Cuyahoga Ohio Terms for Private Placement of Series Seed Preferred Stock refers to the specific terms and conditions that govern the private placement of Series Seed Preferred Stock in the Cuyahoga County, Ohio jurisdiction. This type of stock issuance is typically utilized by startups and early-stage companies to raise capital from a select group of accredited investors. The Cuyahoga Ohio Terms for Private Placement of Series Seed Preferred Stock include various provisions that establish the rights and obligations of both the issuing company and the investors. These terms are designed to protect the interests of the investors while providing necessary flexibility for the company's growth and future funding rounds. Some key terms that may be included in the Cuyahoga Ohio Terms for Private Placement of Series Seed Preferred Stock are: 1. Preferred Dividend: This outlines the rate at which dividends will be paid to the holders of Series Seed Preferred Stock, typically on a quarterly or annual basis. 2. Liquidation Preference: This provision specifies the order in which the proceeds from the sale or liquidation of the company will be distributed among different classes of stockholders. Series Seed Preferred Stockholders usually have a higher priority in receiving their investment back before common stockholders. 3. Conversion Rights: These terms define the conditions under which Series Seed Preferred Stock can be converted into common stock, typically upon the occurrence of a specified event such as an initial public offering (IPO) or a sale of the company. 4. Anti-Dilution Protection: This provision protects investors from dilution by adjusting the conversion ratio in the event of subsequent issuance of stock at a lower price than the initial investment. 5. Voting Rights: Series Seed Preferred Stockholders may be granted certain voting rights, such as the ability to vote on significant corporate actions or the election of board members. 6. Board Representation: Investors may negotiate for the right to nominate one or more individuals to serve on the company's board of directors to represent their interests. It's important to note that while Cuyahoga Ohio is specifically mentioned in the prompt, the terms for private placement of Series Seed Preferred Stock can vary from jurisdiction to jurisdiction. However, these key terms are commonly found in private placement transactions throughout the United States. Within Cuyahoga County, there may not be specific variations in the terms, given that Cuyahoga County is not known for having unique regulations or legal requirements related to Series Seed Preferred Stock. However, it's always advisable for companies and investors to consult legal counsel familiar with local laws to ensure compliance with any jurisdiction-specific requirements.

Cuyahoga Ohio Terms for Private Placement of Series Seed Preferred Stock

Description

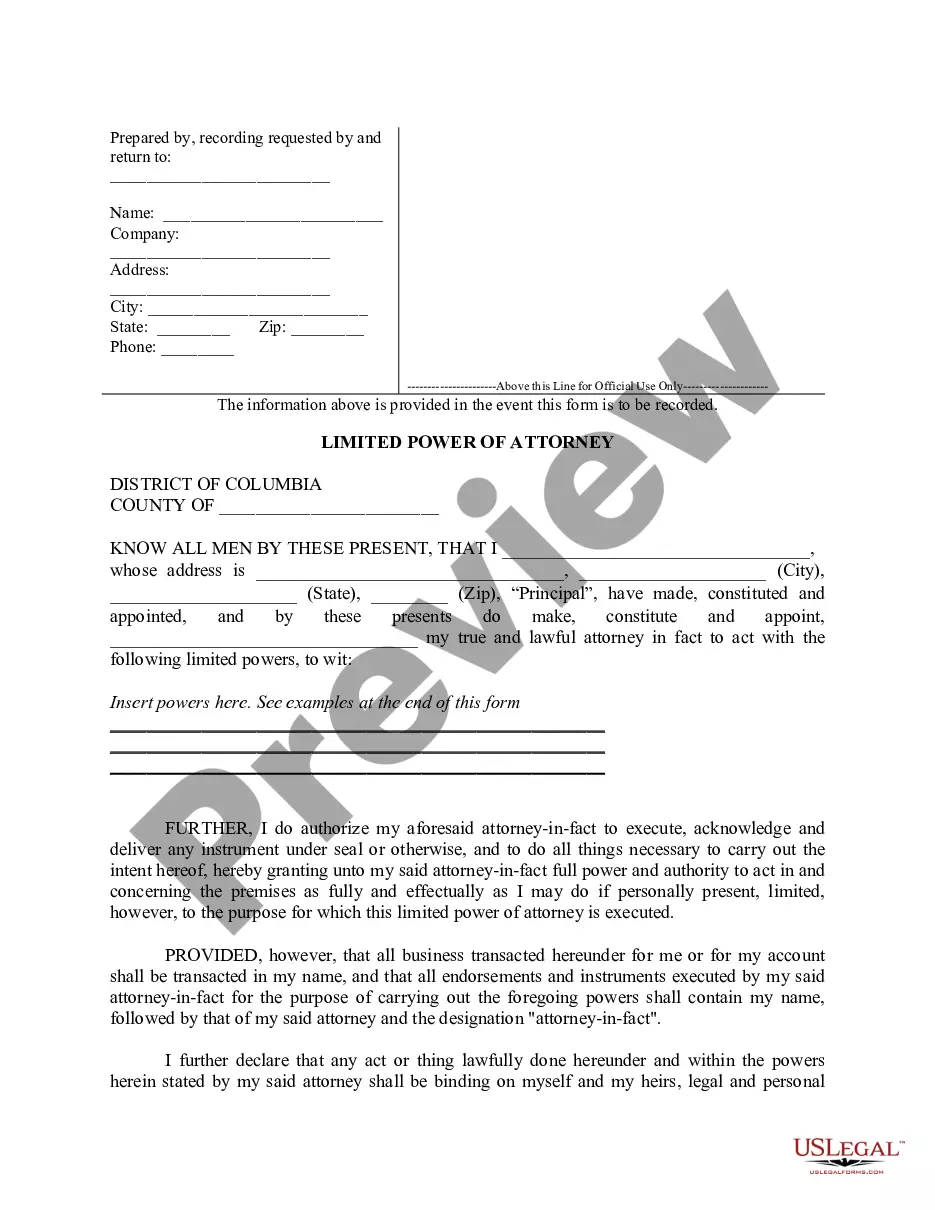

How to fill out Cuyahoga Ohio Terms For Private Placement Of Series Seed Preferred Stock?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cuyahoga Terms for Private Placement of Series Seed Preferred Stock, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Consequently, if you need the recent version of the Cuyahoga Terms for Private Placement of Series Seed Preferred Stock, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Terms for Private Placement of Series Seed Preferred Stock:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Cuyahoga Terms for Private Placement of Series Seed Preferred Stock and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

As the name suggests, a private placement is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors.

A method of marketing of securities whereby the issuer makes the offer of sale of individuals and institutions privately without the issue of a prospectus is known as Private Placement Method. Under this method, securities are offered directly to large buyers with the help of share brokers.

Issuing in the private placement market offers companies a variety of advantages, including maintaining confidentiality, accessing long-term, fixed-rate capital, diversifying financing sources and creating additional financing capacity.

Common Series Seed terms include: Preferred Stock. Preferred stock is a class of stock with certain preferences and rights that are superior to the rights of the common stock that is issued to the founders. Series Seed will generally be issued as preferred stock.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

Private placement by companies means offering its securities or inviting to subscribe its securities for a select group of persons other than by way of a public issue through a private placement offer letter.

As the name suggests, a private placement is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors.

Private Placement and Share Price With a publicly-traded company, the percentage of equity ownership that existing shareholders have prior to the private placement is diluted by the secondary issuance of additional stock, since this increases the total number of shares outstanding.

Seed Preferred Shares means the seed preferred shares in the share capital of the Company, with a par value of US$0.005 each and the rights and privileges as set forth in the Memorandum and Articles.

The original Series Seed equity financing document set was a collaborative effort among lawyers and investors, spearheaded by lawyer-turned-investor Ted Wang, to reduce the cost of fundraising for emerging companies by standardizing the core necessary legal documents, thereby reducing the amount of attorney time