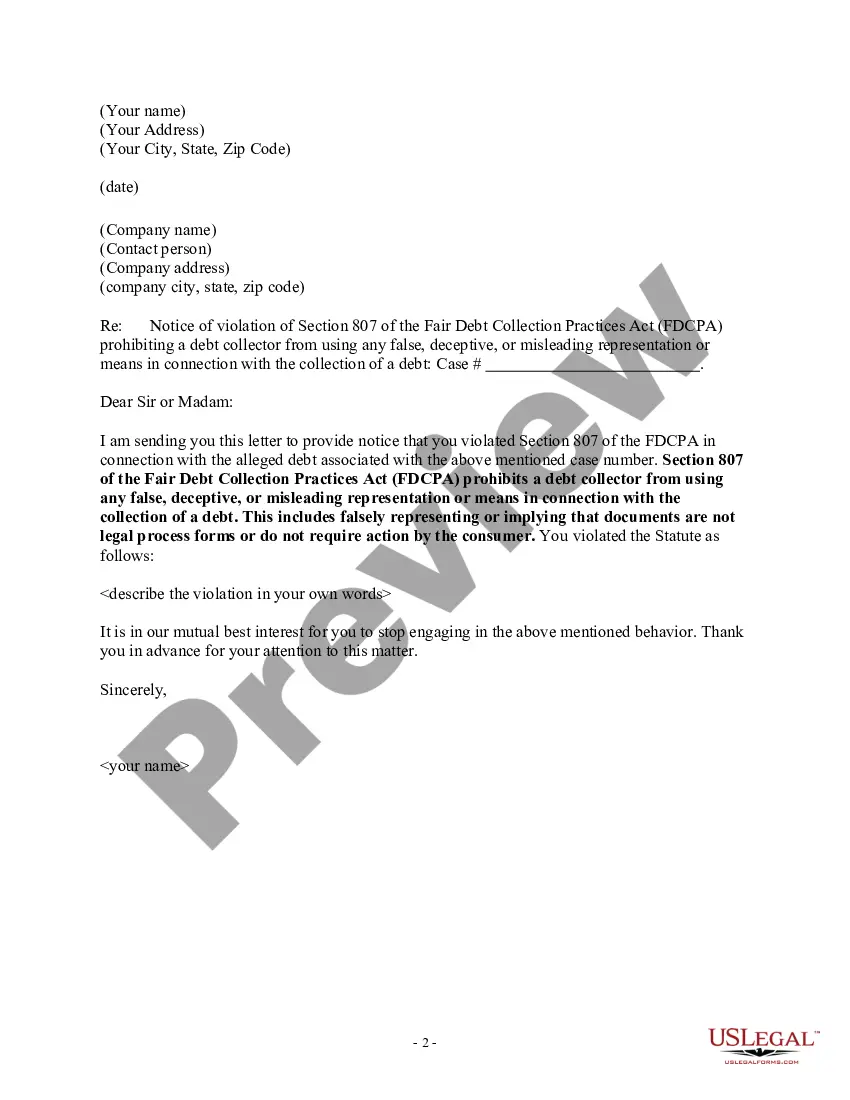

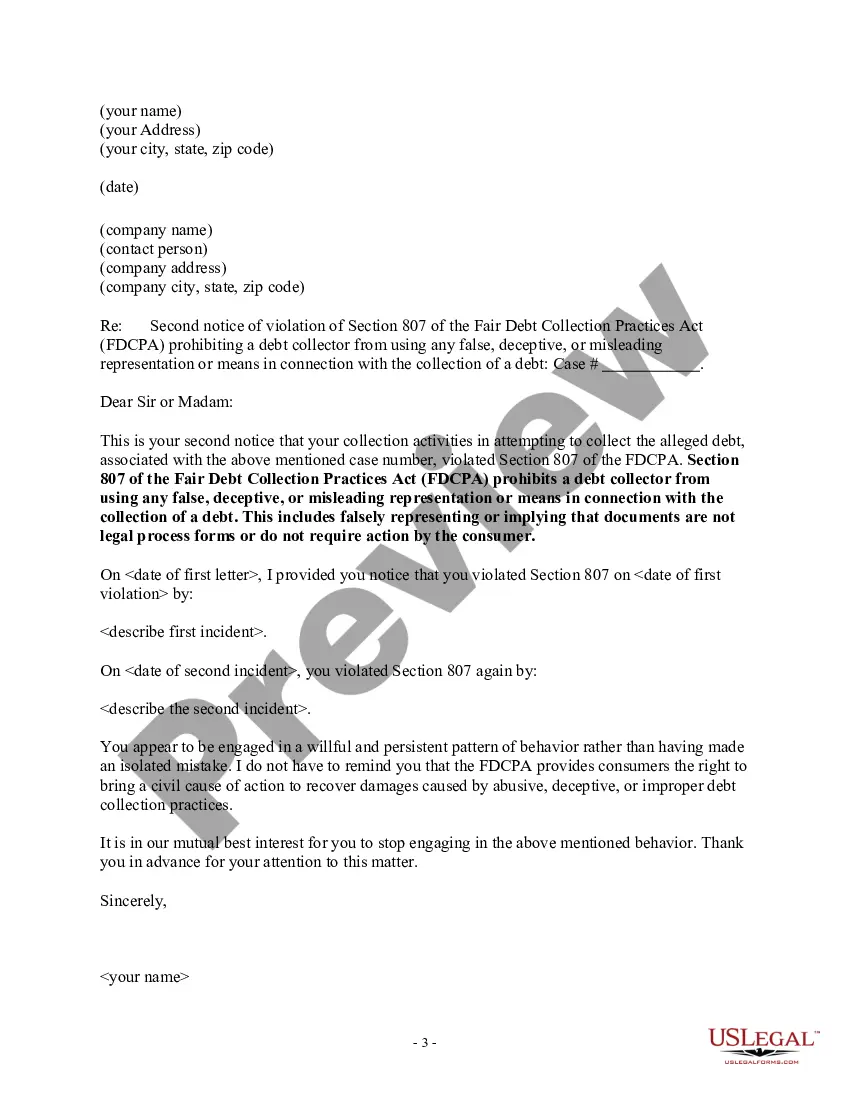

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

King Washington Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Creating documents for the enterprise or personal requirements is always a significant obligation.

When formulating an arrangement, a public service application, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular region.

Nevertheless, small counties and even municipalities also possess legislative regulations that you must consider.

The best part about the US Legal Forms library is that every document you've ever purchased remains accessible - you can retrieve it in your profile within the My documents section anytime. Join the platform and swiftly access verified legal forms for any circumstance with just a few clicks!

- All these factors render it pressure-filled and labor-intensive to produce King Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action without professional help.

- It's simple to prevent squandering funds on lawyers preparing your documents and create a legally valid King Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action independently, utilizing the US Legal Forms online library.

- It is the largest internet repository of state-specific legal templates that are expertly reviewed, so you can trust their legitimacy when selecting a template for your region.

- Previously subscribed members only need to Log In to their profiles to acquire the necessary form.

- If you are still without a subscription, follow the outlined steps below to obtain the King Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- Browse the page you’ve accessed and verify if it contains the document you need.

- To do so, utilize the form description and preview if these choices are available.

Form popularity

FAQ

What are the provisions of the FDCPA? Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

Come to your workplace Under the FDCPA, it's illegal for a debt collector to come to your workplace to collect payment. The act prohibits publicizing your debts, and showing up at your job to collect your debt counts. This means that debt collectors cannot harass you in-person at your work.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Misrepresentation: Collectors can't try to pretend being someone else. Debtors have reported collectors posing as law enforcement agents, attorneys and credit reporting agency officials. Impersonating a police officer is illegal in many jurisdictions, and it's prohibited everywhere as a debt-collection ploy.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Report debt collection scams and abuse to the CFPB (online or by calling 855-411-2372), the FTC (online or by calling 877-382-4357) and your state's attorney general. To get your free credit reports, go to AnnualCreditReport.com, the only federally authorized source.

A creditor believes you are past due on a debt. Creditors may use their own in-house debt collectors or may refer or sell your debt to an outside debt collector. A debt collector also may be calling you to locate someone you know, as long as the collector does not reveal that they are collecting a debt.

Pretend to Work for a Government Agency The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement. They also cannot claim to be working for a consumer reporting agency.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).