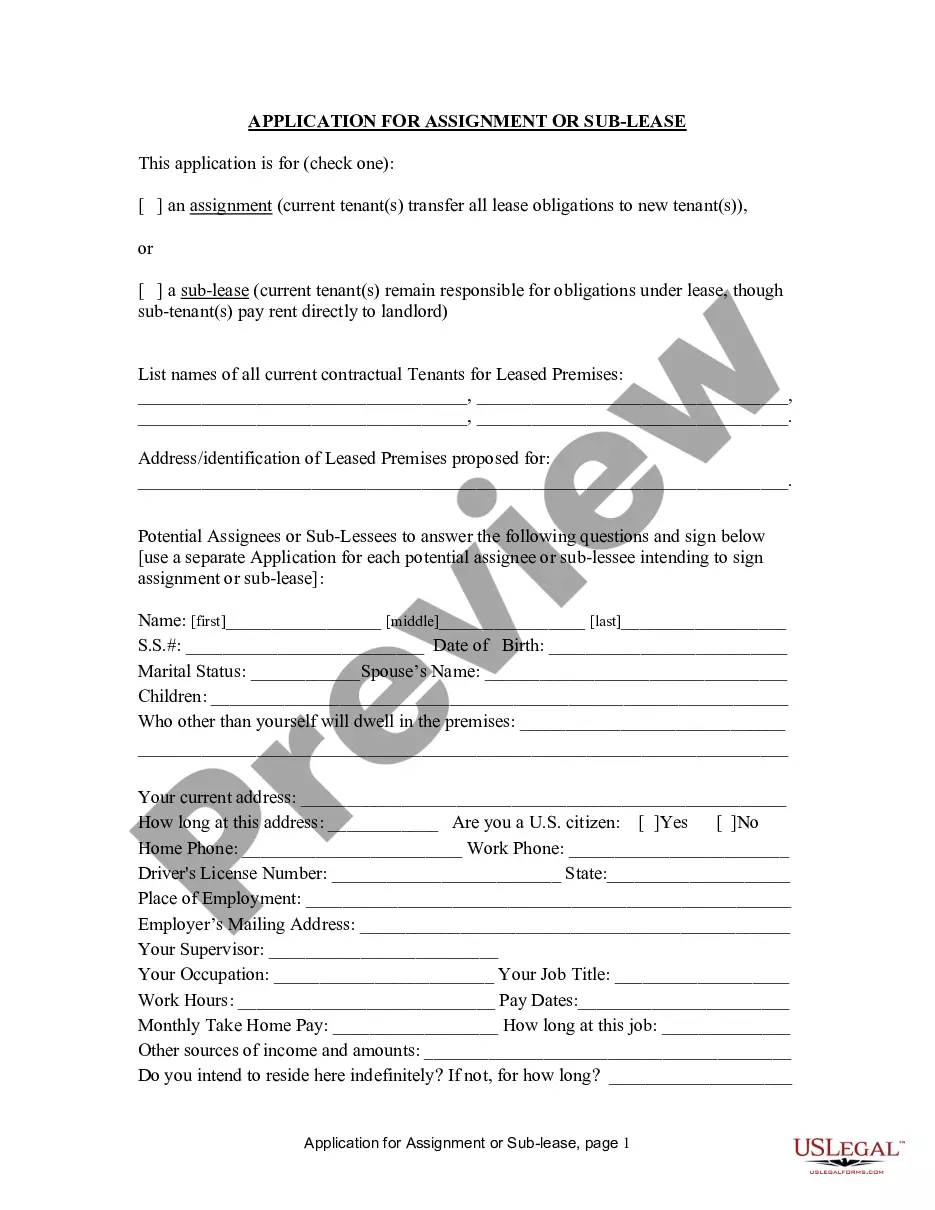

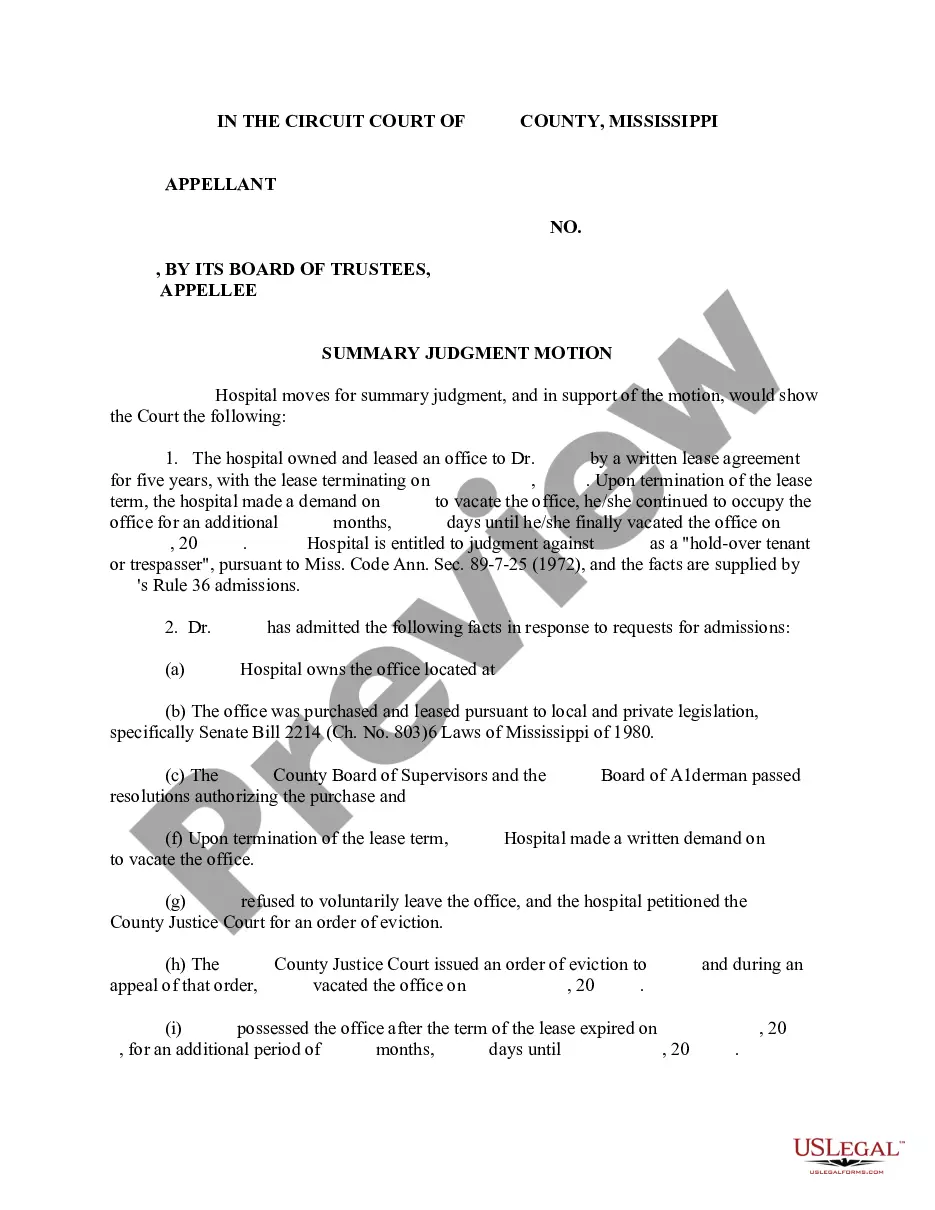

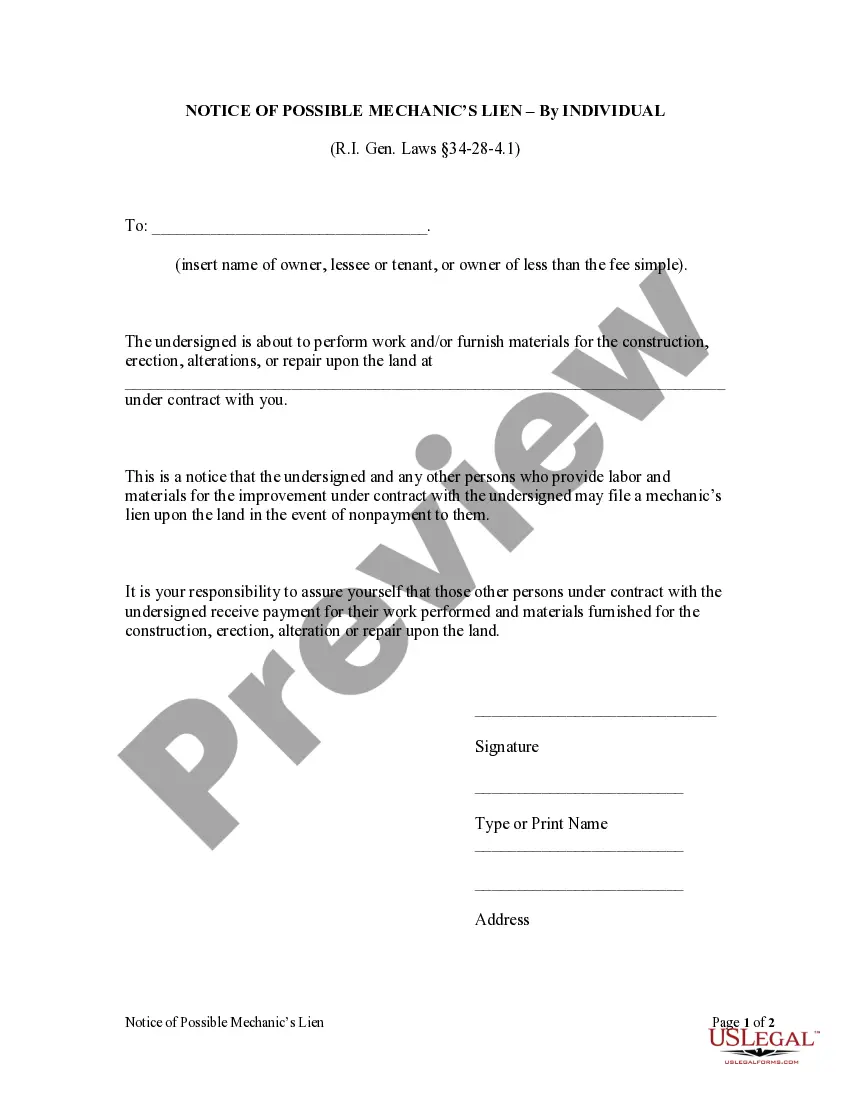

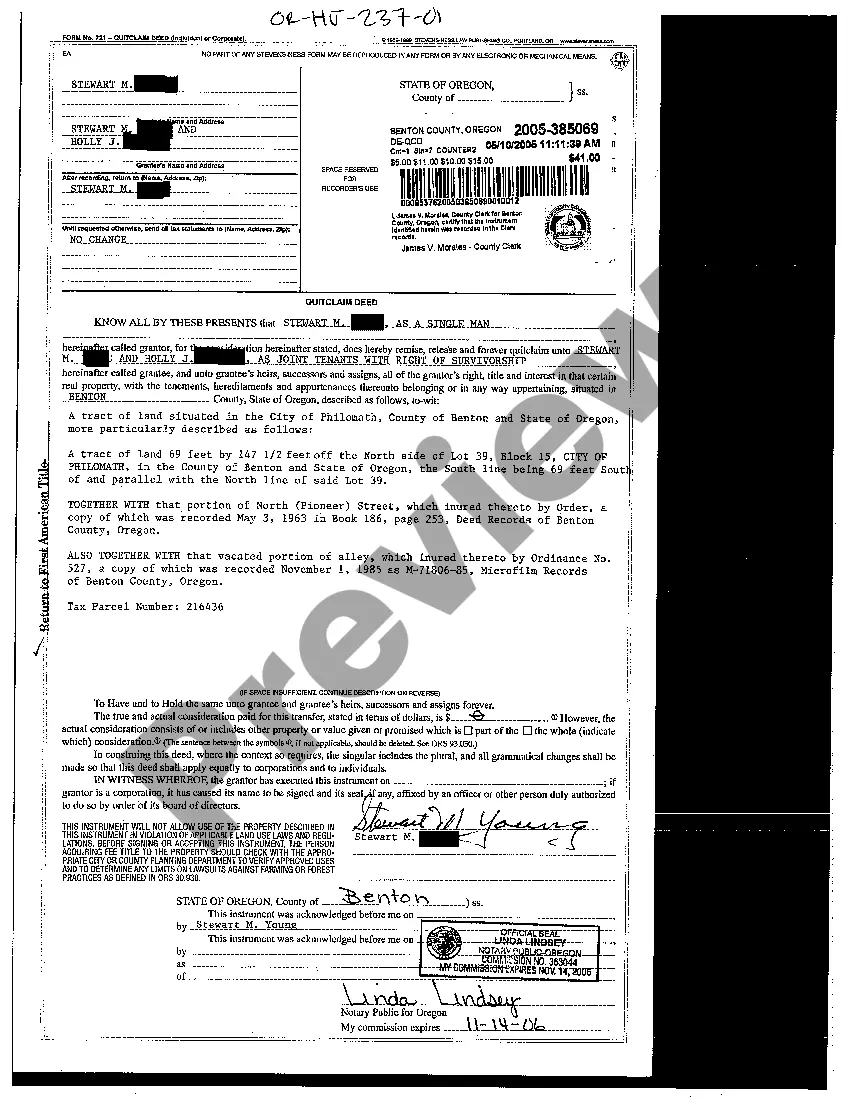

This form is a due diligence checklist used for summarizing and reviewing general business transactions.

Franklin Ohio Summary Due Diligence Checklist for Review Purposes General Business Transaction

Description

How to fill out Franklin Ohio Summary Due Diligence Checklist For Review Purposes General Business Transaction?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official paperwork that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the Franklin Summary Due Diligence Checklist for Review Purposes General Business Transaction.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Franklin Summary Due Diligence Checklist for Review Purposes General Business Transaction will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Franklin Summary Due Diligence Checklist for Review Purposes General Business Transaction:

- Make sure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Franklin Summary Due Diligence Checklist for Review Purposes General Business Transaction on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

Due Diligence Process Steps, Policies and Procedures Evaluate Goals of the Project. As with any project, the first step delineating corporate goals.Analyze of Business Financials.Thorough Inspection of Documents.Business Plan and Model Analysis.Final Offering Formation.Risk Management.

As part of this process we focus on three main areas: Commercial due diligence. Financial due diligence. Legal due diligence.

Checklist for Due Diligence of Company Business Due Diligence.Documents Required During Company Due Diligence.Review of MCA Documents.Review of Articles of Association.Review of Statutory Registers of Company.Review of Book of Accounts and Financial Statements.Review of Taxation Aspects.Review of Legal Aspects.

What Is a Due Diligence Checklist? Preparing an audited financial statement or annual report. A public or private financing transaction. Major bank financing. A joint venture. An initial public offering (IPO) General risk management.

When writing a due diligence report (what others may call an IT assessment report), keep four things in mind: Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

A tax due diligence requirements checklist includes property taxes, tax assets, audits, returns and any overseas activities. Target companies should provide extensive documentation on their tax history to prove their legality, legitimacy, and viability.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Interesting Questions

More info

• How can lenders ensure that the due diligence is thorough? The Board may designate a board-designated employee to serve as a liaison to the due diligence procedures, and, the Board may designate a third party responsible for coordinating the due diligence and financial obligations of the lenders. 6.13.3.6 Determining Ownership Interests Banks and other financial institutions may require borrowers to furnish information identifying each container who is authorized to assume its interest in the collateral secured by the notes or the related obligations. A bank will use such information to determine, to the extent possible and consistent with applicable laws concerning collateral management and security interests in certain liens, if any, and how they may be exercised, who may act as the creditor in the event of bankruptcy of the container, and to whom the liability may be assigned. In general, banks should seek creditworthy, experienced and reputable persons as co-lienholders.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.