Middlesex Massachusetts Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

How long does it typically take to draft a legal document? Due to the differing laws and regulations in each state for various life situations, searching for a Middlesex Affidavit of Heirship for Real Property that fulfills all local requirements can be taxing, and obtaining it from a qualified attorney is frequently expensive.

Numerous online platforms provide the most sought-after state-specific documents for download, but using the US Legal Forms repository is the most beneficial.

US Legal Forms boasts the largest online assortment of templates, categorized by state and area of application. Besides the Middlesex Affidavit of Heirship for Real Property, you can find any particular form needed for managing your business or personal matters, adhering to your county’s stipulations. Professionals verify all samples for their relevance, ensuring you can prepare your documents accurately.

Regardless of how often you need to utilize the obtained template, you can find all the files you’ve ever saved in your account by navigating to the My documents section. Give it a try!

- If you possess an account on the site and your subscription is active, simply Log In, select the needed form, and download it.

- You can access the file in your account at any later time.

- If you are unfamiliar with the site, additional steps are required before obtaining your Middlesex Affidavit of Heirship for Real Property.

- Review the content of the page you are currently on.

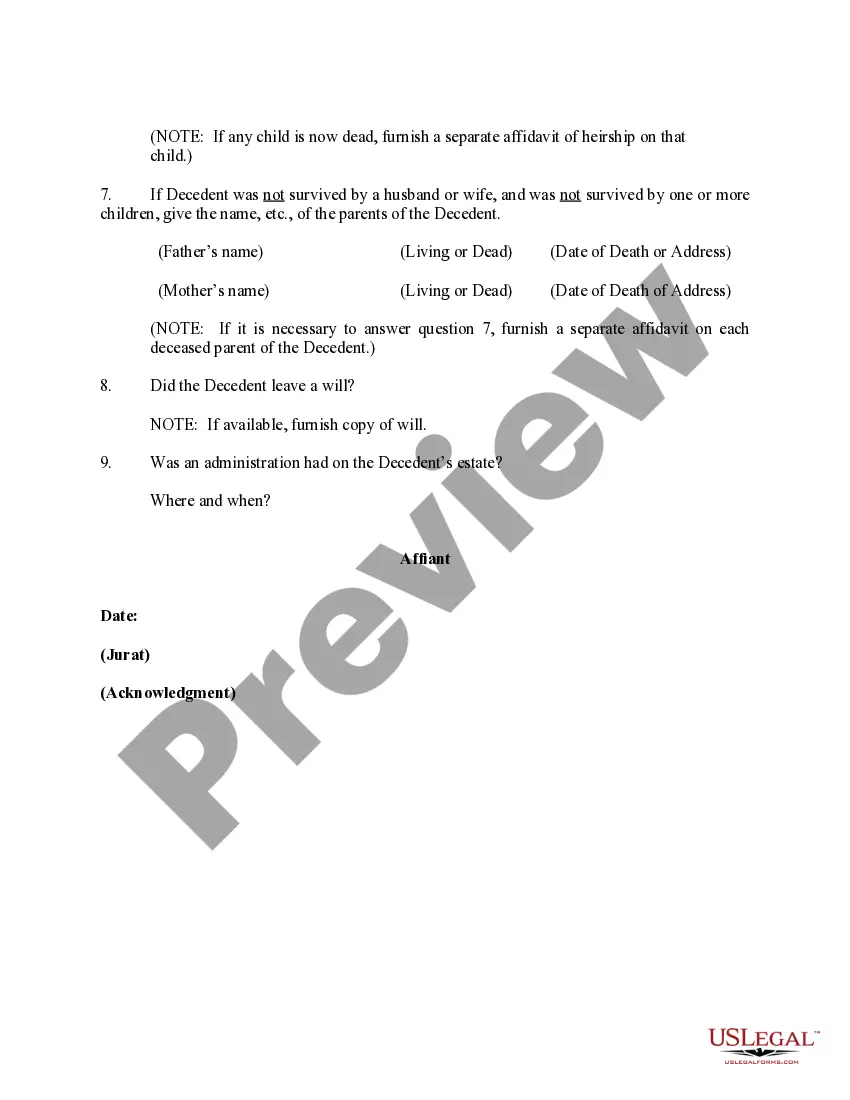

- Examine the description of the template or Preview it (if such an option exists).

- Look for another form using the related option in the header.

- Click Buy Now when you are confident in the selected file.

- Choose the subscription plan that best fits your needs.

- Create an account on the platform or Log In to move forward with payment options.

- Process payment through PayPal or your credit card.

- Change the file format if necessary.

- Click Download to keep the Middlesex Affidavit of Heirship for Real Property.

- Print the document or utilize any preferred online editor to complete it electronically.

Form popularity

FAQ

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

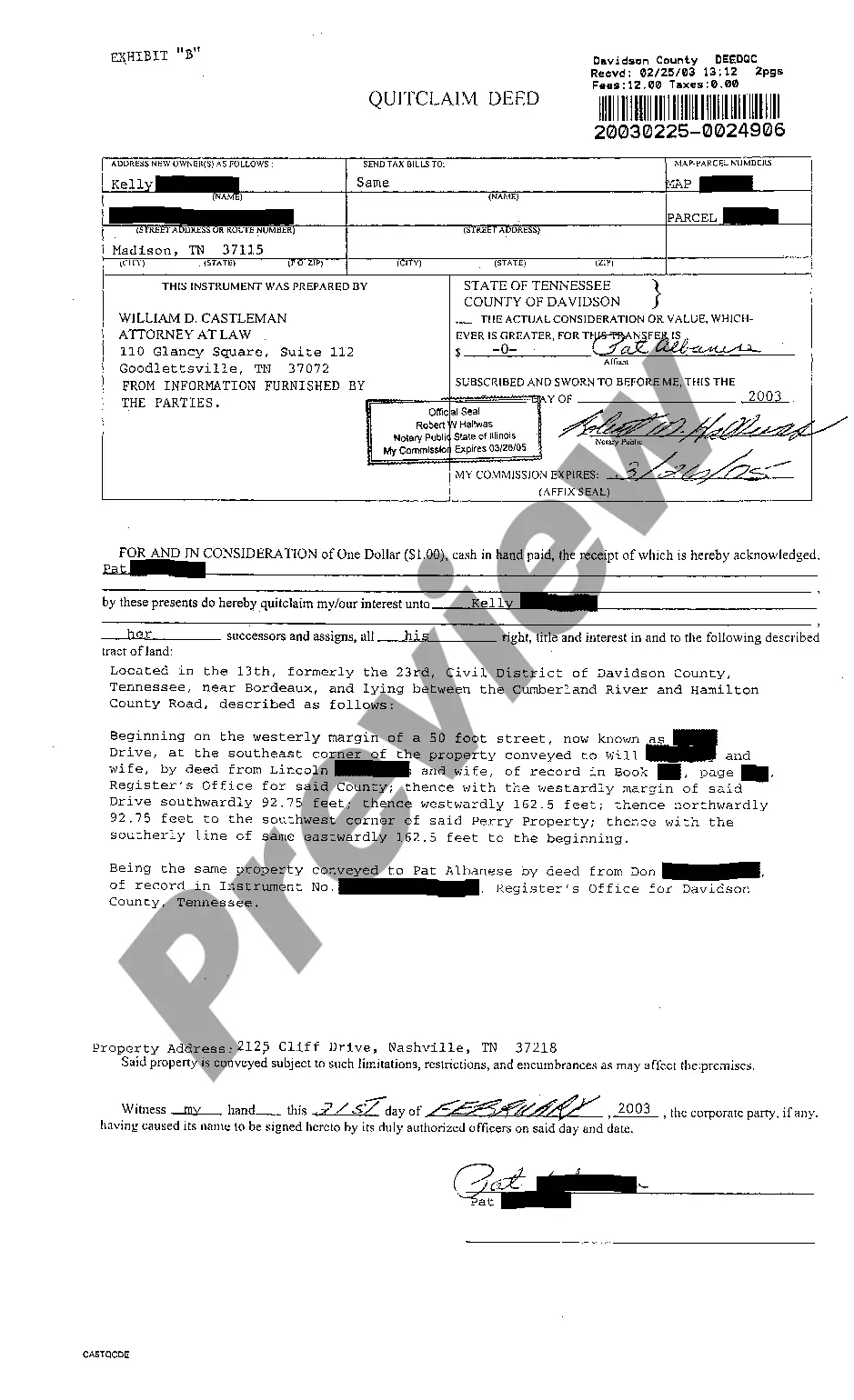

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

Use if a person dies with no will. Non-exempt property transferred to heirs without full probate. Must be less than 75k.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

The affidavit (Form CC-1612) gives the file number of the probate and the court with jurisdiction, as well as the name and date of death of the decedent and the name and address of the subscriber (affiant), stating what interest the subscriber has in the estate.

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are.

Under New Jersey statute, where as estate is valued at less than $50,000, a surviving spouse, partner in a civil union, or domestic partner, may present an affidavit of a small estate before the Superior Court.

The Texas Estates Code allows for the use of Affidavits of Heirship, meaning, a court shall receive Affidavits of Heirship in (a) a proceeding to declare heirship or (b) a suit involving title to property to establish prima facie evidence of the statement of family history, genealogy, marital status or the identity of