Hennepin Minnesota Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

Creating documents for business or personal needs is always a significant obligation.

When setting up an agreement, a public sector request, or a decree of authorization, it's vital to take into account all national and state statutes and regulations of the specific area.

Nevertheless, small counties and even municipalities also possess legislative rules that you must consider.

Reconfirm that the template meets legal standards and click Buy Now. Select the subscription plan, then sign in or create an account with US Legal Forms. Use your credit card or PayPal account to pay for your subscription. Download the selected file in the desired format, print it, or complete it online. The wonderful aspect of the US Legal Forms library is that all the documents you've previously purchased are never lost - you can retrieve them in your profile under the My documents section at any time. Join the platform and easily access validated legal templates for any situation with just a few clicks!

- All these particulars render it cumbersome and time-consuming to formulate a Hennepin Proposal to lessen permitted common and preferred stocks without professional help.

- It's simple to circumvent spending on lawyers for drafting your documents and generate a legally acceptable Hennepin Proposal to lessen permitted common and preferred shares independently, using the US Legal Forms online library.

- It is the largest online repository of state-specific legal templates that are professionally verified, so you can trust their legitimacy when choosing a template for your county.

- Past subscribers only need to Log In to their accounts to retrieve the required form.

- If you do not have a subscription yet, follow the step-by-step instructions below to acquire the Hennepin Proposal to lessen permitted common and preferred shares.

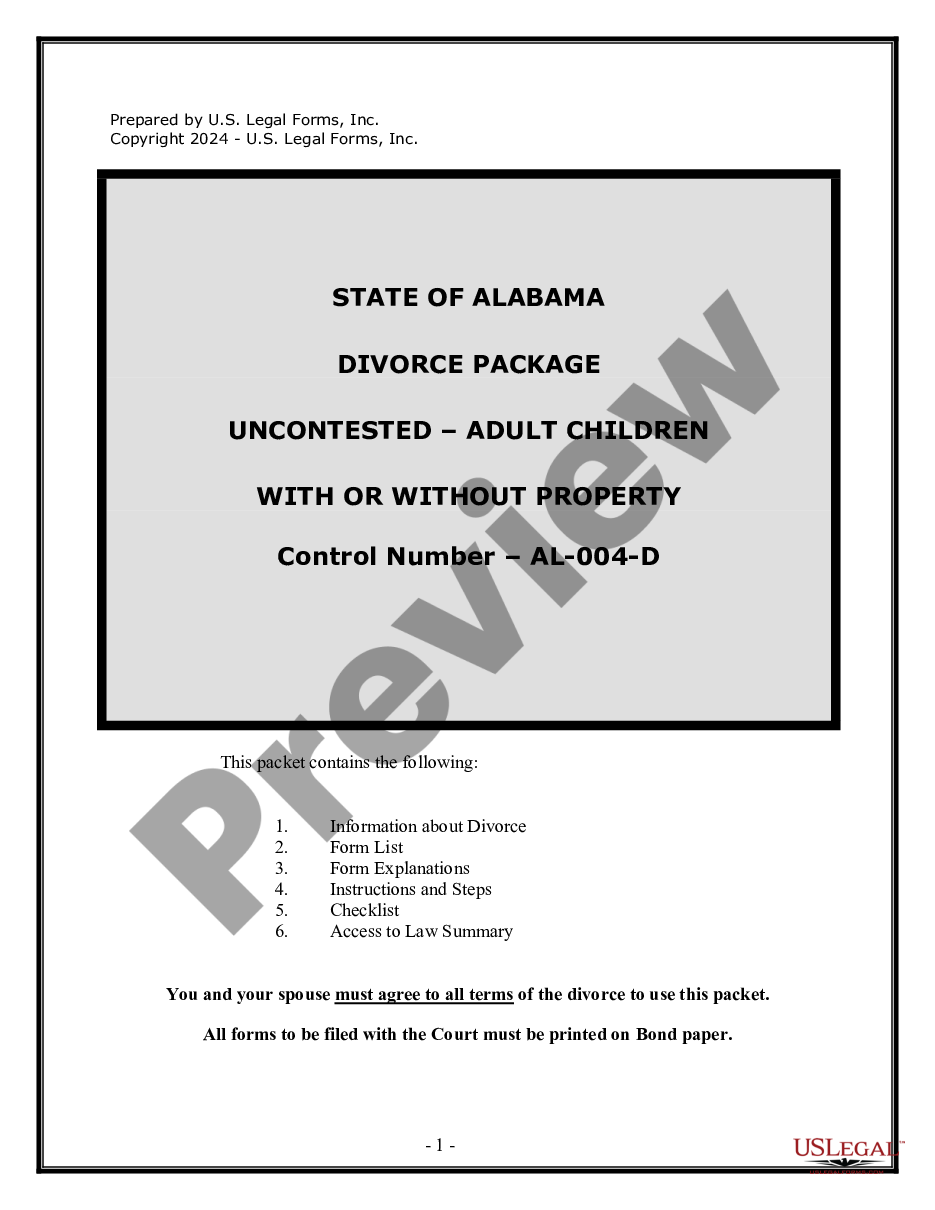

- Browse the page you've accessed and verify if it contains the document you need.

- To achieve this, utilize the form description and preview if these features are present.

Form popularity

FAQ

However, more like stocks and unlike bonds, companies may suspend these payments at any time. Preferred stocks oftentimes share another trait with many bonds the call feature. The company that sold you the preferred stock can usually, but not always, force you to sell the shares back at a predetermined price.

Stocks are far harder to value, because the future cash income associated with a stock is far more difficult to predict. The more profitable the company, the more cash it can distribute to stockholders. There is practically no limit to how high the dividend payments can be.

Preferred stockholders also rank higher in the company's capital structure (which means they'll be paid out before common shareholders during a liquidation of assets). Thus, preferred stocks are generally considered less risky than common stocks, but more risky than bonds.

Pros and Cons of Preferred Stock ProsConsRegular dividendsFew or no voting rightsLow capital loss riskLow capital gain potentialRight to dividends before common stockholdersRight to dividends only if funds remain after interest paid to bondholders1 more row ?

A company may refrain from issuing all of its authorized shares to maintain a controlling interest in the company and therefore prevent a hostile takeover. The number of authorized shares can be changed by shareholder vote.

Common stock tends to outperform bonds and preferred shares. It is also the type of stock that provides the biggest potential for long-term gains. If a company does well, the value of a common stock can go up. But keep in mind, if the company does poorly, the stock's value will also go down.

Preferred stocks do provide more stability and less risk than common stocks, though. While not guaranteed, their dividend payments are prioritized over common stock dividends and may even be back paid if a company can't afford them at any point in time.

Preferred stock may be a better investment for short-term investors who can't hold common stock long enough to overcome dips in the share price. This is because preferred stock tends to fluctuate a lot less, though it also has less potential for long-term growth than common stock.

Most shareholders are attracted to preferred stocks because they offer more consistent dividends than common shares and higher payments than bonds. However, these dividend payments can be deferred by the company if it falls into a period of tight cash flow or other financial hardship.

List of the Advantages of Common Stocks You can invest in companies with limited liability.Common stocks offer a higher earning potential.You can easily purchase common stock on virtually any trading platform.Common stocks can provide dividends.You can trade common stocks in a variety of ways.