Harris Texas Power of Attorney by Trustee of Trust

Description

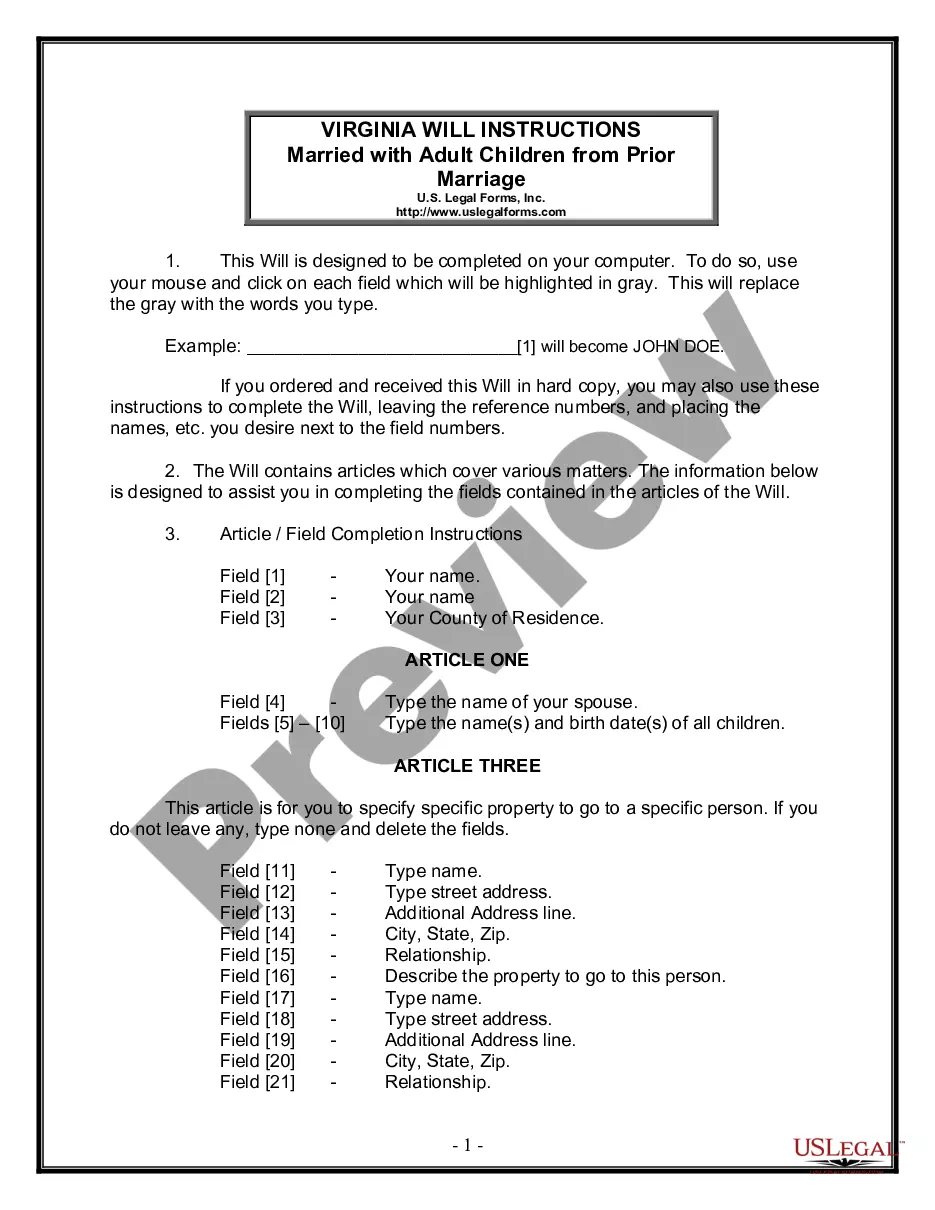

How to fill out Power Of Attorney By Trustee Of Trust?

Drafting legal documents can be challenging.

Furthermore, if you choose to enlist a lawyer to create a business agreement, documents for ownership transfer, prenuptial agreement, divorce forms, or the Harris Power of Attorney by Trustee of Trust, it may incur significant expenses.

Browse the page and confirm there's a template for your area. Review the form description and utilize the Preview option if available to ensure it’s the template you need. Do not worry if the form does not meet your needs - search for the appropriate one in the header. Click Buy Now once you identify the desired sample and choose the most suitable subscription. Log In or create an account to purchase your subscription. Complete a transaction using a credit card or PayPal. Select the document format for your Harris Power of Attorney by Trustee of Trust and download it. After finishing, you can print it out and fill it out by hand or upload the template to an online editor for quicker and more efficient completion. US Legal Forms allows you to use any purchased documents multiple times - you can access your templates in the My documents tab in your profile. Give it a shot now!

- What is the most effective way to conserve time and money while generating valid documents fully compliant with your local and state laws.

- US Legal Forms is a fantastic option, regardless of whether you're seeking templates for personal or business purposes.

- US Legal Forms boasts the largest online archive of state-specific legal documents, offering users the latest and professionally validated forms for any situation all gathered in one location.

- Therefore, if you require the latest version of the Harris Power of Attorney by Trustee of Trust, you can quickly find it on our site.

- Acquiring the documents takes little time.

- Users with existing accounts should ensure their subscription is active, Log In, and select the template using the Download button.

- If you have not signed up yet, here’s how to acquire the Harris Power of Attorney by Trustee of Trust.

Form popularity

FAQ

In Trust: My Trustee may appoint any individual or entity to serve as my Trustee's agent under a power of attorney to transact any business on behalf of my trust or any other trust created under this trust.

A trustee cannot delegate his office or any of his duties either to a co-trustee or to a stranger, unless (a) the instrument of trust so provides, or (b) the delegation is in the regular course of business, or (c) the delegation is necessary, or (d) the beneficiary, being competent to contract, consents to the

The short answer is that, although an attorney has wide powers to deal with both the donor's personal financial affairs and their investments, an attorney cannot act on behalf of the donor when the donor is acting as trustee.

A Successor Trustee is the person responsible for administering the trust after its Grantor either passes away or becomes Incapacitated that is, unable to administer the trust for themselves.

In contrast, a Power of Attorney does not control anything that is owned by your trust. The Power of Attorney controls assets that are not inside your trust such as retirement accounts, life insurance, sometimes annuities, or even bank accounts that are not in trust title.

A power of attorney is a legal document that gives another person legal power to make personal decisions on your behalf. A trustee, on the other hand, is a person or company appointed in a trust document to manage and disburse trust property.

16220. The trustee has the power to collect, hold, and retain trust property received from a settlor or any other person until, in the judgment of the trustee, disposition of the property should be made. The property may be retained even though it includes property in which the trustee is personally interested.

The successor trustee has control over all assets included in your trust. The power of attorney agent is similar, however, not identical. You may still appoint the power of attorney agent as you appointed your trustee and successor trustee, but the power of attorney agent has slightly more power.

A trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.