Middlesex Massachusetts Employee Payroll Record

Description

How to fill out Employee Payroll Record?

A document process consistently accompanies any legal action you undertake.

Establishing a business, seeking or accepting a job proposal, transferring ownership, and numerous other life circumstances necessitate that you prepare official paperwork that varies across the nation.

Thus, having everything compiled in one location is incredibly advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents. Here, you can effortlessly locate and acquire a document for any personal or business purpose relevant to your area, including the Middlesex Employee Payroll Record.

Press Buy Now when you identify the required template. Choose the suitable subscription plan, then Log In or create an account. Select the preferred payment method (via credit card or PayPal) to proceed. Choose the file format and save the Middlesex Employee Payroll Record on your device. Use it as necessary: print it or fill it out electronically, sign it, and file it where requested. This is the simplest and most reliable method to obtain legal documents. All samples available in our library are professionally crafted and verified for compliance with local laws and regulations. Organize your paperwork and manage your legal matters effectively with US Legal Forms!

- Finding forms on the site is exceptionally simple.

- If you already possess a subscription to our service, Log In to your account, search for the template through the search bar, and click Download to save it on your device.

- Subsequently, the Middlesex Employee Payroll Record will be accessible for further use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, adhere to this straightforward guideline to obtain the Middlesex Employee Payroll Record.

- Make sure you have navigated to the correct page with your local form.

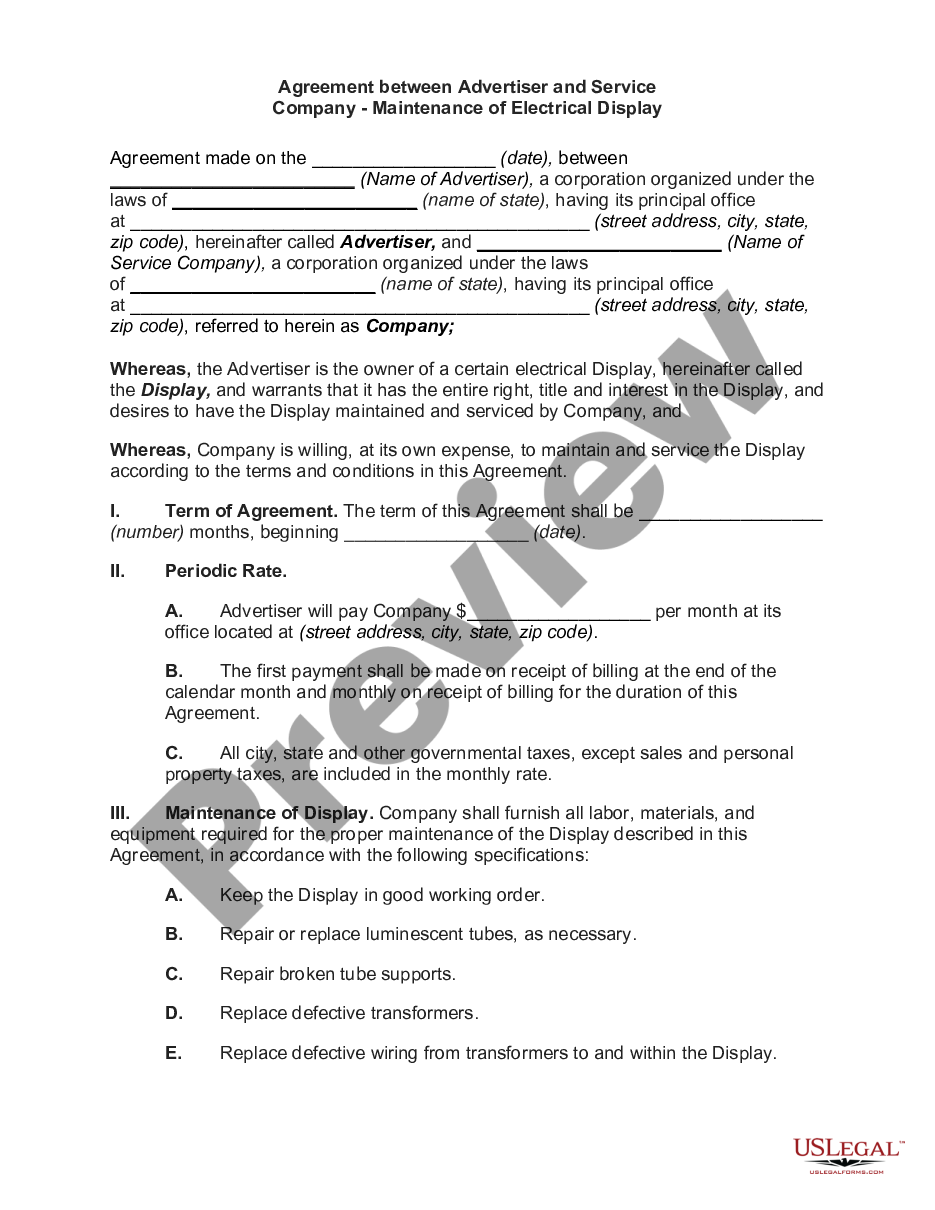

- Utilize the Preview mode (if provided) and scroll through the template.

- Review the description (if available) to ensure the form suits your requirements.

- Look for another document via the search option if the sample does not meet your needs.