The Kings New York Self-Employed Independent Contractor Payment Schedule refers to the payment structure for contractors working for Kings New York, a company based in New York City. This payment schedule outlines the timing and method of payments made to self-employed individuals who provide services or complete projects for the company. The Kings New York Self-Employed Independent Contractor Payment Schedule is designed to ensure fair and timely compensation for contractors, while also streamlining the payment process for both parties involved. By adhering to this schedule, contractors can better manage their finances and plan accordingly, while Kings New York maintains transparency and consistency in compensating their contractors. Different Types of Kings New York Self-Employed Independent Contractor Payment Schedule: 1. Bi-weekly Payment Schedule: Under this payment schedule, contractors receive payment every two weeks for the services or projects completed during that period. This type of schedule provides contractors with a regular and predictable income stream and allows them to plan their budget accordingly. 2. Monthly Payment Schedule: In this payment schedule, contractors receive payment once a month for the work they have completed during that particular month. This type of schedule may be more suitable for contractors with longer-term projects or those who prefer to receive a consolidated payment at the end of each month. 3. Milestone-based Payment Schedule: Some Kings New York contractors may have projects that are divided into milestones or individual stages. In such cases, a milestone-based payment schedule is used. Payment is made upon completion of each milestone, ensuring that contractors receive partial payments throughout the project rather than waiting until the entire project is finished. 4. Commission-based Payment Schedule: For contractors who earn a commission based on their sales or performance, Kings New York may have a commission-based payment schedule. In this case, payments are made based on the agreed-upon commission percentage and the sales or performance achieved by the contractor within a specific time frame. The Kings New York Self-Employed Independent Contractor Payment Schedule aims to provide clarity, consistency, and flexibility to ensure that contractors are paid in a manner that suits their needs and preferences. It is important for both parties to establish a clear understanding of the payment schedule at the beginning of the contracting arrangement to avoid any misunderstandings or disputes in the future.

Kings New York Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Kings New York Self-Employed Independent Contractor Payment Schedule?

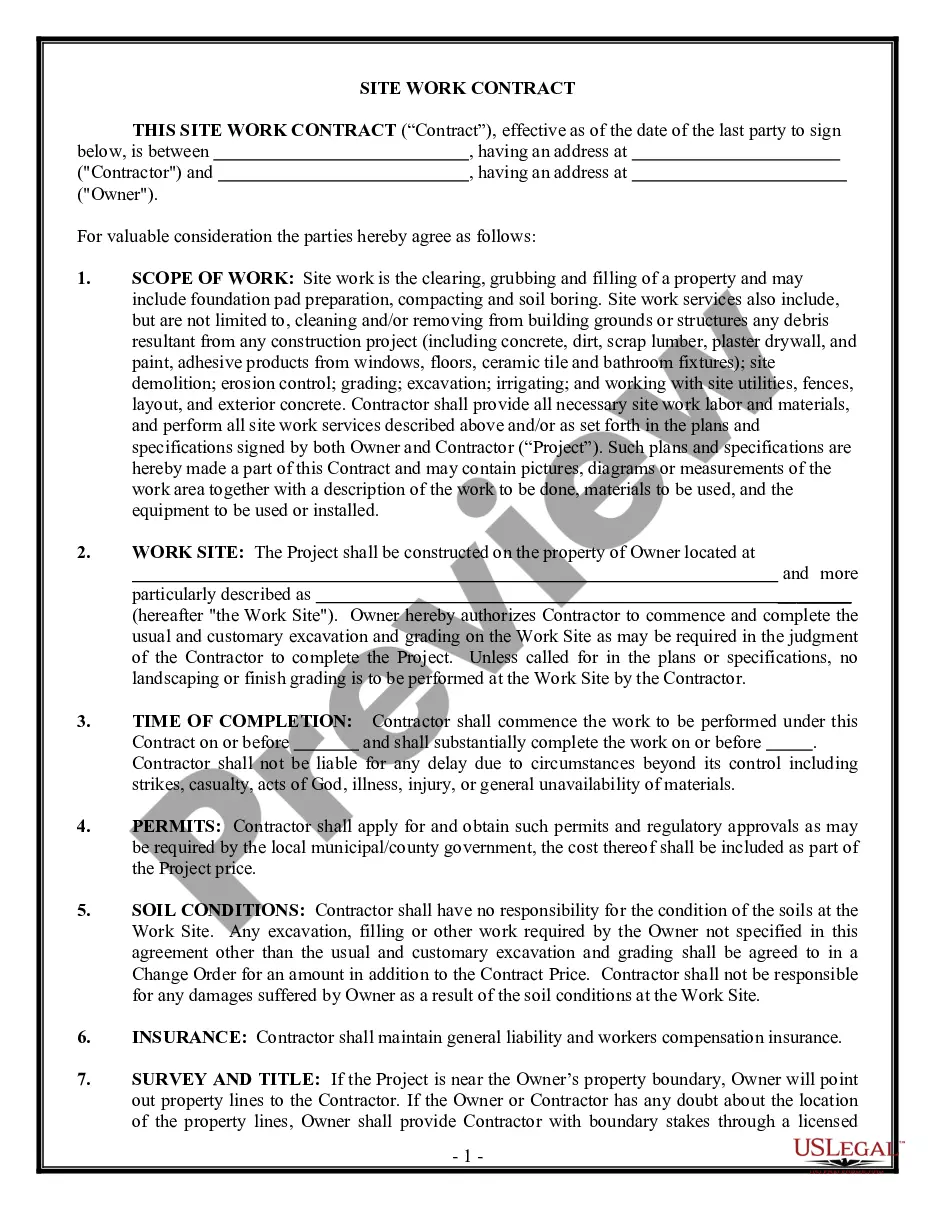

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Kings Self-Employed Independent Contractor Payment Schedule, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the current version of the Kings Self-Employed Independent Contractor Payment Schedule, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Self-Employed Independent Contractor Payment Schedule:

- Look through the page and verify there is a sample for your area.

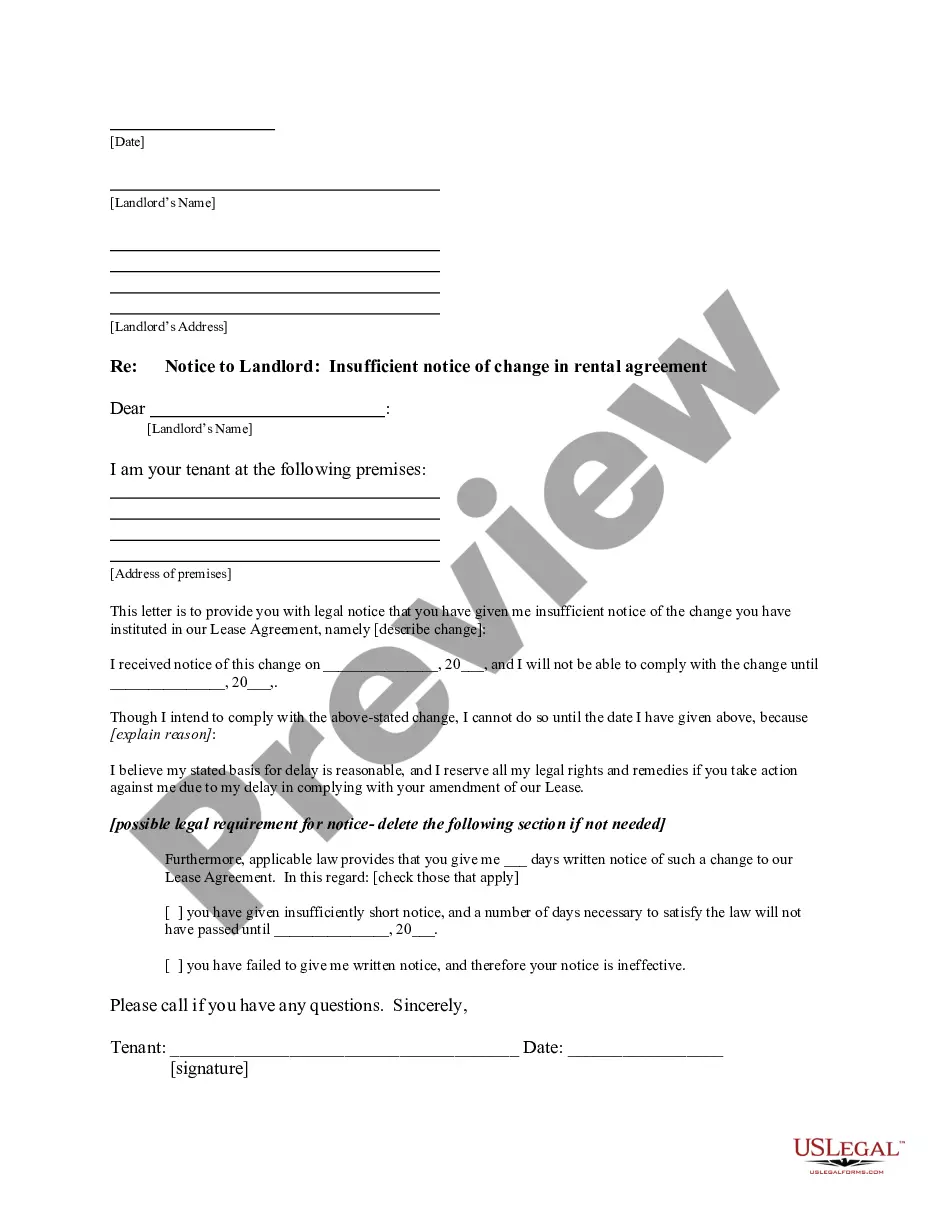

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Kings Self-Employed Independent Contractor Payment Schedule and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!