Nassau New York Log of Records Retention Requirements

Description

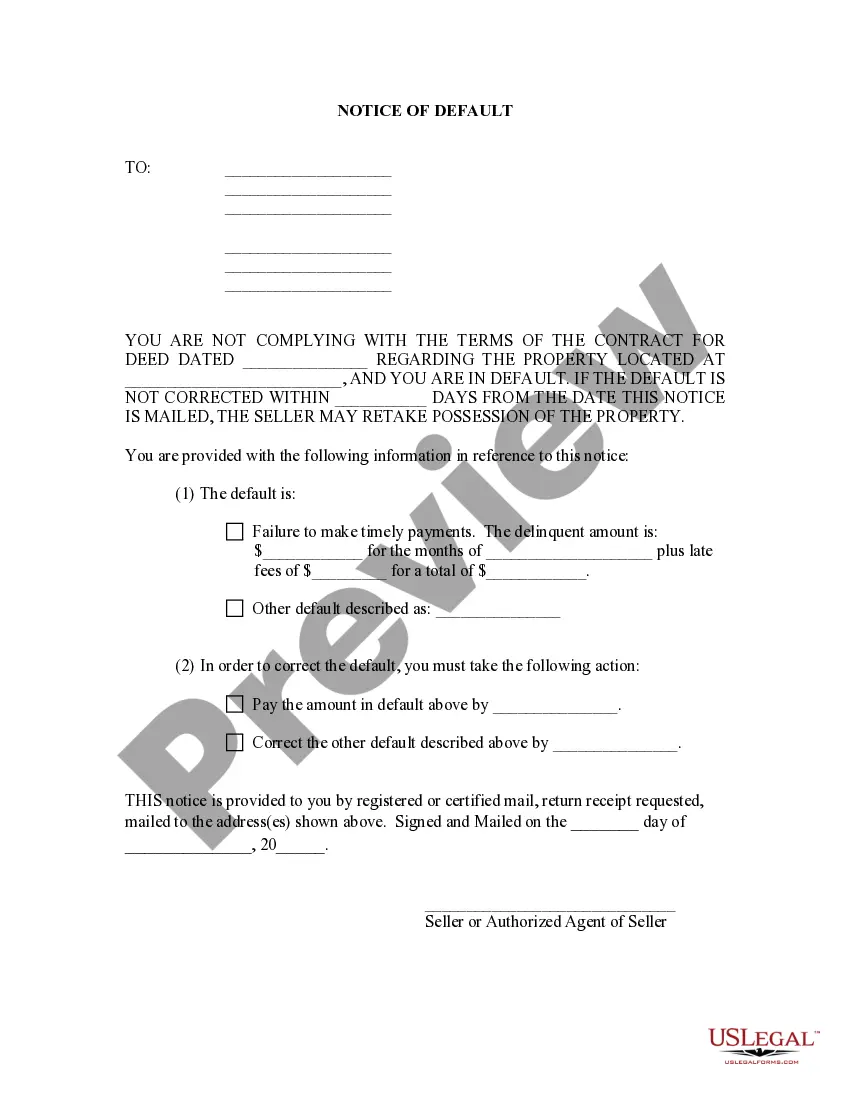

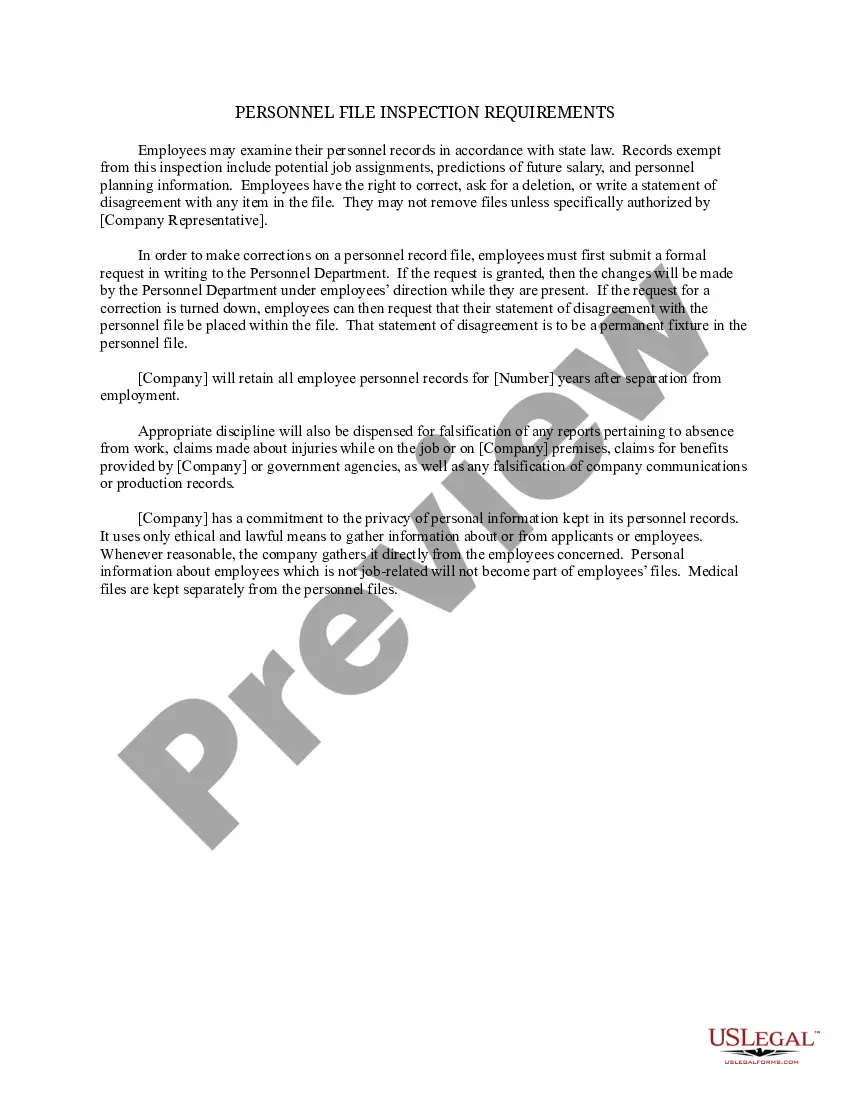

How to fill out Log Of Records Retention Requirements?

Drafting documents for professional or personal requirements is consistently a significant obligation.

When formulating a contract, a request for public service, or a power of attorney, it's crucial to take into account all federal and state statutes of the specific area.

Nevertheless, smaller counties and even municipalities also possess legislative rules that you must regard.

Join the platform and swiftly access validated legal templates for any scenario with just a few clicks!

- All these factors render it challenging and time-consuming to produce Nassau Log of Records Retention Requirements without expert support.

- It's straightforward to avoid incurring expenses on attorneys for creating your paperwork and draft a legally acceptable Nassau Log of Records Retention Requirements independently, utilizing the US Legal Forms online library.

- It represents the most comprehensive online directory of state-specific legal paperwork that are professionally verified, granting you confidence in their legitimacy when selecting a template for your county.

- Formerly subscribed users only need to Log In to their accounts to retrieve the necessary form.

- If you still do not hold a subscription, follow the sequential instructions below to acquire the Nassau Log of Records Retention Requirements.

- Browse the page you've accessed and verify if it contains the document you require.

- To achieve this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Records Retention Guideline #4: Keep everyday paperwork for 3 years Monthly financial statements. Credit card statements. Utility records. Employment applications (for businesses) Medical bills (in case of insurance disputes)

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer and state record-keeping agency may provide guidance.

Permanent or 5 years after closing of the office in India. Registered documents of companies which have been fully wound up and finally dissolved together with correspondence relating to such companies.

KEEP 3 TO 7 YEARS Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

The general minimum amount of time to keep business records is a minimum of 7 years. The following documents and records should be kept; Business Tax Returns and other supporting documents: Until the IRS can no longer audit your return.

Records which must be kept indefinitely or for approximately 100 years for legal and/or administrative purposes, and/or are of enduring value for historical research purposes and so suitable for transfer to the authority's archive or place of deposit.

As a general rule, there is a ten year statute of limitations on IRS collections. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. Subject to some important exceptions, once the ten years are up, the IRS has to stop its collection efforts.

How long should I keep business documents? Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever.

The minimum retention period is the shortest amount of time that a WORM file can be retained in a SnapLock volume. If the application sets the retention period shorter than the minimum retention period, Data ONTAP adjusts the retention period of the file to the volume's minimum retention period.

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.