San Diego California Agreement by Lessee to Make Leasehold Improvements

Description

How to fill out Agreement By Lessee To Make Leasehold Improvements?

Drafting legal documents is essential in the modern era.

However, you don't always have to pursue expert assistance to create some of them from scratch, such as the San Diego Agreement by Lessee to Make Leasehold Improvements, using a platform like US Legal Forms.

US Legal Forms offers over 85,000 documents across various categories like living wills, real estate contracts, and divorce filings. All forms are categorized by their applicable state, which simplifies the search process.

If you're already a member of US Legal Forms, you can access the relevant San Diego Agreement by Lessee to Make Leasehold Improvements, Log In to your account, and download it. Naturally, our platform cannot replace a lawyer entirely. If you encounter an exceptionally complex issue, we advise consulting an attorney to evaluate your form before signing and submitting it.

With over 25 years in the industry, US Legal Forms has established itself as a trusted source for various legal documents for millions of clients. Join them today and obtain your state-compliant paperwork effortlessly!

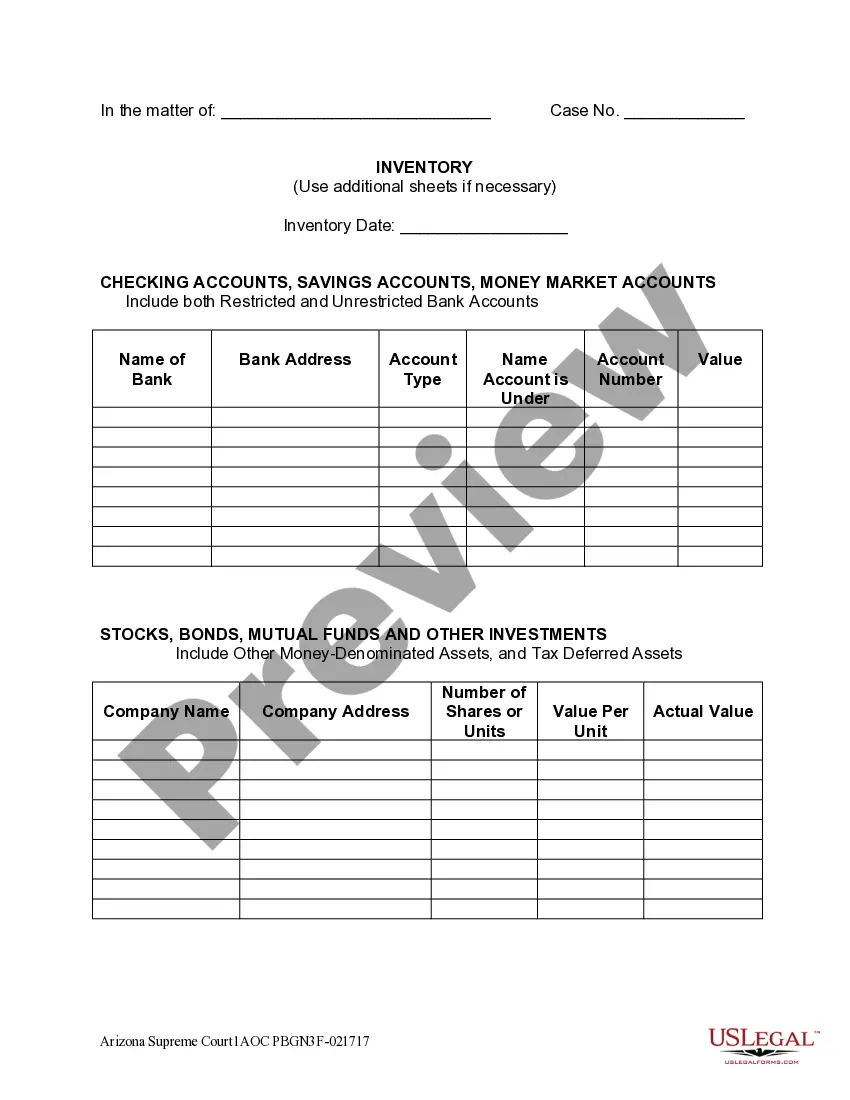

- Review the document's preview and outline (if available) for a general overview of what you’ll obtain after acquiring the form.

- Make sure that the template you select is customized for your state/county/area since state laws can influence the validity of certain documents.

- Examine the associated forms or restart your search to find the appropriate document.

- Click Buy now and set up your account. If you already possess an account, opt to Log In.

- Select the option, choose a convenient payment method, and acquire the San Diego Agreement by Lessee to Make Leasehold Improvements.

- Choose to preserve the form template in any available file format.

- Go to the My documents tab to re-download the document.

Form popularity

FAQ

Tenant can claim for: Necessary improvements to protect or preserve the property (costs expended), Useful improvements, with or without the consent of the lessor (lesser of cost or enhancement value). The claim arises only once the lease is terminated and lessee returned the property.

Leasehold improvements generally revert to the ownership of the landlord upon termination of the lease, unless the tenant can remove them without damaging the leased property. An example of leasehold improvements is offices constructed in unfinished office space.

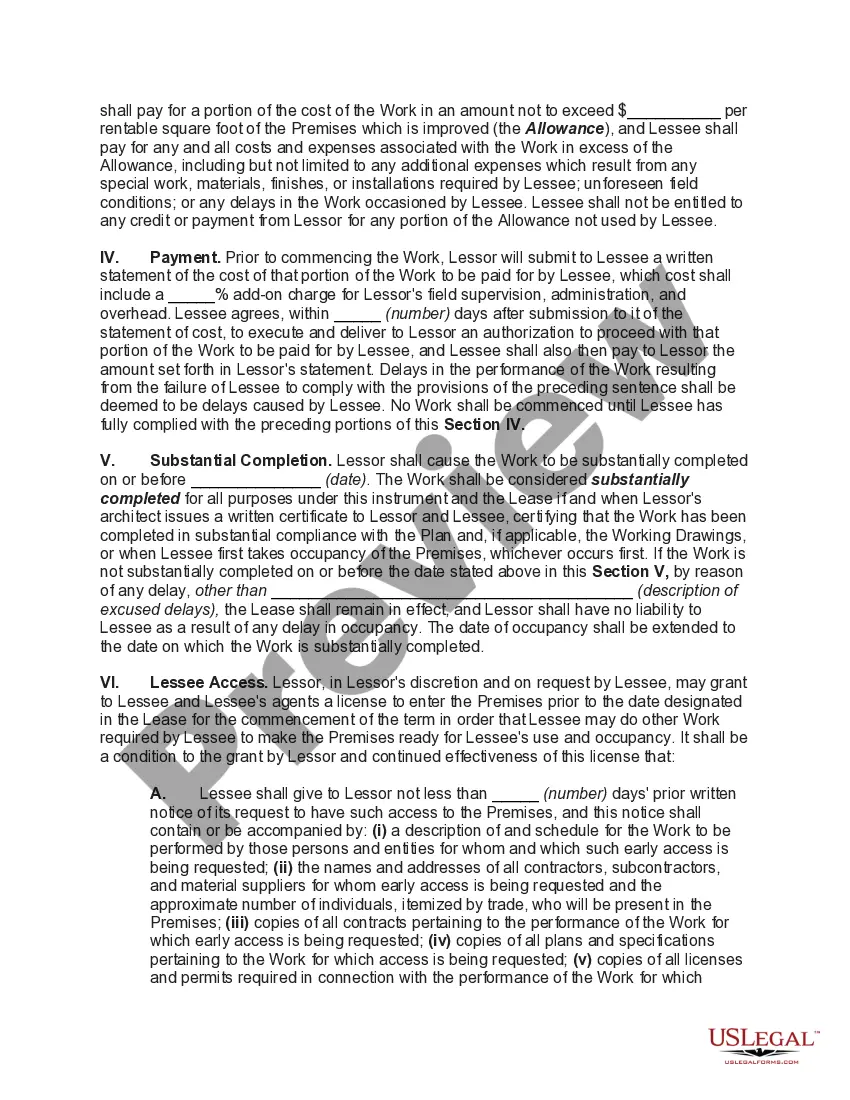

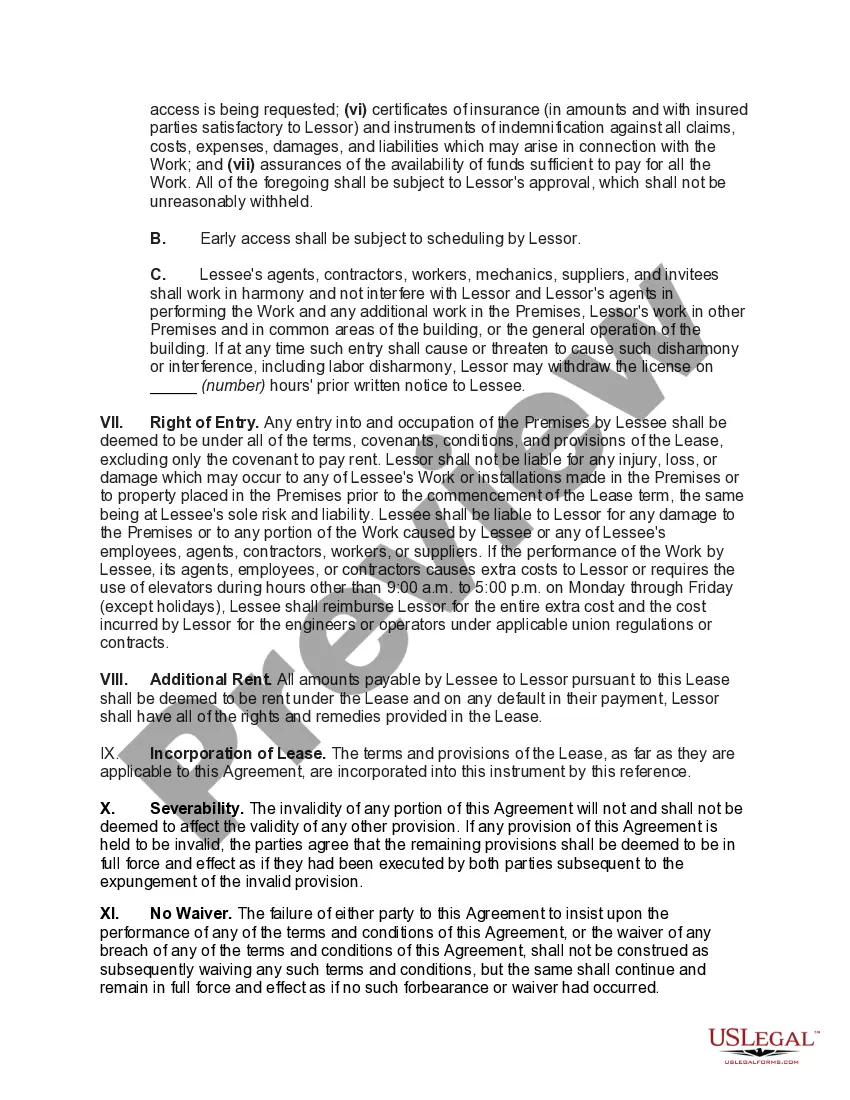

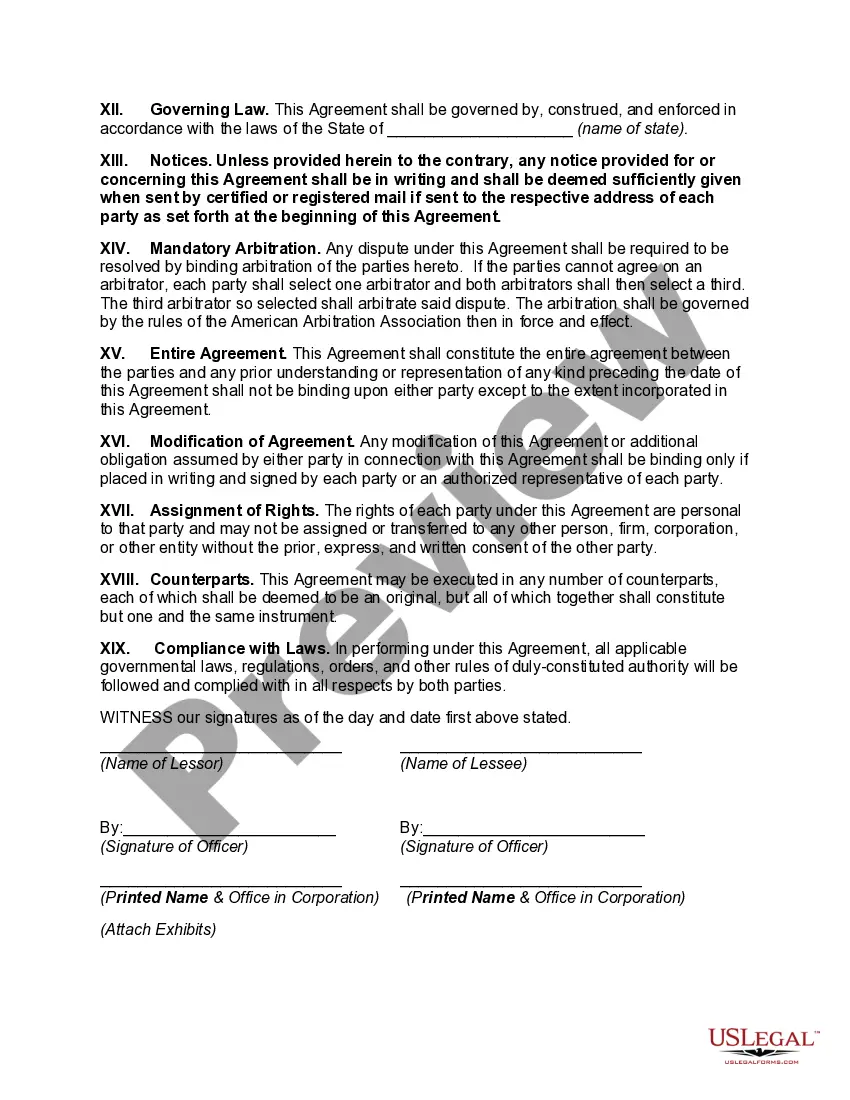

Conversely, lease agreement provisions can obligate a tenant to construct or install improvements on the property. The time period for commencement and completion is agreed to in the lease agreement.

The term leasehold improvement refers to any changes made to customize a rental property to satisfy the particular needs of a specific tenant. These changes and alterations may include painting, installing partitions, changing the flooring, or putting in customized light fixtures.

Leasehold improvements ( LHI ) are modifications made to a leased space or leased asset to make it more useful to, or to fit the particular needs of, the tenant.

Under IRC Sec. 263(a), Capital Expenditures, if a lessee makes a leasehold improvement that isn't a substitute for rent, the lessee is generally required to capitalize the cost of the improvement.

Who pays for commercial tenant improvements? The most common practice is that the landlord pays for the commercial leasehold improvements with a tenant improvement allowance and if the cost of improvements exceeds that TI allowance, you pay the difference.

If the tenant pays for leasehold improvements, the capital expenditure is recorded as an asset on the tenant's balance sheet. Then the expense is recorded on income statements as amortization over either the life of the lease or the useful life of the asset, whichever is shorter.

If the sublease ends before than the original lease expiration date you should also adjust the leasehold improvement estimated useful lives. If the amount of the leasehold improvements is material you would also be required to reclassify the assets as held and used until disposed of.

Thus, landlords must continue to depreciate the remaining basis even after the improvements were demolished; but tenants can write off incurred improvements abandoned at the end of the lease if they hold no continuing interest in the improvements.