Wayne Michigan FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

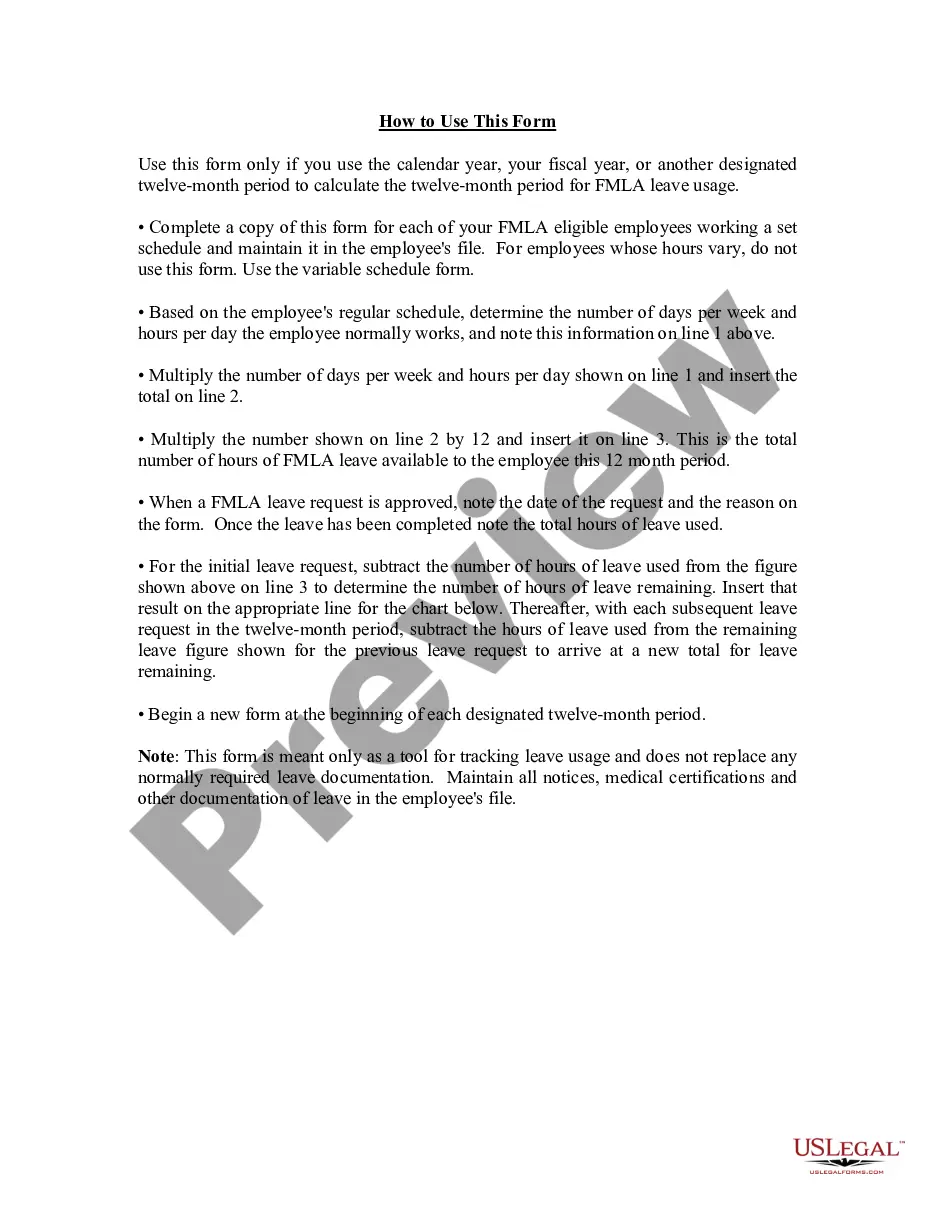

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Set Schedule?

Drafting legal documents can be challenging. Additionally, if you choose to engage a lawyer to create a business agreement, ownership transfer documents, pre-nuptial agreement, divorce documentation, or the Wayne FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule, it could cost you a significant amount.

So what is the most sensible way to conserve both time and funds while creating valid documents fully compliant with your state and local regulations? US Legal Forms is a fantastic option, whether you are looking for templates for personal or commercial use.

Don't fret if the form does not meet your needs - look for the appropriate one in the header. Click Buy Now once you locate the necessary sample and select the most suitable subscription. Log In or create an account to purchase your subscription. Process the payment with a credit card or via PayPal. Select the file format for your Wayne FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule and download it. Once completed, you can print it out and fill it out on paper or upload the template to an online editor for a quicker and more convenient completion. US Legal Forms allows you to utilize all the documents you have ever obtained multiple times - you can find your templates in the My documents tab in your profile. Try it out now!

- US Legal Forms is the largest online repository of state-specific legal documents, offering users the most current and professionally vetted templates for any scenario gathered all in one location.

- Consequently, if you require the latest edition of the Wayne FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule, you can effortlessly discover it on our platform.

- Acquiring the documents takes minimal time.

- If you already hold an account, make sure to confirm your subscription is active, Log In, and select the sample with the Download button.

- If you are not yet subscribed, here’s how you can obtain the Wayne FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule.

- Browse through the page and ensure there is a template for your location.

- Review the form description and use the Preview option, if available, to confirm it's the template you require.

Form popularity

FAQ

Using this method, the employer will look back over the last 12 months from the date of the request, add all FMLA time the employee has used during the previous 12 months and subtract that total from the employee's 12-week leave allotment.

The FMLA, or Family and Medical Leave Act, is a federal law that allows certain employees working for covered employers to take up to 12 weeks of unpaid leave during each 12-month period. The 12-week allowance resets every 12 months, so in a sense, FMLA continues each year.

FMLA leave may be taken in periods of whole weeks, single days, hours, and in some cases even less than an hour. The employer must allow employees to use FMLA leave in the smallest increment of time the employer allows for the use of other forms of leave, as long as it is no more than one hour.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

The 12-month period measured forward from the date any employee's first FMLA leave begins; or, A rolling 12-month period measured backward from the date an employee uses any FMLA leave.

A 12-month Period Measured Forward from the First Day of Your Employee's Leave. Under this method, the 12-month period begins on the first day your employee takes FMLA leave. If FMLA leave is taken after that 12 months ends, their next 12-month period begins on the first day of that leave.

The 12-month period measured forward from the date any employee's first FMLA leave begins; or. A "rolling" 12-month period measured backward from the date an employee uses any FMLA leave.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.