Fulton Georgia Accredited Investor Status Certification Letter

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

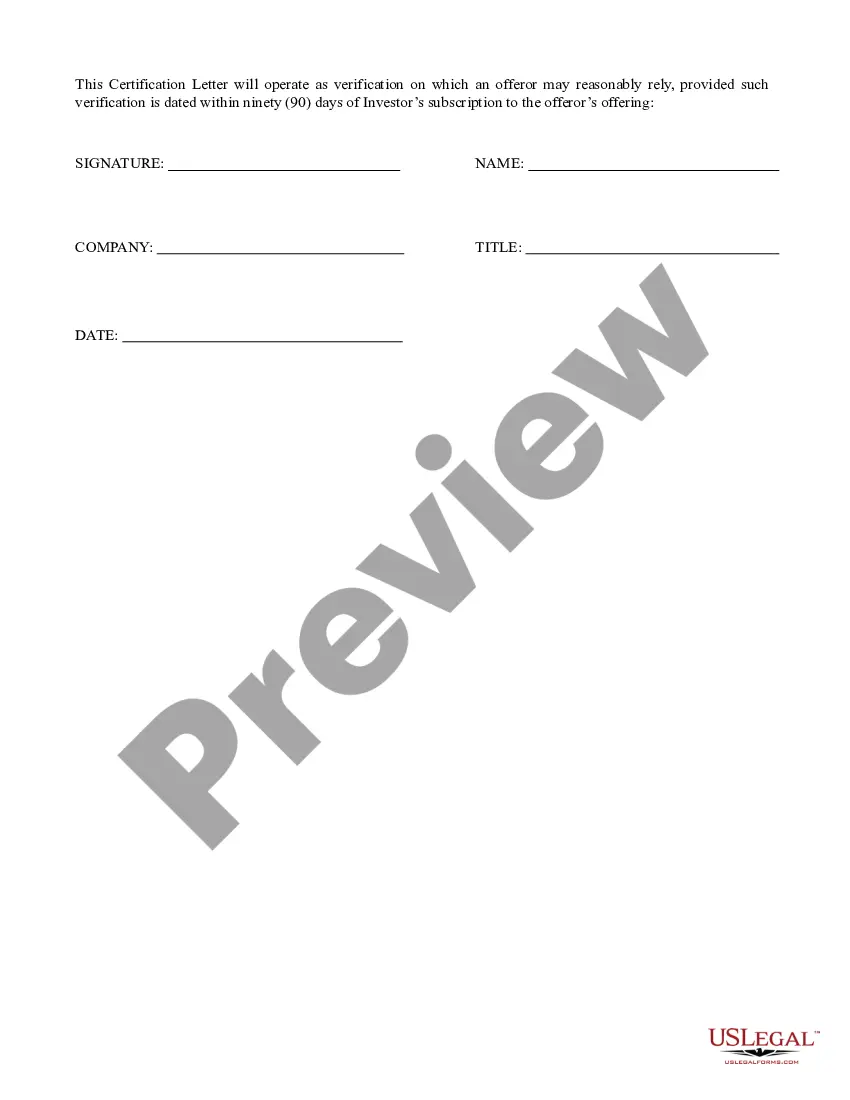

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certification Letter?

Laws and regulations in every sector differ across the nation.

If you're not an attorney, it's simple to become confused among numerous standards when it comes to creating legal documents.

To prevent expensive legal fees when drafting the Fulton Accredited Investor Status Certification Letter, you require a certified template valid for your locality.

That's the most straightforward and cost-effective method to access current templates for any legal situations. Discover them all with a few clicks and keep your documents organized with US Legal Forms!

- That's when utilizing the US Legal Forms platform becomes particularly beneficial.

- US Legal Forms is a reliable online repository with over 85,000 state-specific legal templates used by millions.

- It's an excellent option for professionals and individuals seeking DIY templates for various personal and business situations.

- All forms can be reused: once you acquire a template, it remains accessible in your account for future use.

- Thus, with a subscription account, you can easily Log In and re-download the Fulton Accredited Investor Status Certification Letter from the My documents section.

- For newcomers, a few additional steps are necessary to get the Fulton Accredited Investor Status Certification Letter.

- Inspect the page content to confirm you've located the correct template.

- Utilize the Preview feature or review the form description if present.

Form popularity

FAQ

Do You Have to Prove You Are an Accredited Investor? The burden of proving that you are an accredited investor does not fall directly on you but rather the investment vehicle you would like to invest in. An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor.

Note the SEC requires that no evidence used for verification purposes be any older than 90-days, except for income evidence, these accreditation letters generally expire after 90-days.

However, most investors won't have to frequently undergo intense scrutiny of their financial situations. Instead, they will undergo the verification process only once every five years. During the five-year period, investors may self-certify that they remain accredited.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

An Accreditation Investor Verification Letter is an official document provided by North Capital Private Securities Corporation, through the Accredited.AM website, that you can provide to third parties to satisfy the Accredited Investor verification requirement under Section 506(c) of Regulation D of the Securities Act

To qualify as an accredited investor as a knowledgeable individual or insider, the buyer would request evidence of the buyer's status as a director, general partner or executive at a firm that sells unregistered securities. This evidence may include governing documents, resolutions, or other supporting documents.

You can use a third party letter to obtain an InvestReady certificate as long as the letter is no older than 90 days and it was written by a licensed attorney, CPA, investment advisor, or Broker Dealer.

There are essentially three approaches: (1) the issuer itself can verify each investor's status, (2) the investor's accountant, lawyer, or another professional can verify the investor's status, or (3) the issuer can hire a third-party verification service to verify each investor's status.