Kings New York Accredited Investor Status Certificate Letter-Individual

Description

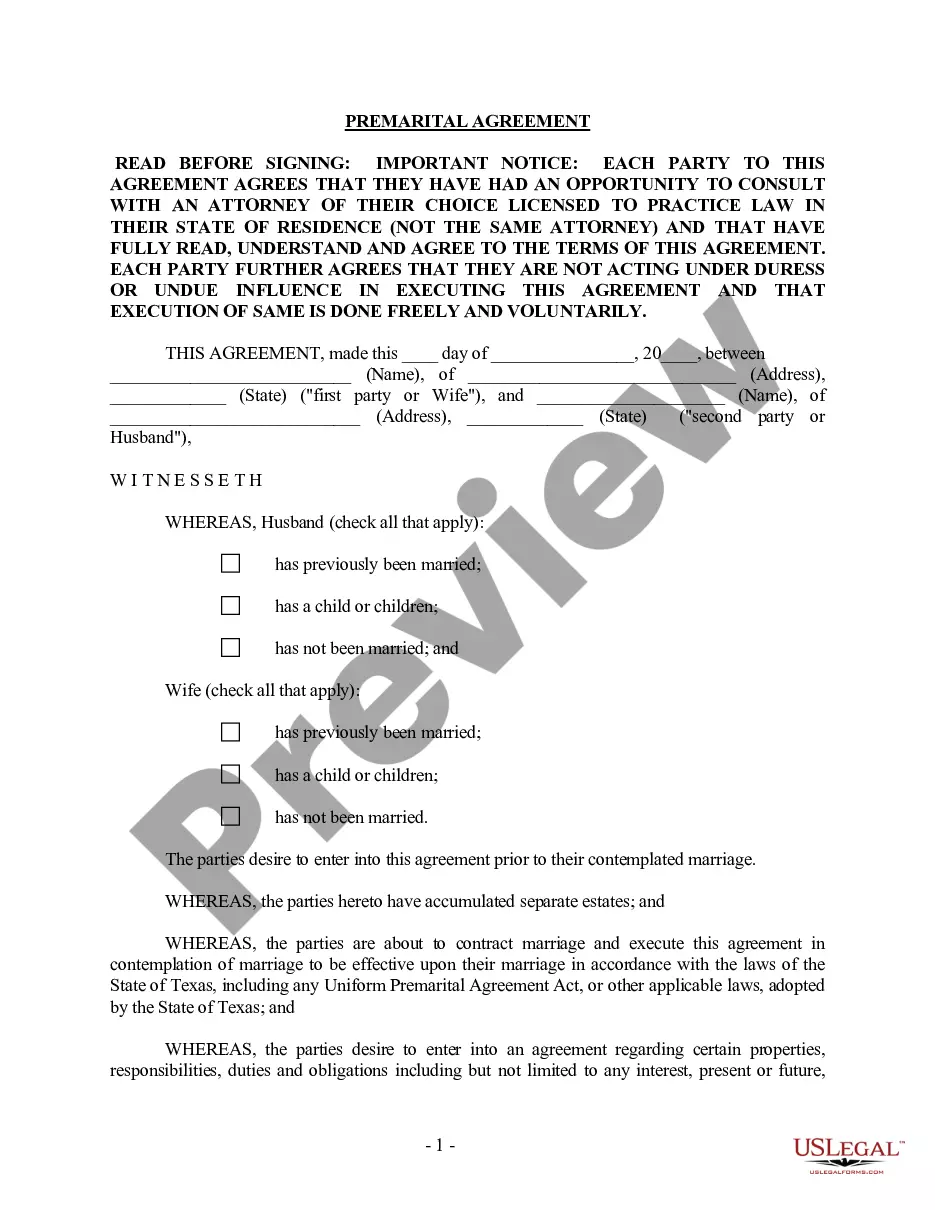

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certificate Letter-Individual?

Managing legal documents is essential in the modern era. However, you don't necessarily need to seek out expert help to construct some of them from scratch, including the Kings Accredited Investor Status Certificate Letter-Individual, using a service like US Legal Forms.

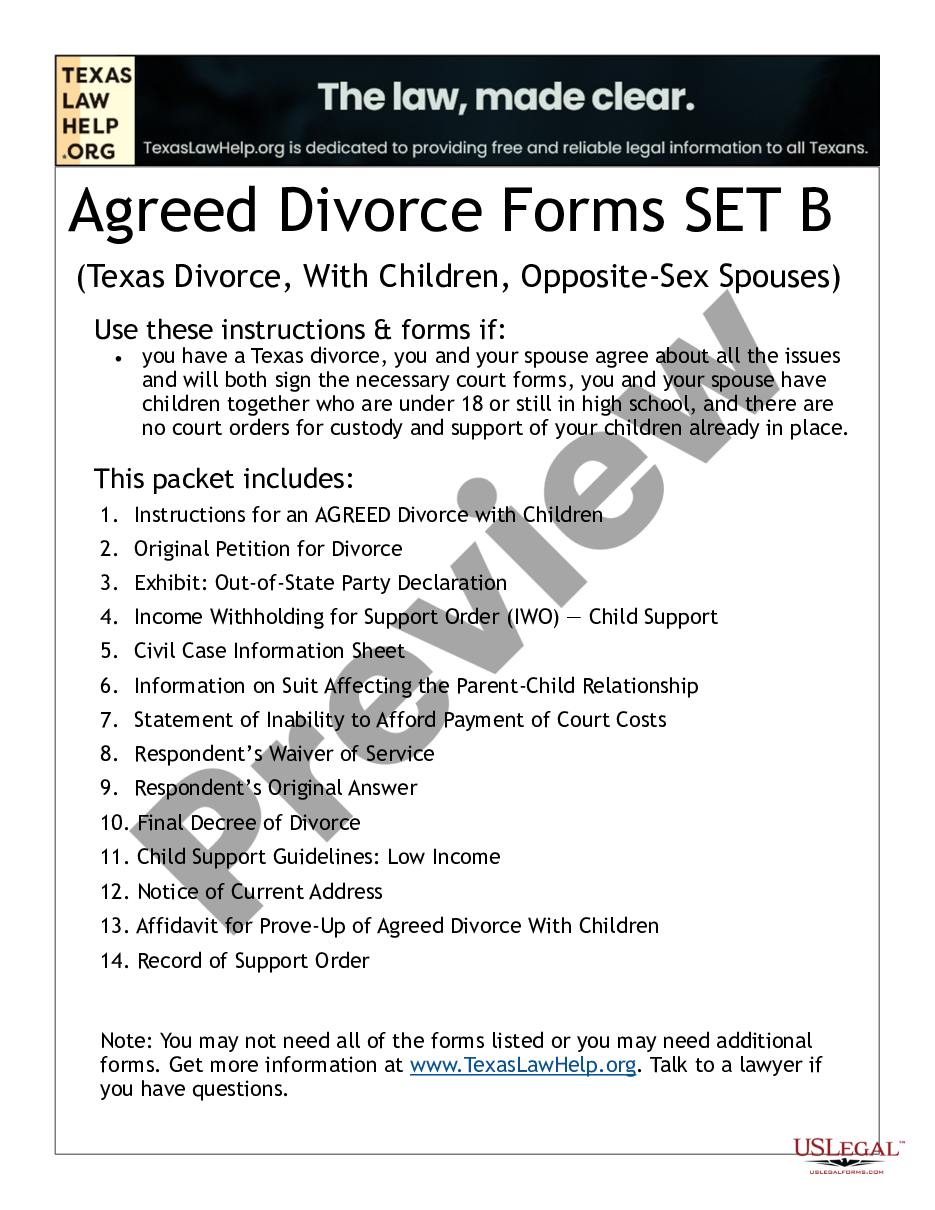

US Legal Forms offers over 85,000 templates to select from across various categories, including living wills, property documents, and divorce agreements. All documents are categorized by their legitimate state, simplifying the search process.

You can also access helpful resources and guides on the site to make any tasks related to document execution easy.

Go to the My documents section to re-download the document.

If you're already a US Legal Forms subscriber, you can find the relevant Kings Accredited Investor Status Certificate Letter-Individual, Log In to your account, and download it. Naturally, our platform cannot fully replace legal counsel. If you're faced with a particularly complicated issue, we advise consulting a lawyer to review your document before completing and submitting it.

With more than 25 years of experience in the industry, US Legal Forms has become a preferred platform for diverse legal documents for millions of users. Join today and obtain your state-specific paperwork with ease!

- Review the document's preview and summary (if available) to gain an overview of what you’ll receive after downloading the file.

- Verify that the document you selected is suitable for your state/county/region as state regulations can influence the acceptance of certain records.

- Look at the related documents or restart your search to find the correct file.

- Click Buy now and set up an account. If you have an existing account, opt to Log In.

- Select your choice, then a suitable payment option, and purchase the Kings Accredited Investor Status Certificate Letter-Individual.

- Choose to save the document template in any available format.

Form popularity

FAQ

An accreditation letter certifies that an individual meets the financial criteria established by regulatory bodies for accredited investors. Essentially, it serves as proof that you are qualified to participate in certain investment opportunities. Having a Kings New York Accredited Investor Status Certificate Letter-Individual can open doors to exclusive investments.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

An accredited investor is a person or entity that is allowed to invest in securities that are not registered with the Securities and Exchange Commission (SEC). To be an accredited investor, an individual or entity must meet certain income and net worth guidelines.

Knowledgeable Employees of Private Funds For a private fund offering, natural persons who are knowledgeable employees of a private fund issuing the securities will qualify as accredited investors for investments in the fund.

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

Individuals (i.e., natural persons) may qualify as accredited investors based on wealth and income thresholds, as well as other measures of financial sophistication.

However, most investors won't have to frequently undergo intense scrutiny of their financial situations. Instead, they will undergo the verification process only once every five years. During the five-year period, investors may self-certify that they remain accredited.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

You can use a third party letter to obtain an InvestReady certificate as long as the letter is no older than 90 days and it was written by a licensed attorney, CPA, investment advisor, or Broker Dealer.