Hillsborough Florida Nonqualified Defined Benefit Deferred Compensation Agreement

Description

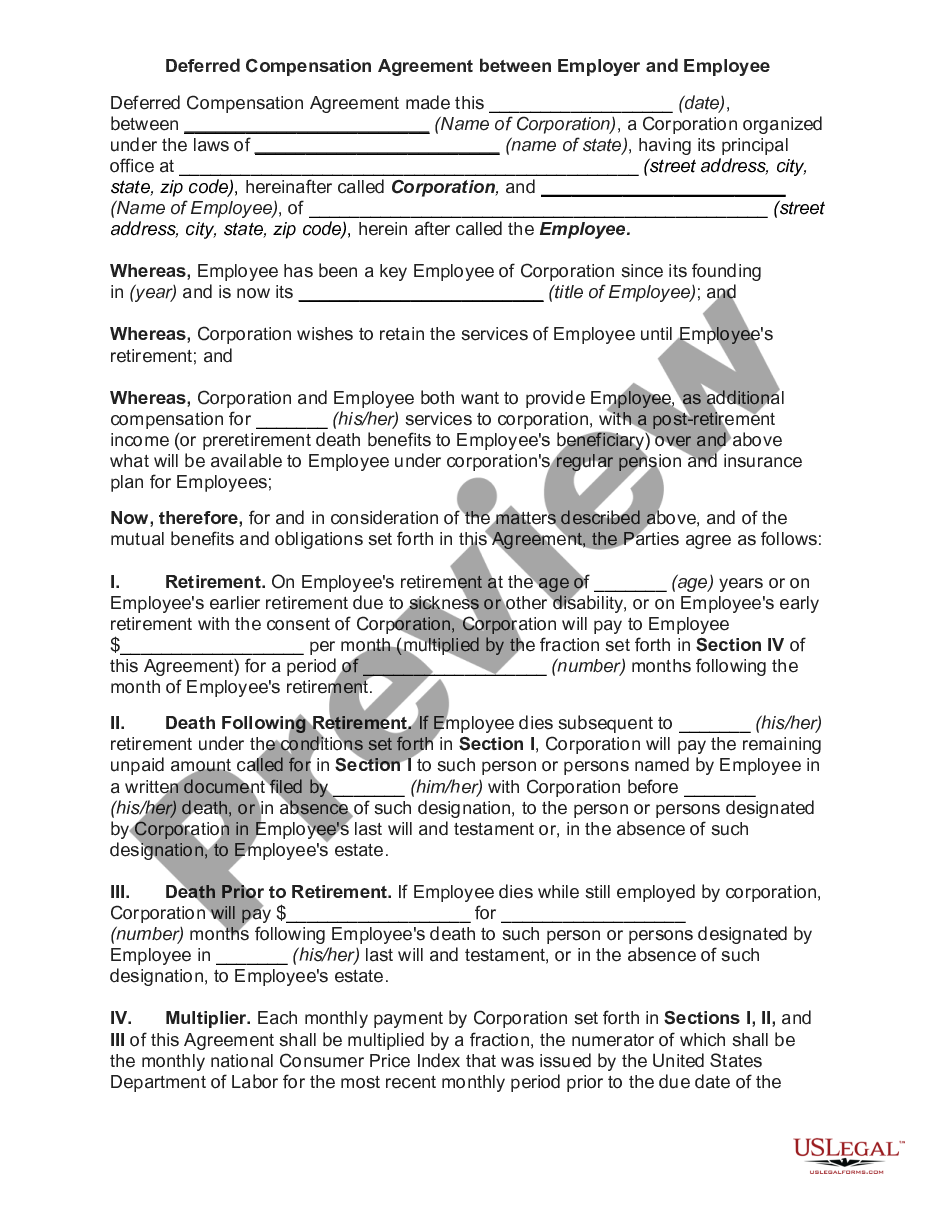

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Creating documents for business or personal requirements is always a significant obligation.

When preparing a contract, a public service application, or a power of attorney, it's important to consider all federal and state regulations of the specific area.

However, smaller counties and even municipalities also have legislative rules that you need to take into account.

To locate the one that satisfies your needs, use the search tab in the page header. Double-check that the template adheres to legal standards and click Buy Now. Choose the subscription plan, then Log In or register for an account with the US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the chosen document in your desired format, print it, or complete it electronically. The wonderful aspect of the US Legal Forms library is that all the paperwork you've ever acquired remains accessible—you can retrieve it in your profile within the My documents tab at any time. Join the platform and easily access verified legal forms for any situation with just a few clicks!

- All these factors make it challenging and time-consuming to prepare the Hillsborough Nonqualified Defined Benefit Deferred Compensation Agreement without professional help.

- It's straightforward to prevent unnecessary expenses on lawyers drafting your documents and generate a legally recognized Hillsborough Nonqualified Defined Benefit Deferred Compensation Agreement by yourself, utilizing the US Legal Forms online library.

- It is the largest online repository of state-specific legal documents that are expertly reviewed, so you can be confident in their authenticity when selecting a sample for your region.

- Previously subscribed users just need to Log In to their accounts to retrieve the needed form.

- If you do not have a subscription yet, follow the step-by-step guidance below to obtain the Hillsborough Nonqualified Defined Benefit Deferred Compensation Agreement.

- Browse the page you've opened and confirm if it contains the document you need.

- To do this, use the form description and preview if these features are available.

Form popularity

FAQ

Nonqualified deferred compensation provides an excellent way to offer executives additional benefits beyond what's provided for the general employee base. Putting these plans into play may increase your ability to attract and retain top employee talent.

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.

A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages by deferring a greater percentage of their compensation (and current income taxes) than is allowed by the IRS in a qualified retirement plan.

A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages by deferring a greater percentage of their compensation (and current income taxes) than is allowed by the IRS in a qualified retirement plan.

NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. You should consider contributing to a corporate NQDC plan only if you are maxing out your qualified plan options, such as a 401(k).

Like a 401(k) plan, an NQDC plan allows employees to defer compensation until retirement or some other predetermined date. In addition to avoiding current income taxes on contributions, employees enjoy tax-deferred growth of accumulated earnings.

"Deferring this income provides one tax advantage: You don't pay federal or state income tax on that portion of your compensation in the year you defer it (you pay only Social Security and Medicare taxes), so it has the potential to grow tax-deferred until you receive it."

A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages by deferring a greater percentage of their compensation (and current income taxes) than is allowed by the IRS in a qualified retirement plan.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.