Travis Texas Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To The Federal Trade Commission?

Developing legal documents is essential in the modern era.

Nonetheless, you don't always need to seek expert help to generate some of them from scratch, such as Travis Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission, utilizing a platform like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from in diverse categories ranging from living wills to real estate paperwork to divorce forms.

If you already have an account, choose to Log In.

Select the payment option, then the required payment method, and purchase the Travis Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission.

- All documents are categorized according to their applicable state, enhancing the search process.

- You can also access informational resources and guides on the site to simplify any tasks related to document preparation.

- Here’s how to locate and download the Travis Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission.

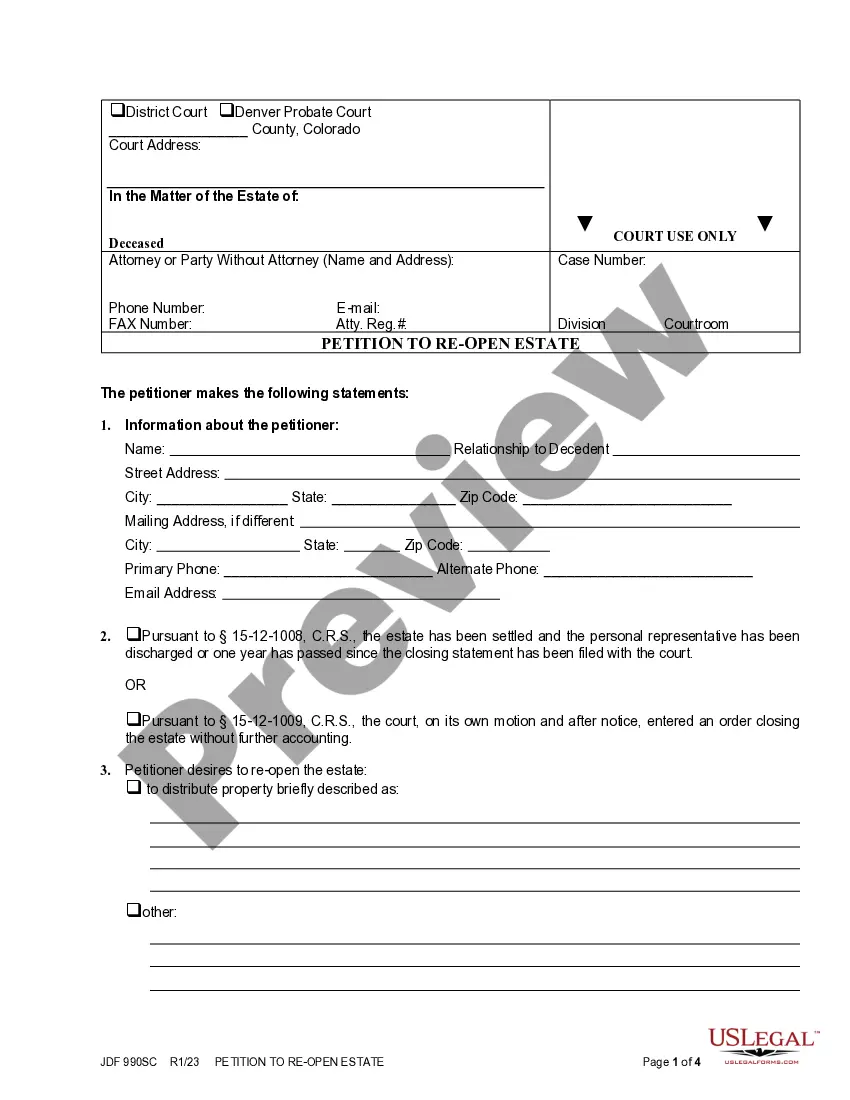

- Review the document’s preview and details (if available) to gain a general understanding of what you will receive after obtaining the document.

- Make sure the template you select is relevant to your state/county/region, as local regulations can impact the legitimacy of certain records.

- Look at related documents or restart the search to find the correct file.

- Click Buy now and set up your account.

Form popularity

FAQ

Texas and Federal Law The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

You can still be sued on that debt. Can a debt collector threaten to sue me or tell me that I will be arrested if I don't pay? A debt collector can never imply that you have committed a crime or tell you that you will be arrested if you don't pay. Debt collectors can threaten to sue you if they intend to do so.

What are the provisions of the FDCPA? Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

The Texas Debt Collection Act is the State of Texas's equivalent of the federal Fair Debt Collection Practices Act (FDCPA). Both laws aim to protect consumers from unfair collection practices and do so by prohibiting debt collectors from using abusive, fraudulent, or misleading tactics during attempts to collect debts.

The Texas Debt Collection Act also sets a statute of limitations for collecting debts. In Texas, debt collectors only have four years to collect a debt, and that limited timeframe means that debt collectors cannot pursue legal action against a debtor if a debt is more than four years old.

When a debt is paid off on time, it will generally do little damage to a person's credit score. However, an overdue debt, particularly one that the creditor has sent into collections, will pull down a person's score for a long time. In Texas, debts can remain on a credit report for up to seven years.

They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.