate. Relinquishment deed (if required) Gift deed (if required)

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.