Cook County, Illinois is a large and diverse county located in the state of Illinois, United States. Cook County is home to Chicago, the third-largest city in the country, as well as numerous suburbs and townships. Within Cook County, there is a legal process known as the Cook Illinois Notice of Need to File Proof of Claim Due to Recovery of Assets — B 204. This notice is typically issued to individuals or entities who are believed to have a claim against recovered assets in a bankruptcy or legal proceeding. The Cook Illinois Notice of Need to File Proof of Claim Due to Recovery of Assets — B 204 serves as a formal notification requiring the recipient to provide a detailed proof of claim with supporting documentation within a specified timeframe. The purpose of this notice is to ensure that all potential claimants have an opportunity to assert their rights and stake a claim to the recovered assets. Relevant keywords related to the Cook Illinois Notice of Need to File Proof of Claim Due to Recovery of Assets include: 1. Cook County 2. Illinois 3. Notice of Need 4. Proof of Claim 5. Recovery of Assets 6. Bankruptcy 7. Legal proceeding 8. Claimants 9. Supporting documentation 10. Claim deadline Different types or variations of the Cook Illinois Notice of Need to File Proof of Claim Due to Recovery of Assets — B 204 may exist depending on the specific bankruptcy case or legal action. For instance, there could be variations based on different bankruptcy chapters (e.g., Chapter 7 or Chapter 13), types of assets involved (e.g., real estate, vehicles, financial accounts), or the nature of the claim (e.g., creditor claim, investor claim, employee claim). It is important for individuals or entities who receive a Cook Illinois Notice of Need to File Proof of Claim Due to Recovery of Assets — B 204 to carefully review the notice's instructions and consult with legal counsel if necessary. Failing to respond to the notice within the specified timeframe may result in the loss of the opportunity to assert a claim to the recovered assets.

Cook Illinois For Chapter 11 Cases: The List of Creditors Who Have the 20 Largest Unsecured Claims Against You Who Are Not Insiders (non-individuals)

Description

How to fill out Cook Illinois For Chapter 11 Cases: The List Of Creditors Who Have The 20 Largest Unsecured Claims Against You Who Are Not Insiders (non-individuals)?

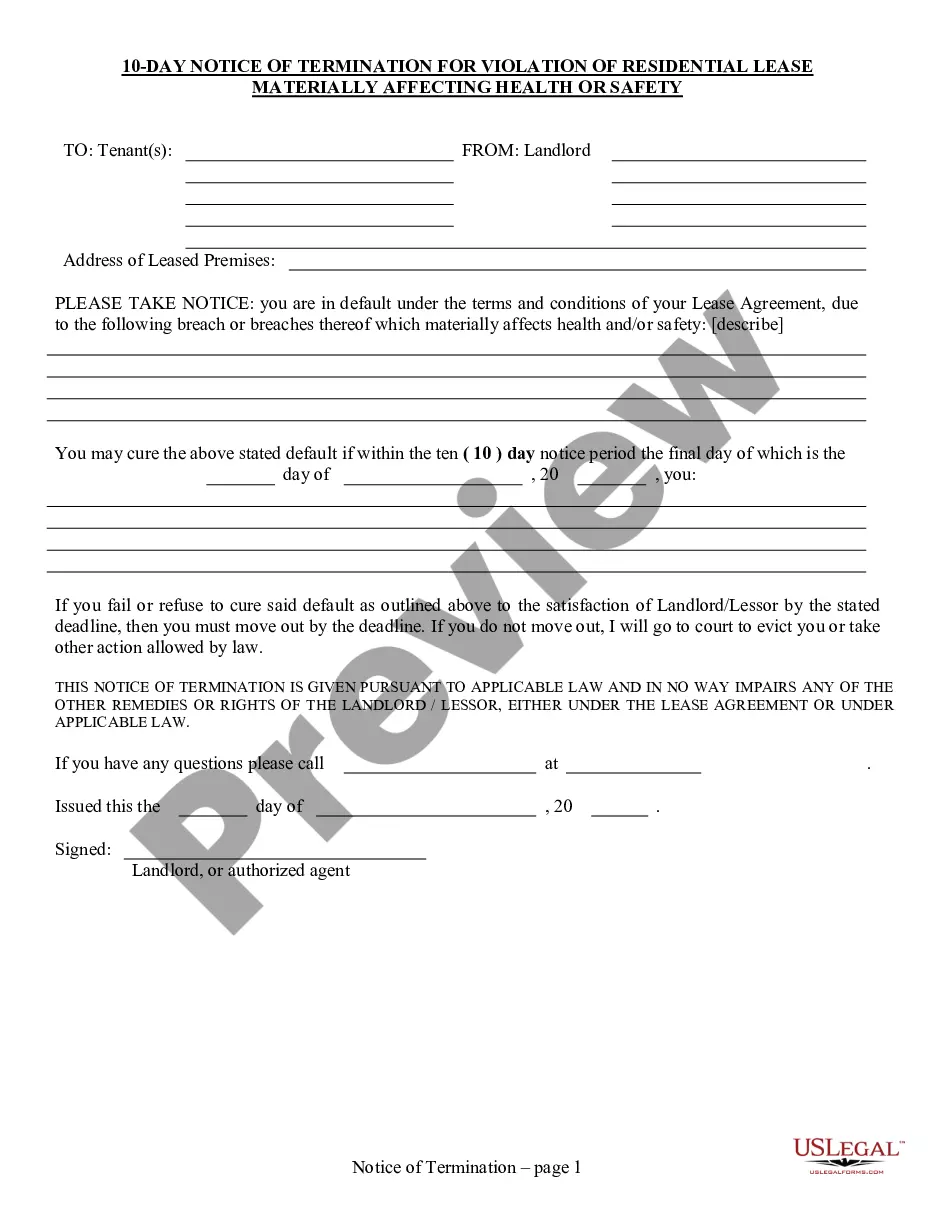

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Cook Notice of Need to File Proof of Claim Due to Recovery of Assets - B 204 is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Cook Notice of Need to File Proof of Claim Due to Recovery of Assets - B 204. Follow the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cook Notice of Need to File Proof of Claim Due to Recovery of Assets - B 204 in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

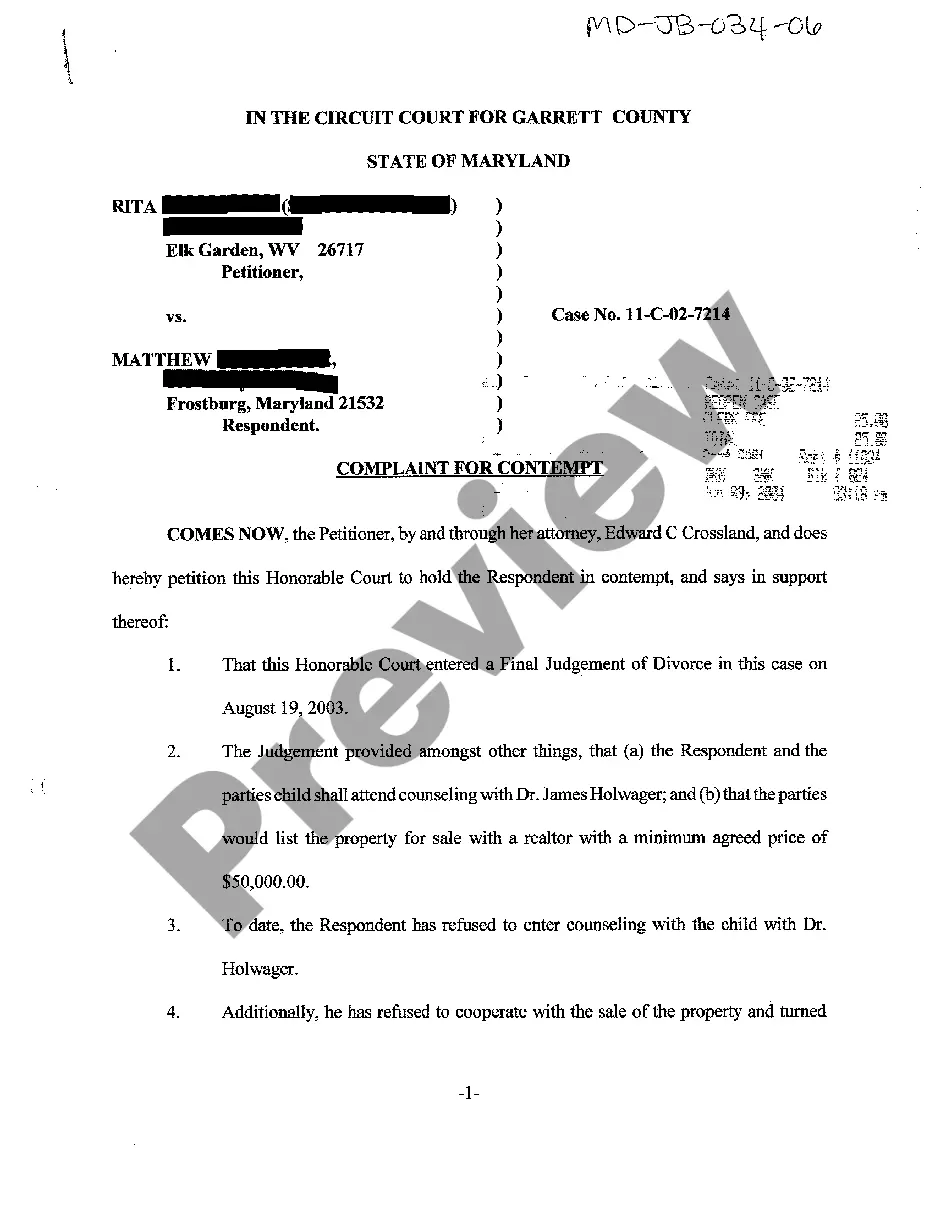

An individual or group generally has a burden of proof with regard to any claims that they make, which means that they have to provide sufficient evidence in order to support those claims, either as part of their original argument, or in response to the claim being questioned.

If a secured creditor fails to file proof of claim, then you will not make any payments toward what you owe on your house or car during your repayment plan. At the end of the bankruptcy process, to keep the collateral, you will still owe the full amount of these secured debts. Plus, you may owe interest and other fees.

A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

Legal Definition of informal proof of claim : a writing by a creditor that contains a demand for payment of a debt and an intention to hold the debtor's bankruptcy estate liable but that is not in the form prescribed in the Bankruptcy Code for proofs of claim.

Filing a Proof of Claim Online Through ePOC Creditors can easily create, file, or amend a Proof of Claim (Official Form 410) online using the Court's Electronic Proof of Claim (ePOC) system. Attorneys registered to use CM/ECF may electronically file Proofs of Claims through CM/ECF.

What evidence needs to be collected to prove your case Witness statements. Incident reports (work injury reports or police reports if they apply) Medical records. Pay stubs and tax returns to prove your lost wages. Reports from experts proving your future lost wage claims and your future medical claims.

Form 410. Form 410 is the form used by creditors to file a proof of claim. In some cases, a bankruptcy judge may accept an informal proof of claim. This must be a written document filed with the bankruptcy court, and it must make a demand against the debtor's bankruptcy estate.

Proof of Claim and Release means the form to be provided to the Class, upon further order(s) of the Court, by which Class Members may make claims against the Gross Settlement Fund.