Orange California Window Contractor Agreement - Self-Employed

Description

How to fill out Window Contractor Agreement - Self-Employed?

Managing legal documents is essential in modern society. However, it isn't always necessary to seek expert assistance to generate some of them from scratch, such as the Orange Window Contractor Agreement - Self-Employed, using a service like US Legal Forms.

US Legal Forms offers over 85,000 templates available in several categories, including advance directives, property paperwork, and divorce documents. All forms are categorized by their applicable state, simplifying the search process. Additionally, you can find comprehensive resources and instructions on the website to make any tasks related to form completion hassle-free.

Here’s how to find and download the Orange Window Contractor Agreement - Self-Employed.

Navigate to the My documents section to re-download the document.

If you're already subscribed to US Legal Forms, you can find the required Orange Window Contractor Agreement - Self-Employed, Log In to your account, and download it. Naturally, our platform cannot entirely substitute for a lawyer. For very complex situations, we advise utilizing an attorney's services to review your document prior to signing and submitting it.

With over 25 years in the industry, US Legal Forms has established itself as a reliable source for a variety of legal paperwork for millions of users. Join them today and obtain your state-specific documents with ease!

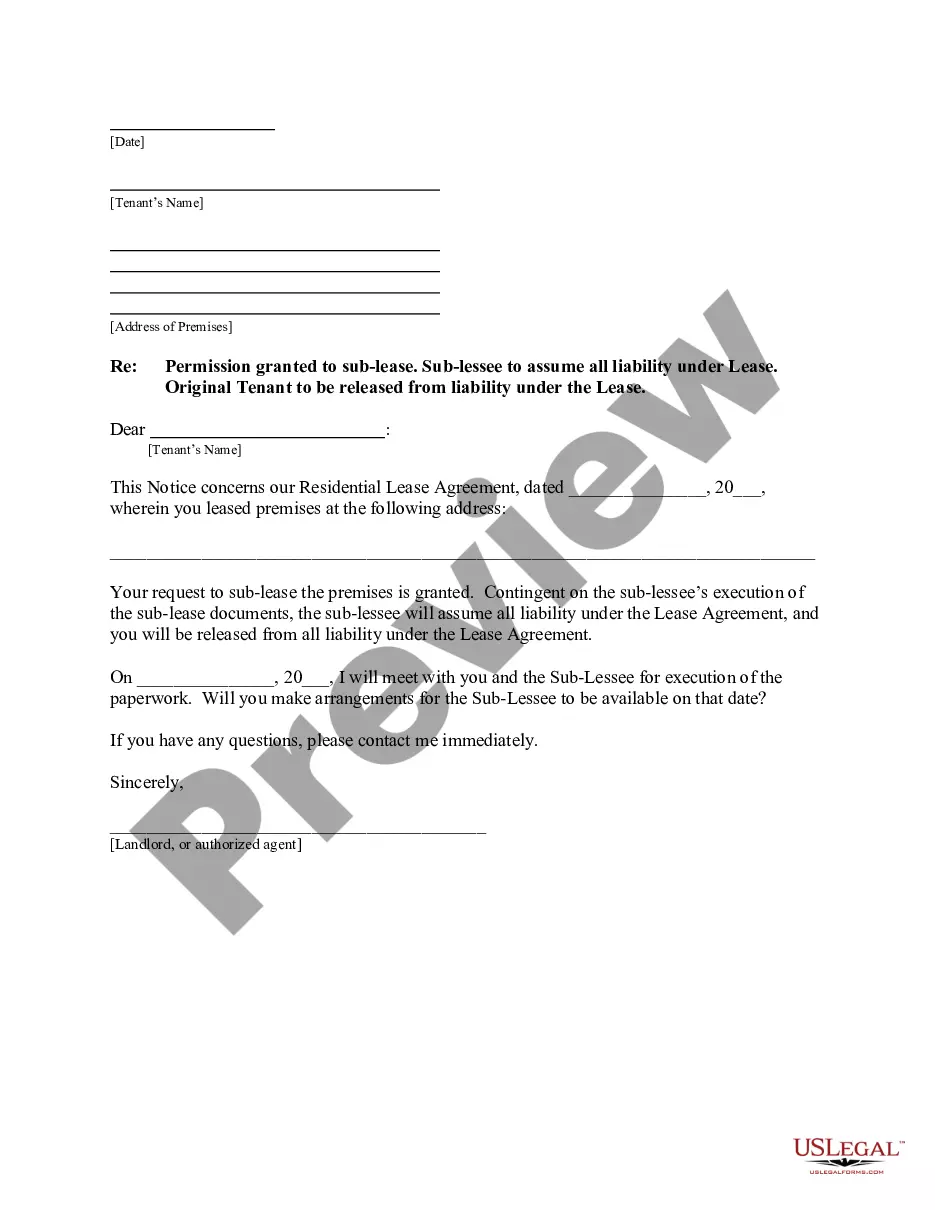

- Review the document's preview and description (if available) to get a preliminary understanding of what will be provided after acquiring the document.

- Ensure that the document you choose is pertinent to your state/county/locality since state laws can influence the legitimacy of specific forms.

- Look at related forms or restart the search to find the correct document.

- Click Buy now and set up your account. If you have an existing account, opt to Log In.

- Select the pricing {plan, then an appropriate payment method, and buy the Orange Window Contractor Agreement - Self-Employed.

- Choose to save the form template in any available file format.

Form popularity

FAQ

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

You should include the following terms and conditions in your employment contracts: Name and personal details of the employer and the employee. Commencement date of employment and probation period (if a permanent employee). Job title and description setting out the role and duties of the employee.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

An employee usually works as the employer directs them. A contractor runs their own business and provides a service, usually works the hours required to do a task, and has a high level of control over the way they work.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.