Oakland Michigan Leased Personal Property Workform

Description

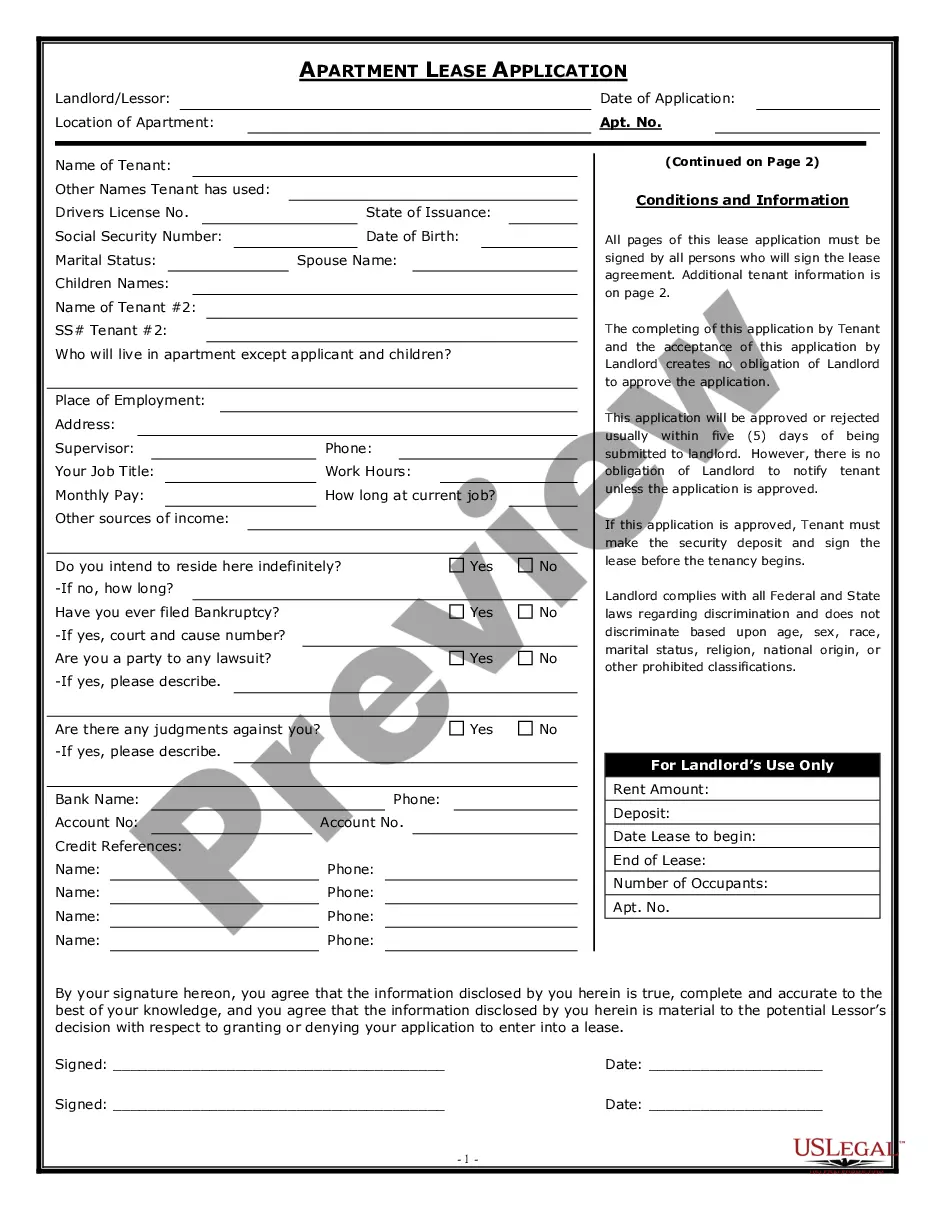

How to fill out Leased Personal Property Workform?

Drafting documentation, such as the Oakland Leased Personal Property Workform, to oversee your legal matters can be a demanding and time-consuming endeavor. Numerous situations necessitate an attorney’s involvement, which can also render this process costly. Nevertheless, you have the capability to manage your legal concerns independently. US Legal Forms is here to assist. Our platform provides more than 85,000 legal templates designed for various scenarios and life situations. We guarantee that each document complies with the statutes of every state, ensuring you won’t have to worry about possible legal compliance issues.

If you are already familiar with our platform and hold a subscription with US, you understand how simple it is to obtain the Oakland Leased Personal Property Workform template. Just Log In to your account, download the template, and customize it to fit your needs. Have you misplaced your form? No problem. It can be located in the My documents section in your account - accessible on both desktop and mobile.

The onboarding process for new users is equally straightforward! Here’s what you need to complete before acquiring the Oakland Leased Personal Property Workform: Ensure that your form is tailored to your state/county as regulations for preparing legal documentation can vary between states. Gain further insight about the form by previewing it or reviewing a concise description. If the Oakland Leased Personal Property Workform isn’t what you were searching for, utilize the search bar at the header to find an alternative.

Finding and purchasing the right document with US Legal Forms is effortless. Countless businesses and individuals are already benefiting from our extensive library. Join now if you want to discover what other benefits you can gain with US Legal Forms!

- Sign in or create an account to start using our website and download the document.

- Everything appears satisfactory on your end? Click the Buy now button and choose the subscription plan.

- Select the payment method and enter your payment information.

- Your template is ready. You can attempt to download it.

Form popularity

FAQ

A personal exemption in Michigan allows individuals to exclude a portion of their income from taxation. This exemption can affect various tax situations, including those related to personal property. Knowing your eligibility for exemptions can help you optimize your finances. Utilizing resources like the Oakland Michigan Leased Personal Property Workform can assist in navigating these regulations.

In general, most CA small businesses will pay between $50 and $100 for a general business license. Larger corporations may be subject to charges based on their projected revenue.

Step 3- Get a City of Oakland Business License ($95) Every business in Oakland, including home-based businesses and property owners who rent residential or commercial space, need to file a Business Tax Certificate and pay an annual tax. You can: Apply Online.

Beyond reducing the taxable value of your home, California allows for exemptions from property taxes if you meet certain requirements....Method #2: Claim All Tax Breaks to Which You're Entitled Main residence.Veterans.Disabled veterans.Senior citizens who buy a new California home.Disaster relief.Family transfers.

If you own a home and it is your principal place of residence on January 1, you may apply for an exemption of $7,000 from your assessed value. New property owners will automatically receive a Homeowners' Property Tax Exemption Claim Form.

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st.

California's Eviction Moratorium expired on September 30th. However, Oakland's Emergency Moratorium will continue to prohibit most evictions, rent increases beyond the CPI, and late fees on covered units until the City Council lifts the local emergency.

A property owner is not required to pay a property tax in California if they are 65 years or older. You can find more information on the California Board of Equalization website.

You may be eligible for property tax assistance if you are 62 years of age or older, blind or disabled, own and live in your own home, and meet certain household income limitations. For additional information regarding homeowner property tax assistance, contact the California Franchise Tax Board at 1-800-868-4171.

We will review and process eligible applications, as funding allows. Oakland residents will be contacted by one of our partner agencies (BACS, EDC, EBALDC & Safe Passages) within the next 30-45 business days. No further action is needed from you, at this time.