Riverside California Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Riverside California Deed And Assignment From Trustee To Trust Beneficiaries?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Riverside Deed and Assignment from Trustee to Trust Beneficiaries.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Riverside Deed and Assignment from Trustee to Trust Beneficiaries will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Riverside Deed and Assignment from Trustee to Trust Beneficiaries:

- Ensure you have opened the proper page with your regional form.

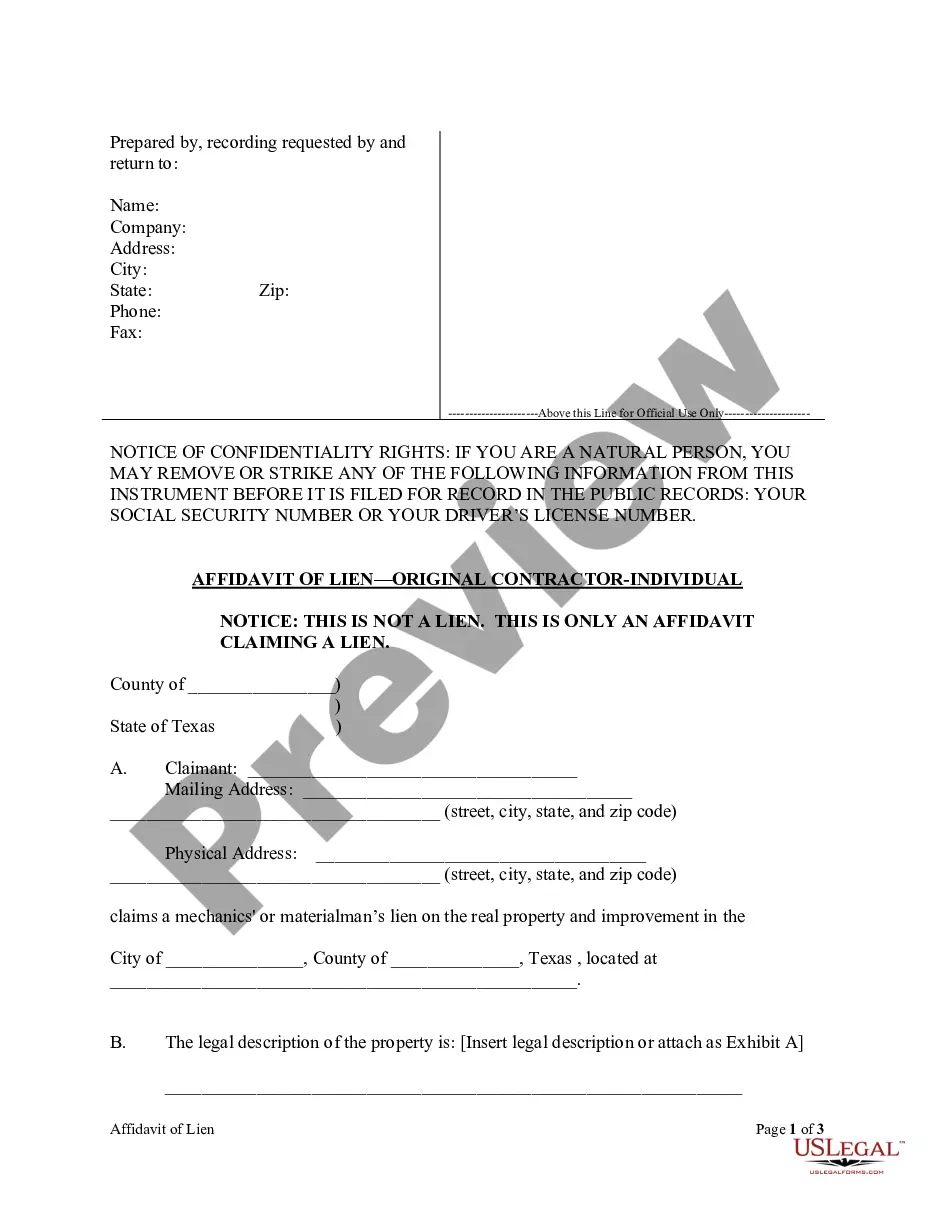

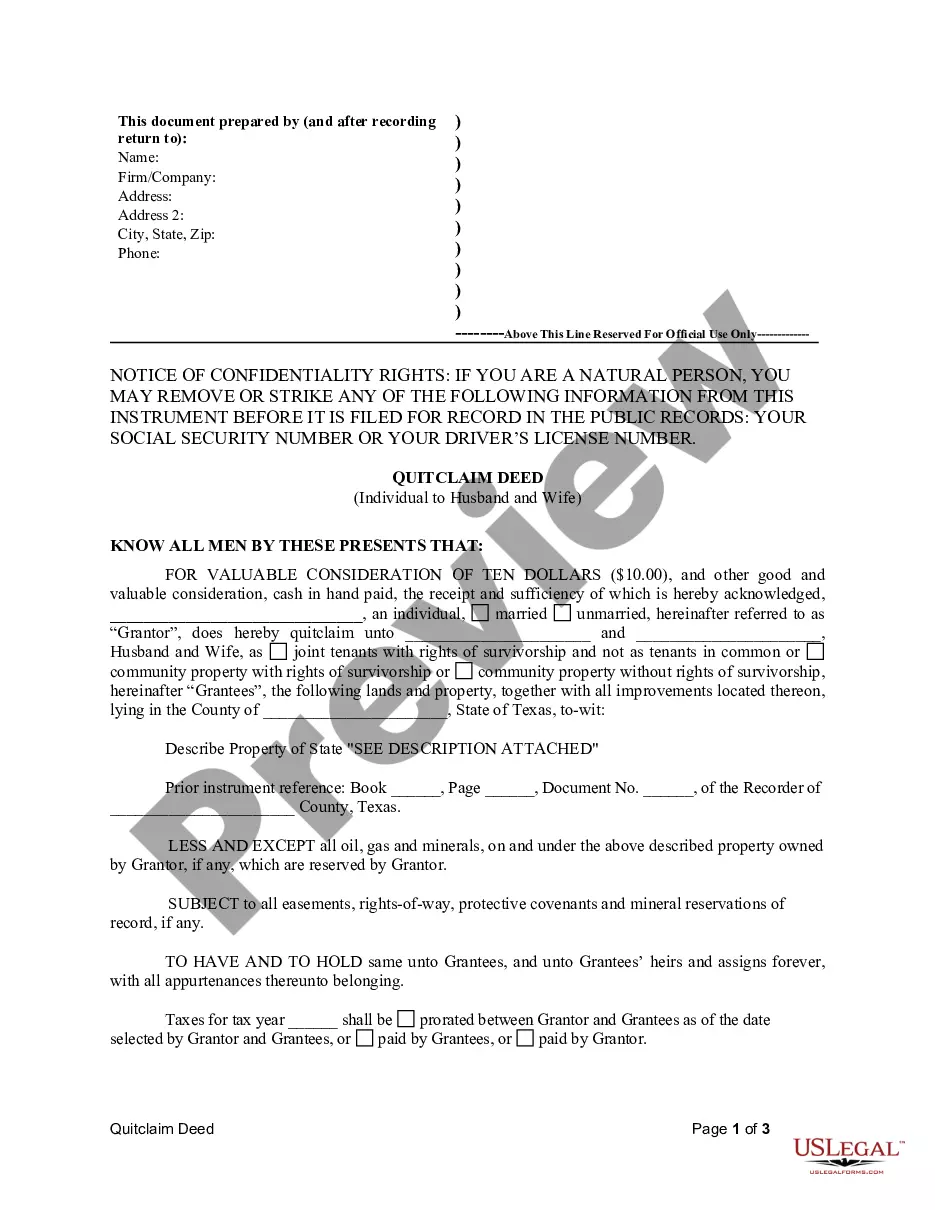

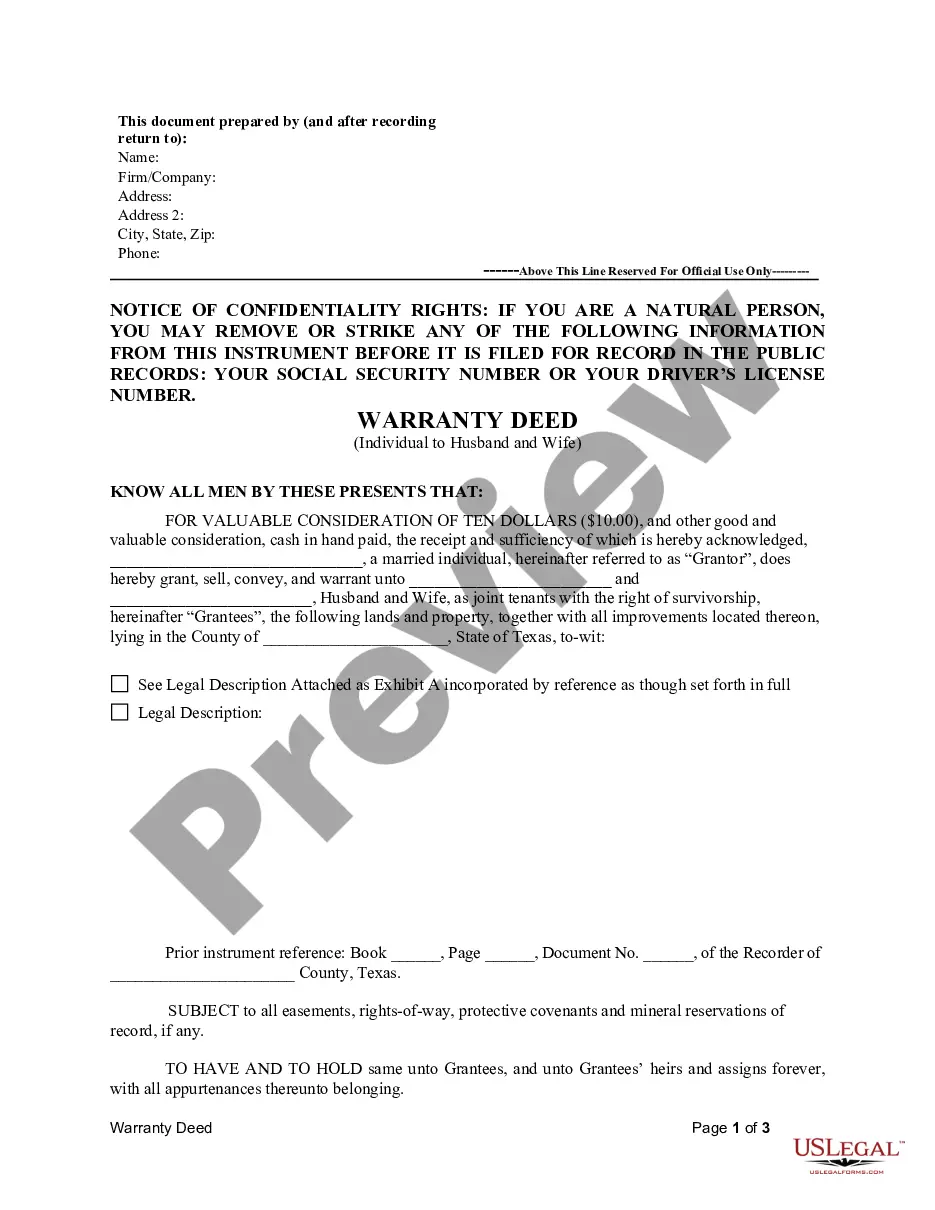

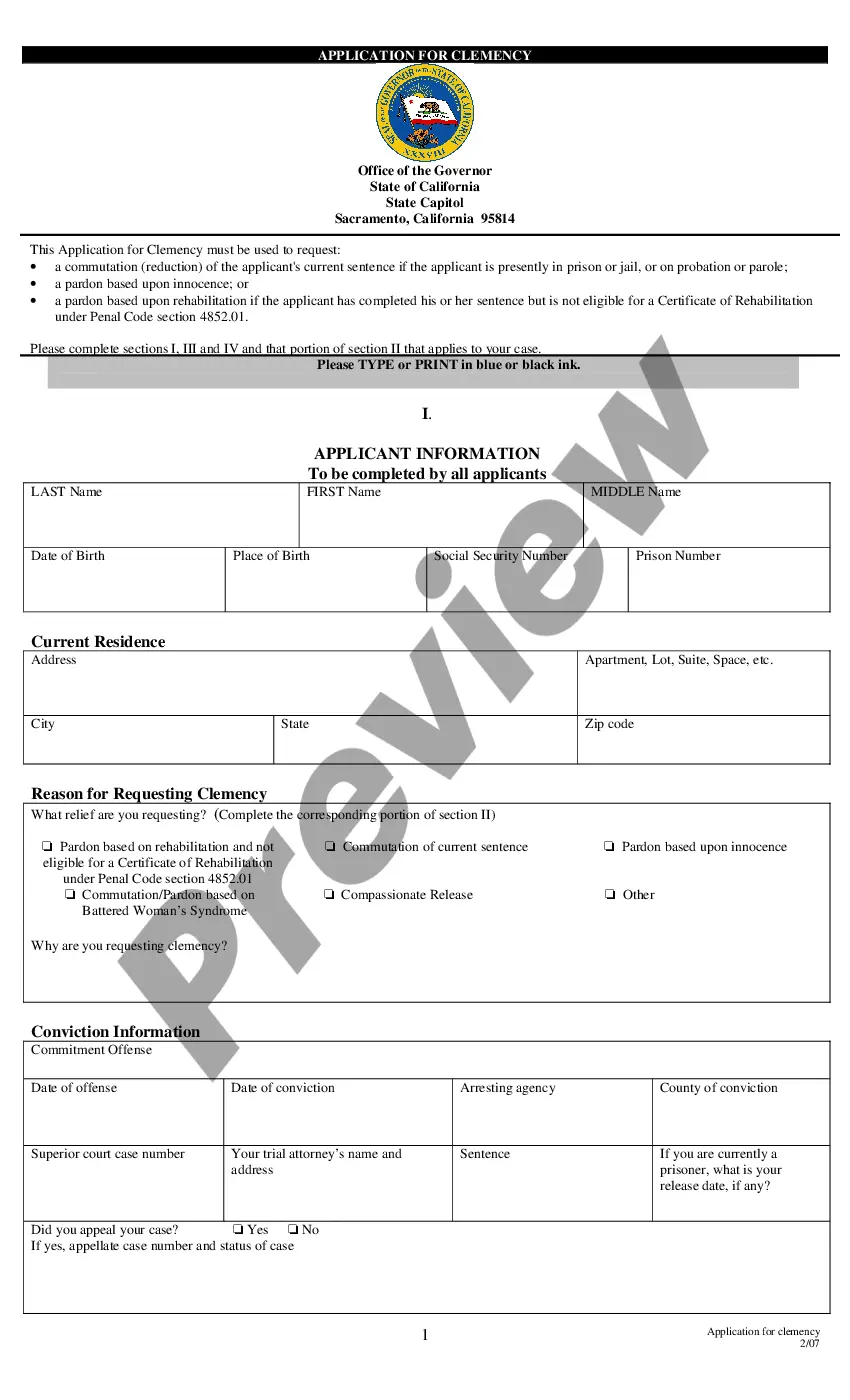

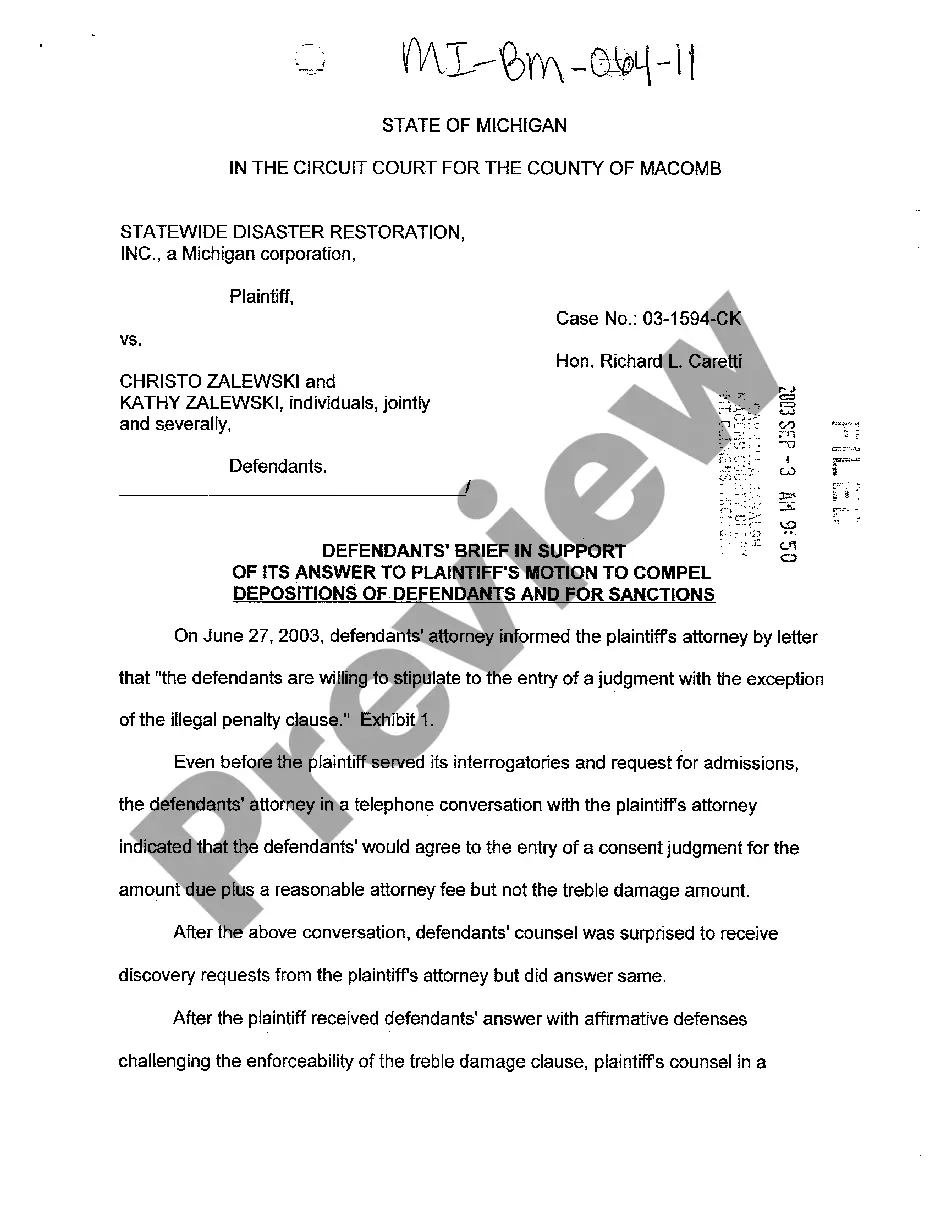

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Riverside Deed and Assignment from Trustee to Trust Beneficiaries on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Riverside County Assessor-County Clerk-Recorder Address 2724 Gateway Drive. Riverside, CA 92507. Address PO Box 751. Riverside, CA 92502. Phone (951) 955-6200 County Clerk Recorder. Email accrmail@asrclkrec.com.

Offers services for records, licenses, and permits. Please note: Documents accepted between pm and 4pm will be recorded the following business day.

When done properly, a deed is recorded anywhere from two weeks to three months after closing.

In California, there are several ways to record real estate documents: In-person submission. Under this option, a person or his messenger service may visit the county recorder's office to submit the recording over the counter.Mail-in recording.Use of a title company or attorney courier service.

To order official records by mail: Complete the application form: Form: Official Records. Find your document number, if needed:Prepare payment. Fees for each document. First Page.Mail application, payment, and additional information, if necessary, to the following address: Riverside County Clerk-Recorder.

Recording Fee for Grant DeedType of FeeFeeBase Fee G.C. § 27361(a) G.C. § 27361.4(a) G.C. § 27361.4(b) G.C. § 27361.4(c) G.C. § 27361(d)(1) G.C. § 27397 (c) Subsection 1$15.005 more rows

Recording Requirements The property must be located in Riverside County.The document must be authorized or required by law to be recorded.The document must be submitted with the proper fees and taxes.The document must be in compliance with state and local laws.

Online processing time is 48 hours. This is our average processing time, which may occasionally increase as our volume of requests increases. We will mail you your record upon completion. The County of Riverside is not responsible for the delivery of mail by the United States Post Office or any other delivery service.

Riverside County, California County Administrative Center. 4080 Lemon St, 1st floor / PO Box 751, Riverside, California 92501 / 92502-0751.Gateway Office. 2724 Gateway Dr, Riverside, California 92507.Hemet Office.Palm Desert Office.Temecula Office.Blythe Office.

The Recorder's office is responsible for providing constructive notice of private acts and creating and maintaining custody of permanent records for all documents filed and recorded in Riverside County.