Houston, Texas Correction Assignment of Overriding Royalty Interest Correcting Lease Description is a legal document used to rectify errors or discrepancies in the lease description related to the assignment of overriding royalty interest in the energy industry. This type of correction in lease description is crucial for ensuring accurate and valid property transactions and royalties. There are different types of Correction Assignment of Overriding Royalty Interest Correcting Lease Descriptions that may occur in Houston, Texas: 1. Geographic Correction: This type of correction involves rectifying errors in the geographical boundaries mentioned in the lease description. It may involve updating or clarifying location coordinates, land descriptions, or any other geographic references related to the assigned overriding royalty interest. 2. Parcel Correction: In some cases, incorrect details regarding the parcel size or boundaries may be discovered in the lease description. This type of correction aims to accurately define the surface area or boundaries of the property in question, thus ensuring clarity in assigning overriding royalty interests. 3. Ownership Correction: This correction involves rectifying any inaccuracies related to the ownership of the overriding royalty interest. It may occur when the previous lease incorrectly identified the owner or failed to mention certain co-owners. The correction ensures that the assignment accurately reflects the rightful owners of the overriding royalty interest. 4. Term Correction: Sometimes, errors may occur in the lease description regarding the term or duration of the overriding royalty interest. This correction aims to rectify any mistakes or omissions related to the lease term, providing clarity on the duration of the assignment. Correcting the lease description with a Houston, Texas Correction Assignment of Overriding Royalty Interest Correcting Lease Description is essential to maintain transparency and accuracy in property transactions within the energy industry. By amending any errors or discrepancies, the assignment of overriding royalty interest can be legally binding and properly recorded. Note: In order to access specific legal advice regarding Correction Assignment of Overriding Royalty Interest Correcting Lease Description in Houston, Texas, it is recommended to consult with a qualified attorney specialized in real estate and energy law.

Houston Texas Correction Assignment of Overriding Royalty Interest Correcting Lease Description

Description

How to fill out Houston Texas Correction Assignment Of Overriding Royalty Interest Correcting Lease Description?

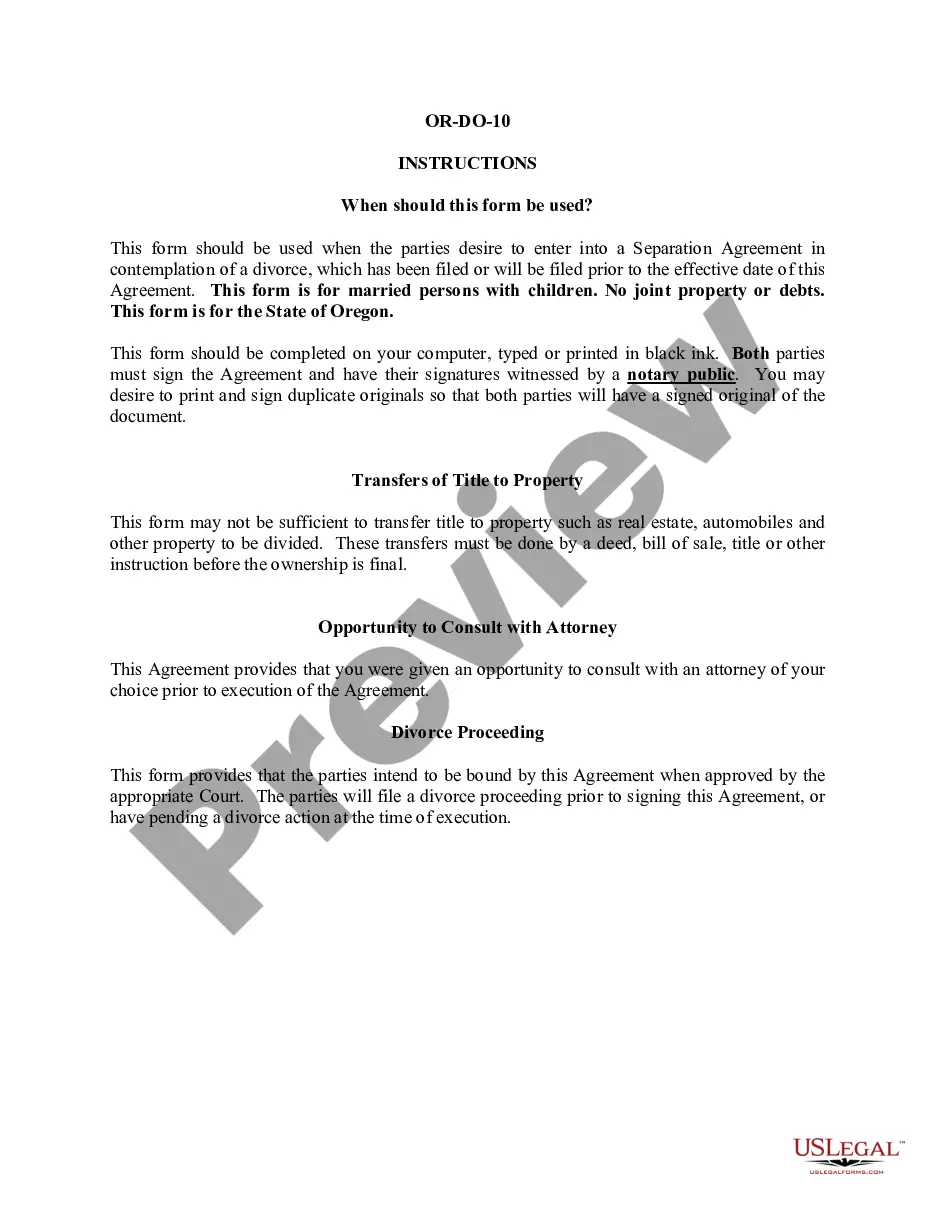

Creating documents, like Houston Correction Assignment of Overriding Royalty Interest Correcting Lease Description, to manage your legal matters is a difficult and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms intended for different scenarios and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Houston Correction Assignment of Overriding Royalty Interest Correcting Lease Description form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Houston Correction Assignment of Overriding Royalty Interest Correcting Lease Description:

- Ensure that your document is specific to your state/county since the rules for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Houston Correction Assignment of Overriding Royalty Interest Correcting Lease Description isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our service and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s easy to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Overriding Royalty Interest (ORRI) ? a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

A landowner can also insert a clause in the lease to take royalty either ?in kind? or ?in value.? Taking royalty ?in kind? means that the Lessor can take physical possession of the oil, gas or liquids once they leave the ground, and he may market the production himself.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1031 Exchange: another term for Like-Kind Exchange. 8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

The Bankruptcy Code defines a production payment as a type of ?term overriding royalty? or ?an interest in liquid or gaseous hydrocarbons in place or to be produced from particular real property that entitles the owner thereof to a share of production, or the value thereof, for a term limited by time, quantity, or

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

An overriding royalty is an interest in an asset that provides rights of participation which allow the investor to enjoy a royalty that is above and beyond the basic royalty that he or she is entitled to as part of the compensation for the investment.

A spacing unit is a legally described boundary designated by a governmental agency (the Oklahoma Corporation Commission (OCC) in the case of Oklahoma)) as a ?common source of supply? of oil and gas for purposes of dividing fairly, among the various owners, production from a particular well or wells.