Harris Texas Notice of Unpaid Invoice is a legal document issued by the county of Harris, Texas, to inform individuals or businesses that they have an outstanding payment that needs to be settled. This notice is usually sent to debtors who have failed to make required payments for goods or services provided by the creditor. The purpose of the Harris Texas Notice of Unpaid Invoice is to formally demand payment for the outstanding debt. It serves as a warning to the debtor that legal action may be taken if the payment is not received within a specified timeframe. This notice is an essential step in the debt collection process and is often used by businesses and individuals to recover their outstanding debts. The Harris Texas Notice of Unpaid Invoice typically includes crucial information such as the creditor's name, contact details, the debtor's name and address, the invoice number, the outstanding balance, the due date of the payment, and a detailed breakdown of the goods or services provided. There may be several types of Harris Texas Notice of Unpaid Invoice, depending on the specific circumstances and the entity issuing the notice. Some common variations include: 1. Harris County Tax Assessor-Collector Notice of Unpaid Invoice: These notices are issued by the Harris County Tax Assessor-Collector department to notify individuals or businesses of unpaid property taxes or other county-related fees. 2. Harris County Toll Road Authority (EXTRA) Notice of Unpaid Invoice: EXTRA issues these notices to collect outstanding toll charges for using the Harris County toll roads. 3. Harris County Clerk's Office Notice of Unpaid Invoice: This notice is sent by the Harris County Clerk's Office to inform individuals or businesses of unpaid court fines, fees, or other court-related expenses. Receiving a Harris Texas Notice of Unpaid Invoice is a serious matter, and it is essential for debtors to respond promptly to avoid further legal actions. It is recommended to review the notice carefully, cross-check the details with any relevant records, and contact the creditor or the issuing entity for further clarification or to seek negotiation for payment arrangements.

Harris Texas Notice of Unpaid Invoice

Description

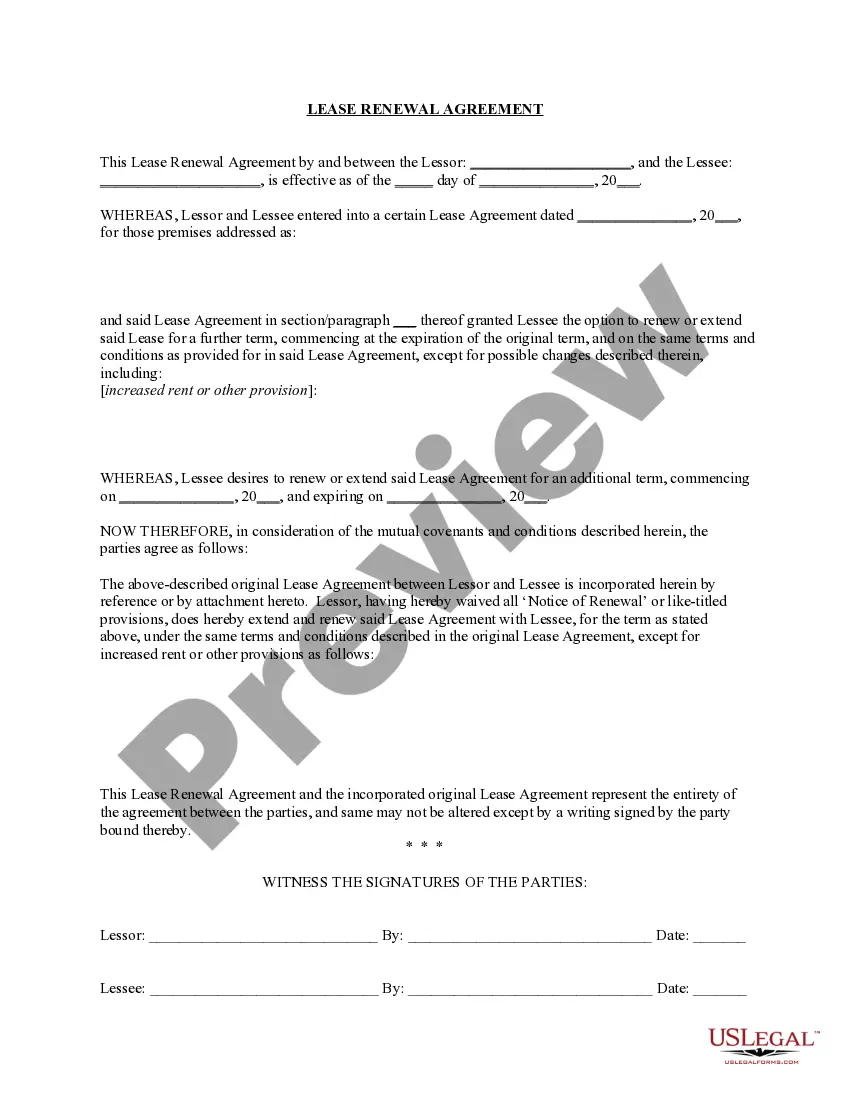

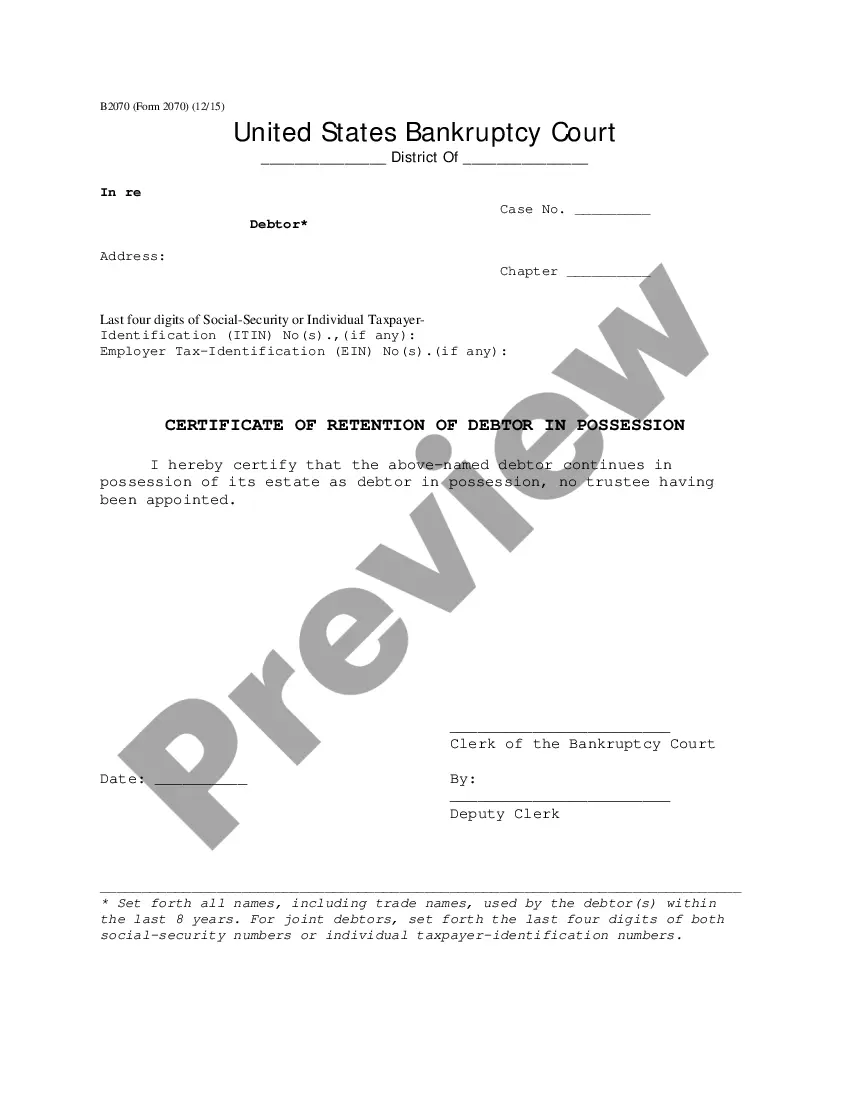

How to fill out Notice Of Unpaid Invoice?

Laws and policies in each sector differ across the nation.

If you're not a lawyer, it's simple to become confused by numerous standards when it comes to creating legal paperwork.

To prevent expensive legal fees when preparing the Harris Notice of Unpaid Invoice, you require a verified template valid for your region.

Proceed by clicking the Buy Now button to purchase the template once you find the correct one.

- That's when utilizing the US Legal Forms platform becomes particularly beneficial.

- US Legal Forms is endorsed by millions and hosts a collection of over 85,000 state-specific legal templates.

- It provides an excellent solution for professionals and individuals seeking do-it-yourself templates for various life and business occasions.

- All the documents can be utilized multiple times: once you buy a sample, it stays available in your account for future use.

- Thus, when you have an account with a valid subscription, you can easily Log In and re-download the Harris Notice of Unpaid Invoice from the My documents section.

- For first-time users, a few extra steps are needed to obtain the Harris Notice of Unpaid Invoice.

- Review the content on the page to ensure you have located the right sample.

- Utilize the Preview feature or read the form description if it exists.

- Search for another document if there are discrepancies with any of your requirements.

Form popularity

FAQ

If you miss your court date or still refuse to pay, you may face jail time at that point. If you still haven't paid your toll balance in Harris County after 60 days, and you've ignored collection efforts from the TRA and debt collectors, an administrative court hearing will be scheduled.

Log In. Log In / Register. Note: Username is not case sensitive. Log In. Violations/Toll-By-Plate. To access your Violation Notice/Toll Bill, enter your Violation Notice/Toll Bill Number AND License Plate Number: VIEW VIOLATION NOTICE / TOLL BILL.

Who is subject to a vehicle registration block for nonpayment of tolls? A Habitual Violator who has accrued 100 or more unpaid tolls and who has been issued two notices of nonpayment within a year is subject to a vehicle registration block.

You can pay your violation on the Toll Violation page of our website, The Toll Roads app or tear off the bottom portion of the notice and send a check for the amount due to: The Toll Roads Violations Dept., PO Box 50190, Irvine, CA 92619-0190.

Under Texas law, someone who fails to pay a toll may be charged with a criminal misdemeanor for toll evasion under Chapter 370.11 of the Texas Transportation Code. If found guilty, the registered owner of the vehicle can face fines of up to $250 per unpaid toll in addition to court administrative fees.

If you took an unpaid trip on a Virginia toll facility you may be able to pay the toll through a missed-a-toll process before receiving a toll invoice or violation notice, often at a lower cost. Use the map and form below to locate the road you traveled on and find out whether you can pay your missed toll.

By order of Commissioners Court, tolls are being waived on Harris County toll roads in order to assist those who must continue to travel throughout the county through the duration of the Harris County Judge's declaration of a local disaster.

Visit to check the status of your registration before driving your vehicle. Please contact the E-ZPass Customer Service Center to resolve outstanding toll violations.

You won't get arrested, no matter how many of them there are. However, not paying tolls means you can get charged with a criminal misdemeanor. Conviction of this crime leads to fines, and you'll also have to pay extra court fees. However, failure to show up in court can land you in jail.

Toll bills can be paid online at TxTag.org or by calling the TxTag Customer Service Center at (888) 468-9824. The Texas Department of Transportation is responsible for maintaining 80,000 miles of road and for supporting aviation, maritime, rail, and public transportation across the state.