Santa Clara, California, is a vibrant city located in the heart of Silicon Valley. With its bustling economy and thriving tech industry, it's no surprise that many individuals and businesses seek financial protection through Chapter 11 bankruptcy. A key document required in the Chapter 11 process is the Statement of Current Monthly Income for Use in Chapter 11 — Post 2005. This statement serves as an essential tool for debtors and their bankruptcy attorneys to assess the financial position of the individual or business filing for Chapter 11 bankruptcy in Santa Clara, California. It provides a detailed breakdown of the debtor's monthly income, helping to determine their feasibility to meet ongoing obligations and develop a repayment plan. The Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 in Santa Clara, California, encompasses several variants, depending on the filing entity: 1. Individual Debtor: When an individual files for Chapter 11 bankruptcy, they must submit a personal Statement of Current Monthly Income. This document outlines the individual debtor's sources of income, such as wages, salaries, self-employment earnings, rental income, and any other regular income streams. 2. Business Debtor: For businesses in Santa Clara, California, undergoing Chapter 11 bankruptcy, a Statement of Current Monthly Income designed for business entities is required. This statement covers sources of income, including sales revenue, service fees, rental or lease income, royalties, and any other income generated by the business. 3. Joint Debtor: In cases where a married couple files joint bankruptcy petition under Chapter 11 in Santa Clara, California, a Joint Statement of Current Monthly Income is necessary. This statement combines and itemizes the income from both individuals, providing a comprehensive overview of the household's financial situation. Regardless of the type of debtor, the Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 in Santa Clara, California, must adhere to specific guidelines set forth by the Bankruptcy Code and local court rules. These guidelines ensure accurate reporting of income, deductions, and expenses, ultimately determining the debtor's eligibility for Chapter 11 bankruptcy and repayment plans. In conclusion, the Statement of Current Monthly Income for Use in Chapter 11 — Post 2005 is an indispensable document in Santa Clara, California, bankruptcy proceedings. It offers a comprehensive snapshot of the debtor's financial situation, aiding in the development of an effective repayment plan. Whether it applies to individuals, businesses, or joint filers, this document is crucial for assessing financial viability and determining the necessary steps forward in the Chapter 11 bankruptcy process.

Santa Clara California Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

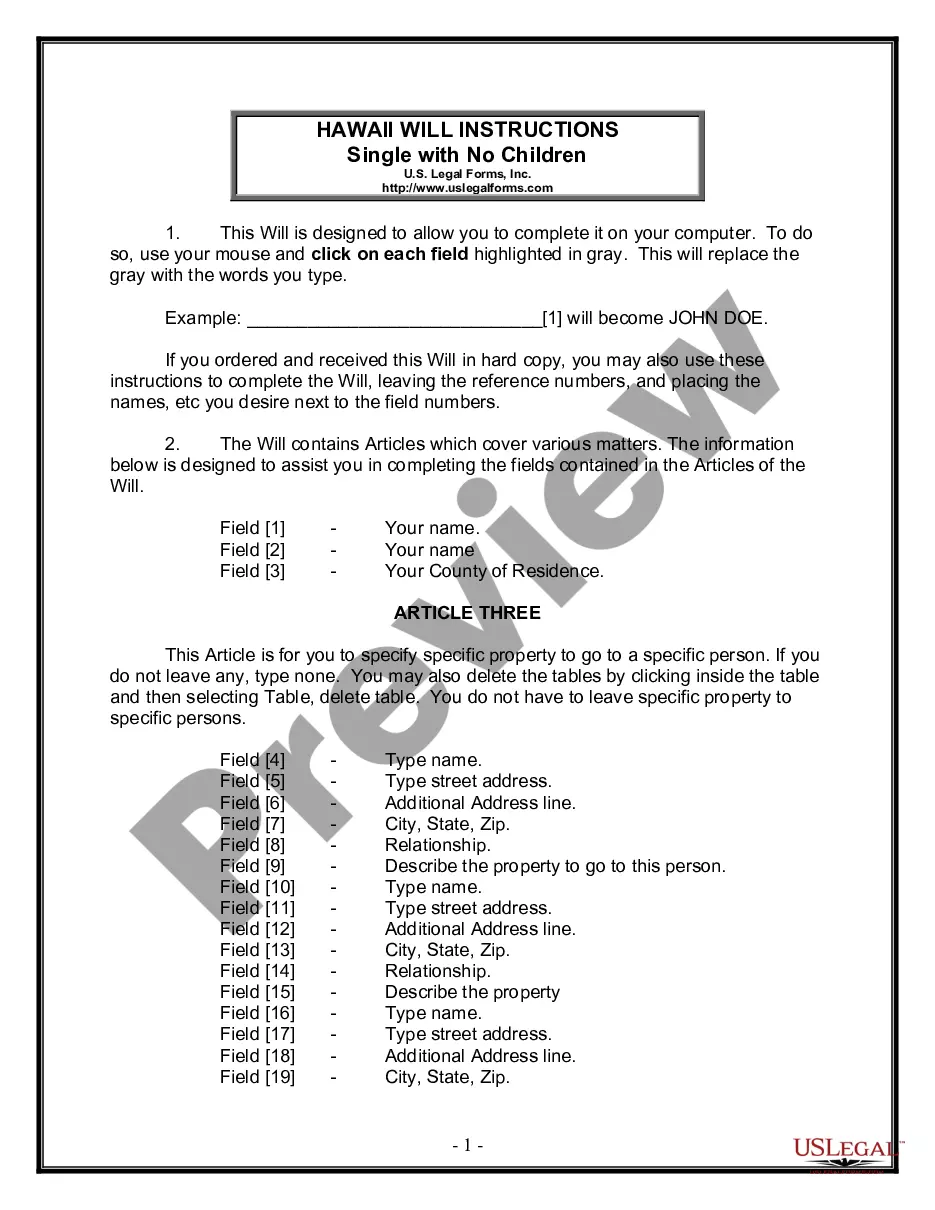

How to fill out Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

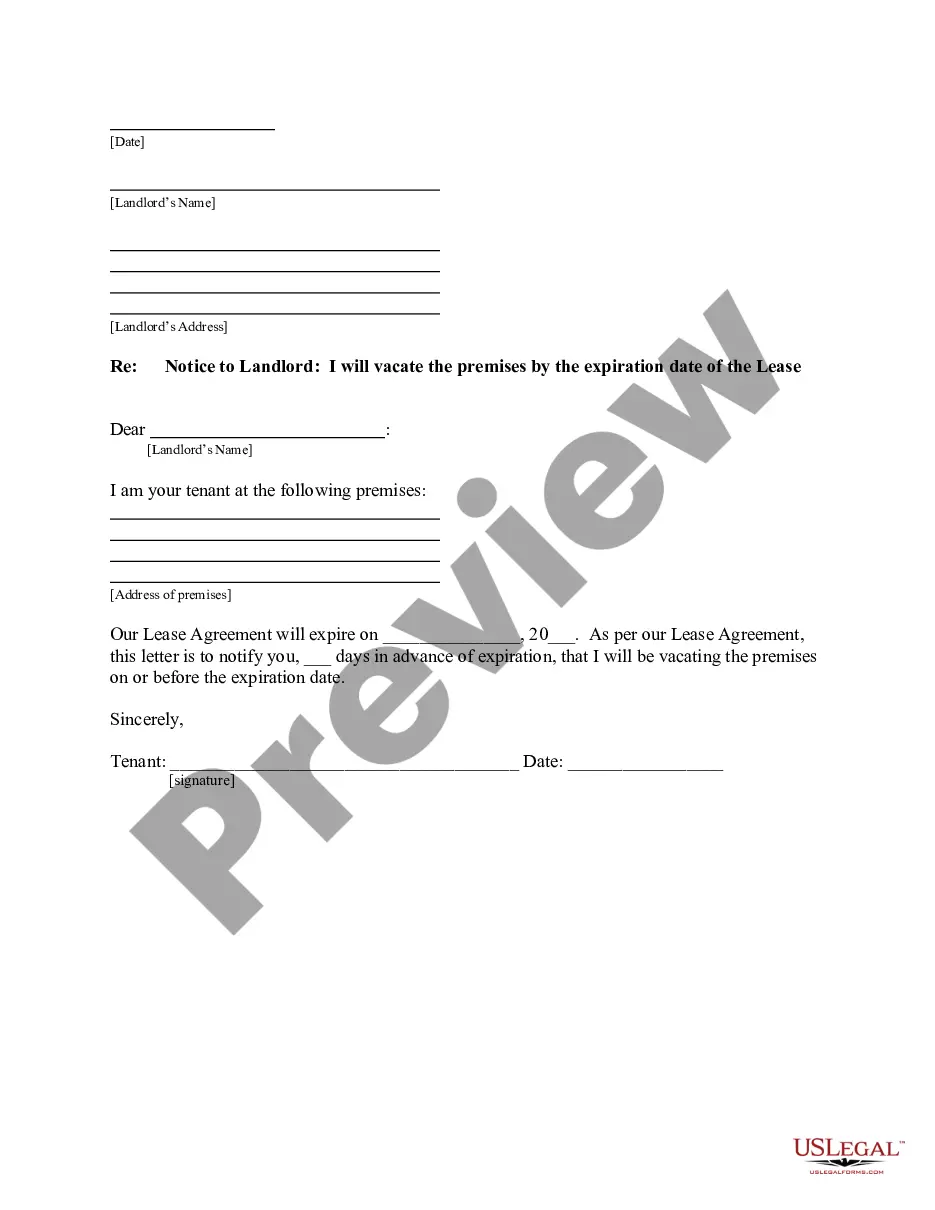

Are you seeking to swiftly create a legally-binding Santa Clara Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 or perhaps any other paperwork to handle your personal or business affairs.

You can choose one of the two alternatives: engage a specialist to create a legal document for you or compose it entirely by yourself. The positive news is, there's another choice - US Legal Forms. It will assist you in obtaining well-prepared legal documents without having to incur exorbitant costs for legal services.

If the document isn’t what you needed, begin the search process again using the search box in the header.

Choose the plan that best fits your requirements and proceed to check out. Select the file format you wish to receive your document in and download it. Print it, complete it, and sign in the designated area. If you have already created an account, you can simply Log In to your account, locate the Santa Clara Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 template, and download it. To re-download the form, navigate to the My documents section. Purchasing and downloading legal forms is effortless when you utilize our services. Additionally, the documents we provide are revised by legal professionals, ensuring you have greater reassurance when managing legal matters. Give US Legal Forms a try now and experience it for yourself!

- US Legal Forms offers an extensive collection of over 85,000 state-specific document templates, including the Santa Clara Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 and form packages.

- We provide documents for a wide range of scenarios: from dissolution of marriage paperwork to real estate forms.

- We have been in the business for over 25 years and have earned an impeccable reputation among our clientele.

- Here's how you can become one of them and acquire the required template without unnecessary complications.

- First and foremost, thoroughly ensure that the Santa Clara Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 complies with your state's or county's regulations.

- If the document includes a description, be sure to check its intended purpose.