Middlesex Massachusetts Self-Employed Lifeguard Services Contract

Description

How to fill out Middlesex Massachusetts Self-Employed Lifeguard Services Contract?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Middlesex Self-Employed Lifeguard Services Contract, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Middlesex Self-Employed Lifeguard Services Contract from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Middlesex Self-Employed Lifeguard Services Contract:

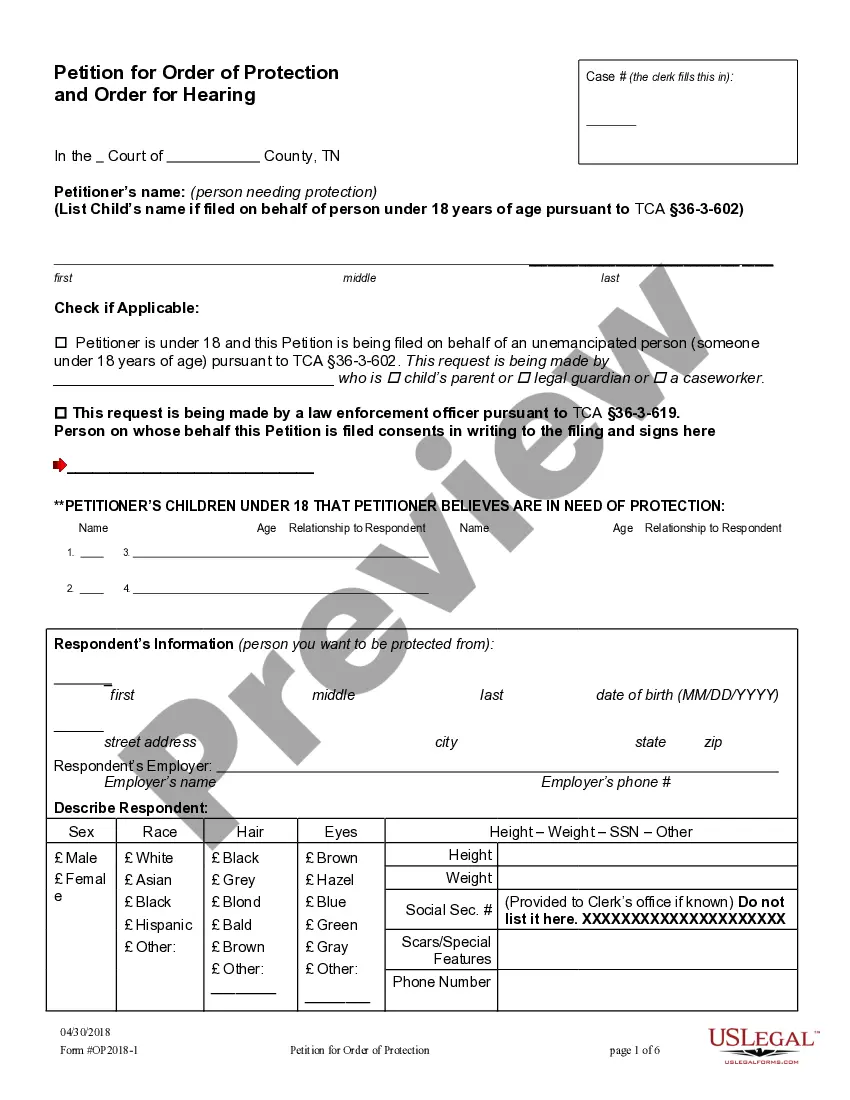

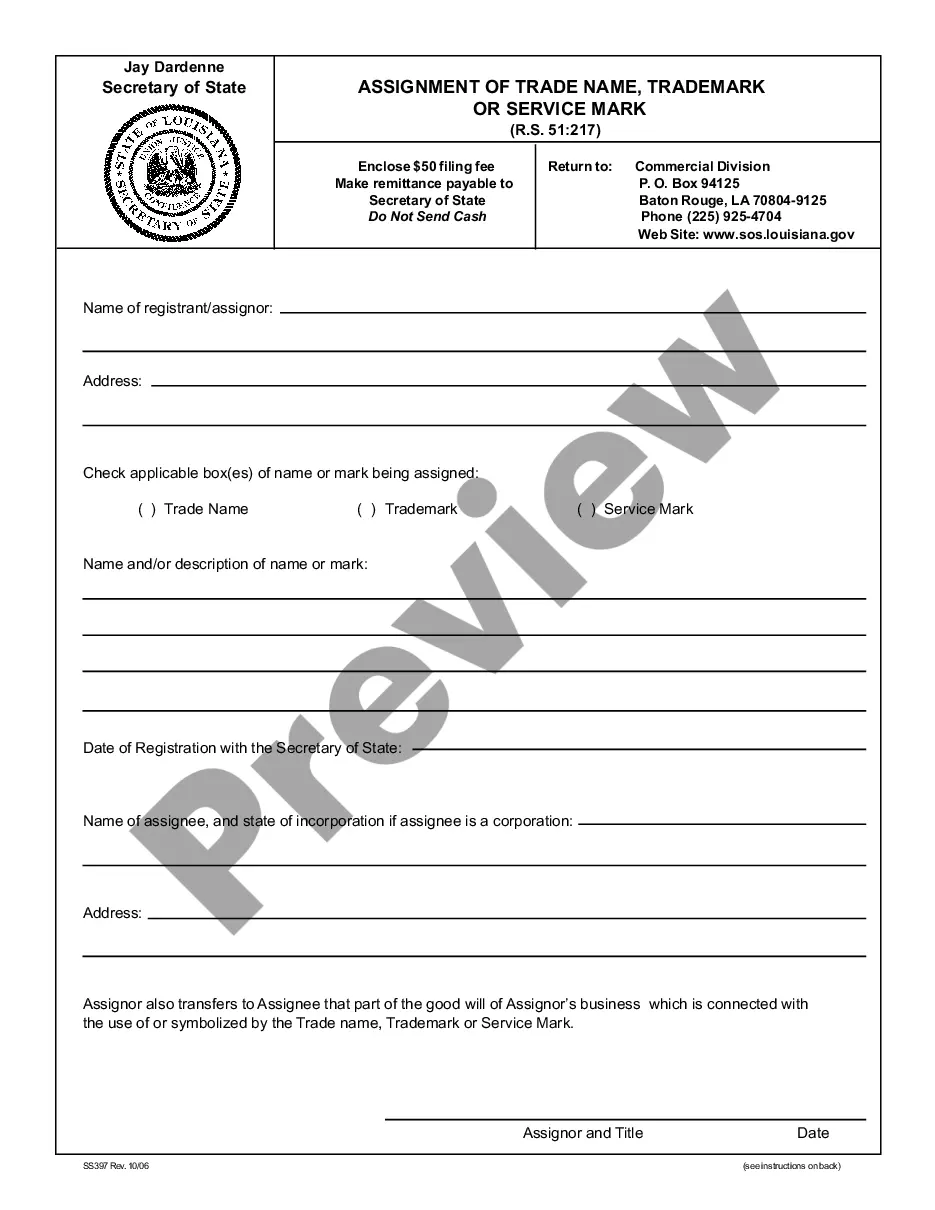

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A contract for services is an agreement between a business and an individual who is self-employed wherein the business agrees to pay the individual for a limited amount of service without that individual formally becoming an employee.

How to become an independent contractor Identify your business structure.Choose and register your business name.Get business licenses and permit.Get a business number and find your taxation requirements.Get insurance for your business.Establish the requirements for your workplace safety.Manage your business well.

Important Contract Terms for Service Agreements Term/Duration:Responsibilities/Scope of Work:Payment Terms:Dispute Resolution Terms:Intellectual Property Rights:Liabilities/Indemnification:Modifications/Amendments:Waiver:

Contracted Services means medical services, nursing services, health-related services, ancillary services, or environmental services provided according to a documented agreement between a health care institution and the person providing the medical services, nursing services, health-related services, ancillary services

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

How do I write a Service Agreement? State how long the services are needed.Include the state where the work is taking place.Describe the service being provided.Provide the contractor's and client's information.Outline the compensation.State the agreement's terms.Include any additional clauses.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

It provides a level of legal protection to both parties, and makes sure that everyone is on the same page from the beginning. A service agreement might also be called a general service contract or service level agreement.

Assuming you are already registered with SARS personally, then by default your sole proprietorship will also be registered. If you are not yet registered with SARS, you can register at a physical SARS branch, or online through the SARS eFiling service.