Travis Texas Real Property — Schedule — - Form 6A - Post 2005 is a legal document that provides a detailed description of real estate properties located in Travis County, Texas. This form is a crucial part of the real estate transaction process and is used to conduct thorough due diligence and ensure accurate representation of the property's characteristics. This form generally includes the following information: 1. Property Identification: The Schedule A form begins by identifying the property through its legal description, which typically includes the tract/lot number, subdivision name, and any relevant block numbers. It may also include information about the county, district, and relevant surveys. 2. Abstract of Title: This section outlines the ownership history of the property, including the names of previous and current owners, along with dates of acquisition. Any liens, encumbrances, or easements affecting the property will also be documented here. 3. Deed and Title Information: The form includes details regarding the type of deed that will convey the property, such as general warranty deed, special warranty deed, or quitclaim deed. It further provides information about the title policy, title company, and closing date, ensuring clarity and transparency during the transaction process. 4. Survey and Legal Description: This section provides additional details about the property's boundaries, dimensions, and improvements like buildings or structures. It may reference a plat, map, or survey that is attached or recorded with the county. 5. Tax Information: The Schedule A form also includes information related to property taxes, including the tax identification number, appraised value, and any outstanding taxes payable. This assists the buyer in understanding the tax liabilities associated with the property. Different types of Travis Texas Real Property — Schedule — - Form 6A - Post 2005 can be categorized based on the specific nature of the real estate transaction. For example: 1. Residential Property Schedule A: This type of schedule would be used for single-family homes, condominiums, townhouses, or any residential property within Travis County. 2. Commercial Property Schedule A: This schedule is intended for commercial real estate properties such as office buildings, retail spaces, warehouses, or any other non-residential properties located in Travis County. 3. Vacant Land Schedule A: This form is specific to undeveloped land or parcels without any existing structures and is used to describe the boundaries, easements, and any related information pertaining to vacant land in Travis County. In conclusion, Travis Texas Real Property — Schedule — - Form 6A - Post 2005 is an essential legal instrument used to accurately describe and document real estate properties in Travis County, Texas. Proper completion of this form is crucial to ensuring transparent real estate transactions and minimizing potential disputes or misunderstandings between buyers and sellers.

Travis Texas Real Property - Schedule A - Form 6A - Post 2005

Description

How to fill out Travis Texas Real Property - Schedule A - Form 6A - Post 2005?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Travis Real Property - Schedule A - Form 6A - Post 2005, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Travis Real Property - Schedule A - Form 6A - Post 2005 from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Travis Real Property - Schedule A - Form 6A - Post 2005:

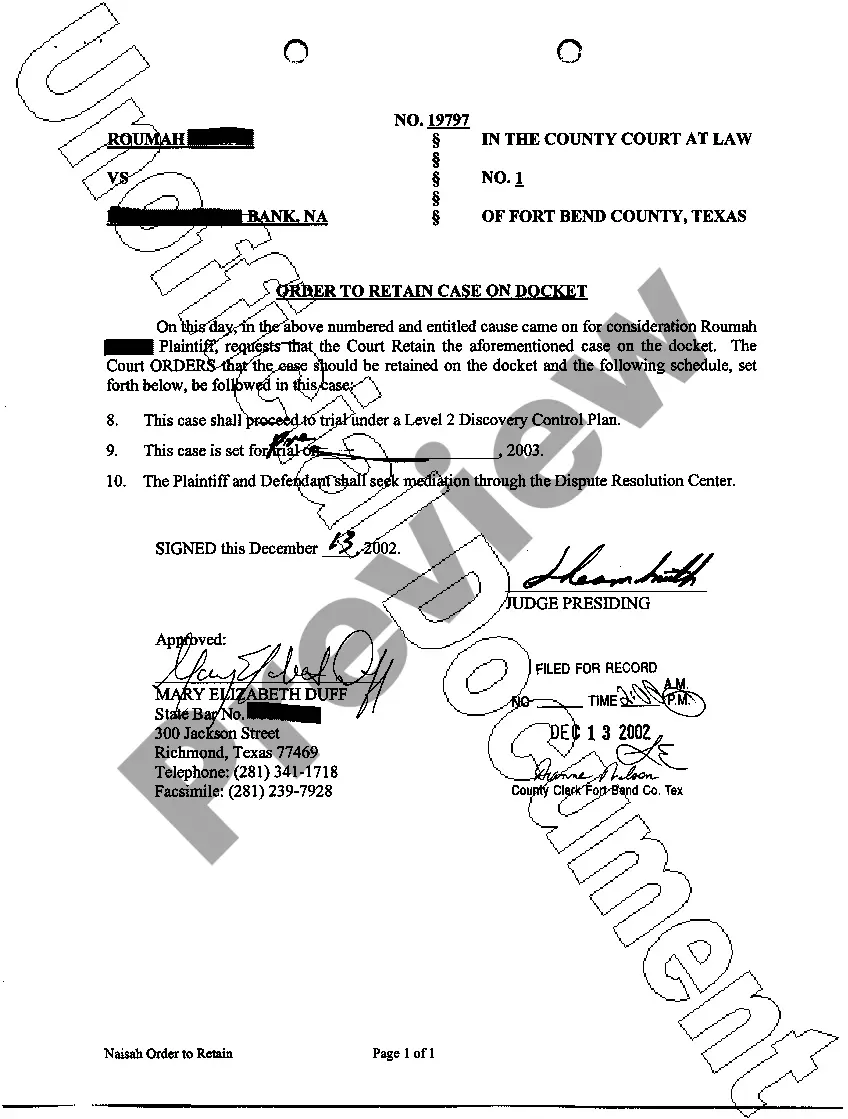

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Real Property documents may be filed and recorded with the Travis County Clerk's Office in person or by mail. The original documents with original signatures are required for the recording. The County Clerk's Office will not record a copy. Recordings are completed immediately once received in the County Clerk's Office.

Texas Real Estate Deed and Title Transfer Process The documents are filed at the county recorder's office and are part of public record.

The County Clerk's office maintains Official Public Records beginning in 1836. The records include deeds, land patent records, mortgages, judgments and tax liens.

Contact Us Main Phone. Email. recording@traviscountytx.gov. Postal Mail. Travis County Clerk. P.O. Box 149325. Austin, TX 78714. Commercial Carrier. Recording Division. Travis County Clerk. 5501 Airport Boulevard, #100B. Austin, TX 78751.

You can eRecord your documents online through Simplifile right now in Travis County. You don't have to leave the office, use the mail, or stand in line saving you time and money. If you have a PC, high-speed internet access, and a scanner, you have what you need to start eRecording in Travis County.

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

YOU WILL NEED TO CONTACT THE DISTRICT CLERK'S OFFICE AT 512-943-1212.

Once a deed is acknowledged, it should be filed in the county where the land is located. If the tract extends into more than one county, the deed may be recorded in any county where part of the property is located (Texas Property Code, Sec- tion 11.001a).