Travis Texas Checklist - After the Appraisal Interview

Description

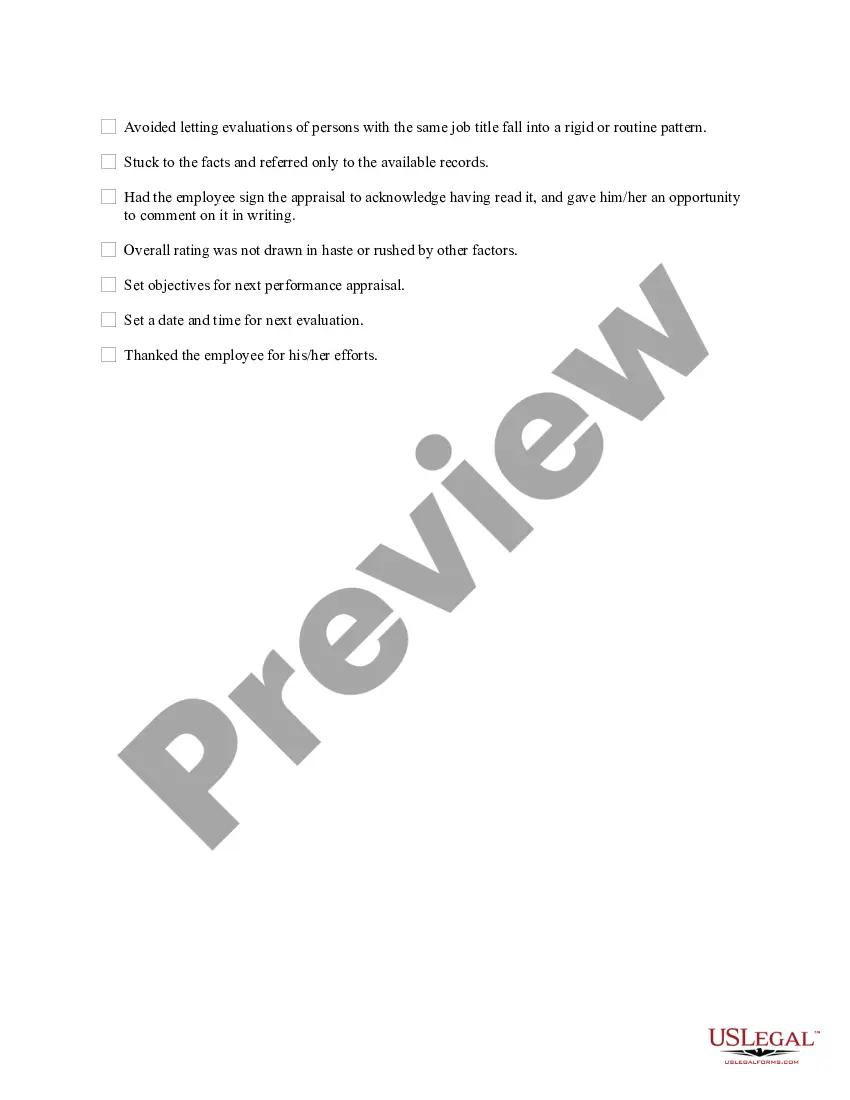

How to fill out Travis Texas Checklist - After The Appraisal Interview?

Preparing documents for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Travis Checklist - After the Appraisal Interview without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Travis Checklist - After the Appraisal Interview on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Travis Checklist - After the Appraisal Interview:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

General homestead exemption (for school taxes): In Texas, the general homestead exemption available to most qualifying homeowners is worth $25,000. That means that a home valued at $175,000 will only be taxed on $150,000 of that value.

For Travis County homeowners: Online protest forms can be filed at can be mailed to PO Box 149012, Austin, Texas 78714. Forms can be dropped off at 850 E.

Origins of Texas Homestead Exemption The homestead exemption has existed continuously in Texas law since the Constitution of 1845. As of 2019, a homestead plus surrounding land may not exceed 20 acres.

Notice of protest The protest form can be submitted online using the Bexar Appraisal District's eFile system. Other options available include sending the form by email to protest@bcad.org, by fax to 210-242-2454 or mail: P.O. Box 830248, San Antonio, TX 78283.

Property owners may submit their protest and evidence through our online portal, by mail (PO Box 149012, Austin, TX 78714), or by hand delivery to the designated dropbox in front of our office (850 East Anderson Lane).

Unlike the homestead tax exemption, Texas homestead liability protections arise automatically; no filing is required. As long as the homestead is occupied, liability protection cannot be lost.

Filing a protest You can use the form on the back of the Notice of Appraised Value that you received from the appraisal district, since it already has your account information printed on it. Or you can file your protest online. In Travis County, go to .

So how can you easily find out if you have a homestead exemption? At the Harris County Appraisal District website of you can look up your account and see which if any exemptions have been applied to your account.

Once you receive the exemption, you do not need to reapply unless the chief appraiser sends you a new application. In that case, you must file the new application. If you should move or your qualification ends, you must inform the appraisal district in writing before the next May 1st.

These values are determined by the appraisal district: Market Value: What the property would sell for. Assessed Value: The limited property value after exemptions are applied. Taxable Value: The property value you pay taxes on.

Interesting Questions

More info

Other cities, including Chicago, have adopted similar safeguards — and their costs have fallen. They've been successful in keeping those costs low by reducing the number of hospitals that handle care for patients with autism. “We want to try to get ahead of that,” says Dr. Lissette Deutsche, director of the UC ISD Office of Special Education and Developmental Disabilities. “We're very concerned about what's going on elsewhere.” The National Autism Association's study found that many hospitals, including UC, were “missing in action” in managing care for autistic children, says Jennifer L. Pampas, executive director at Autism CARES, which advocates for early identification and intervention for autism spectrum disorders and other developmental disabilities. UC ISD's move on the guidelines is welcome, Lissette Deutsche says, because its existing policies are a “step in that direction.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.