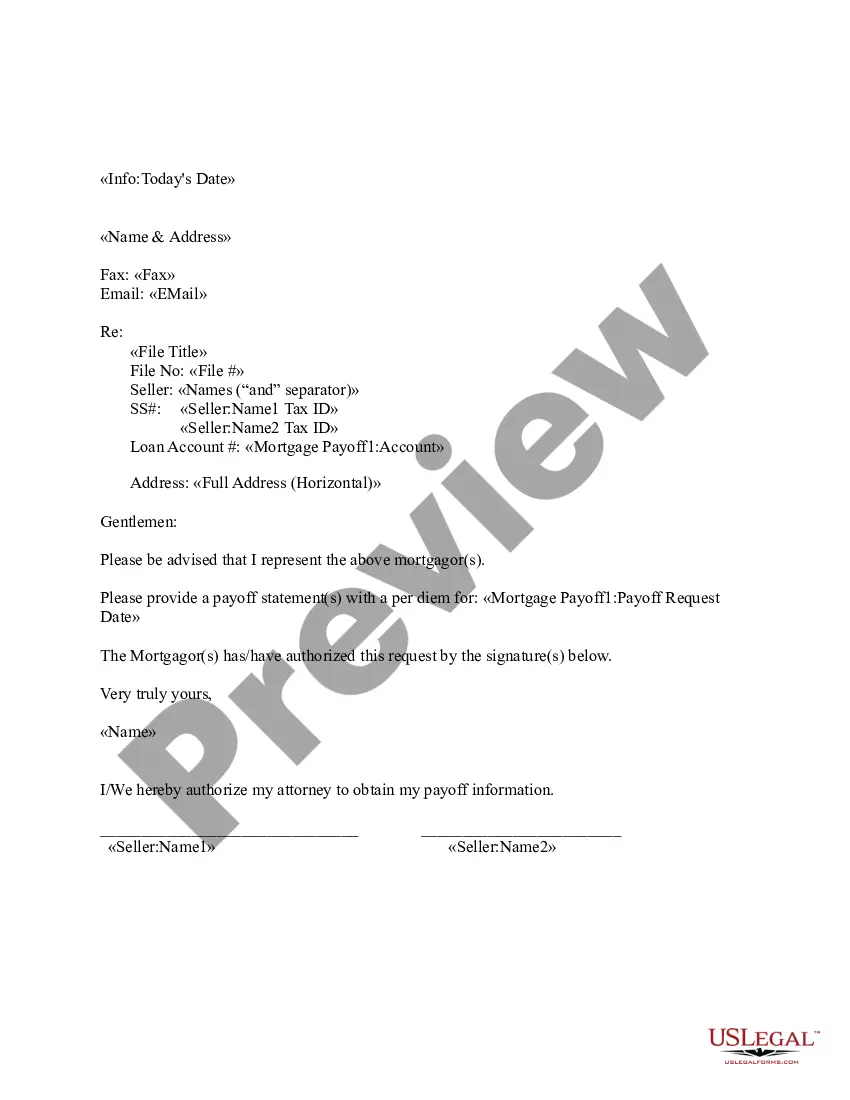

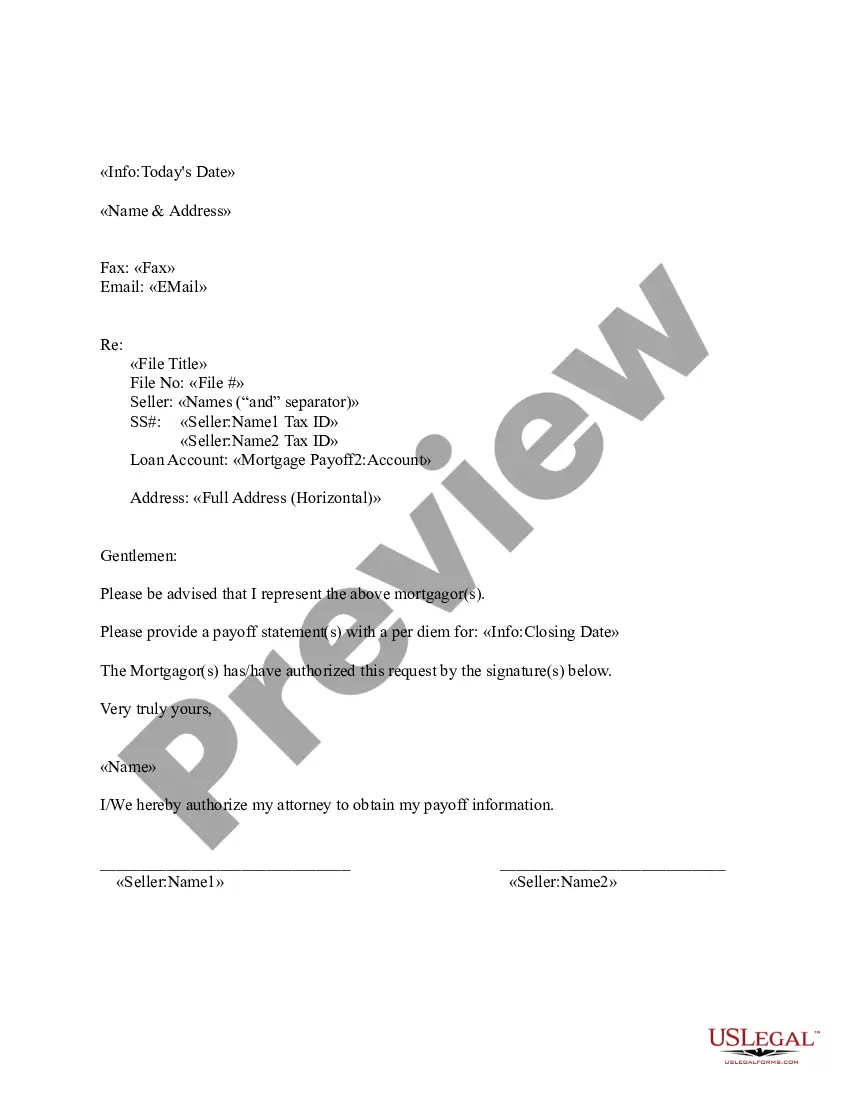

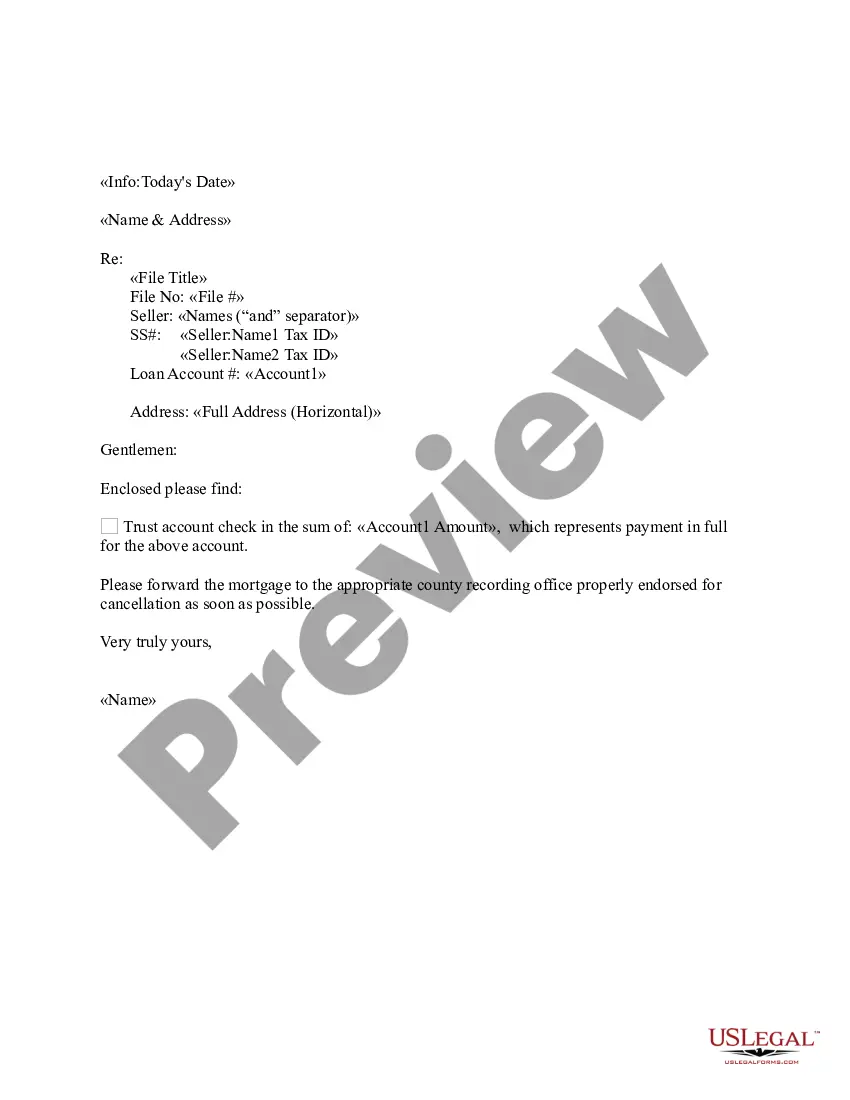

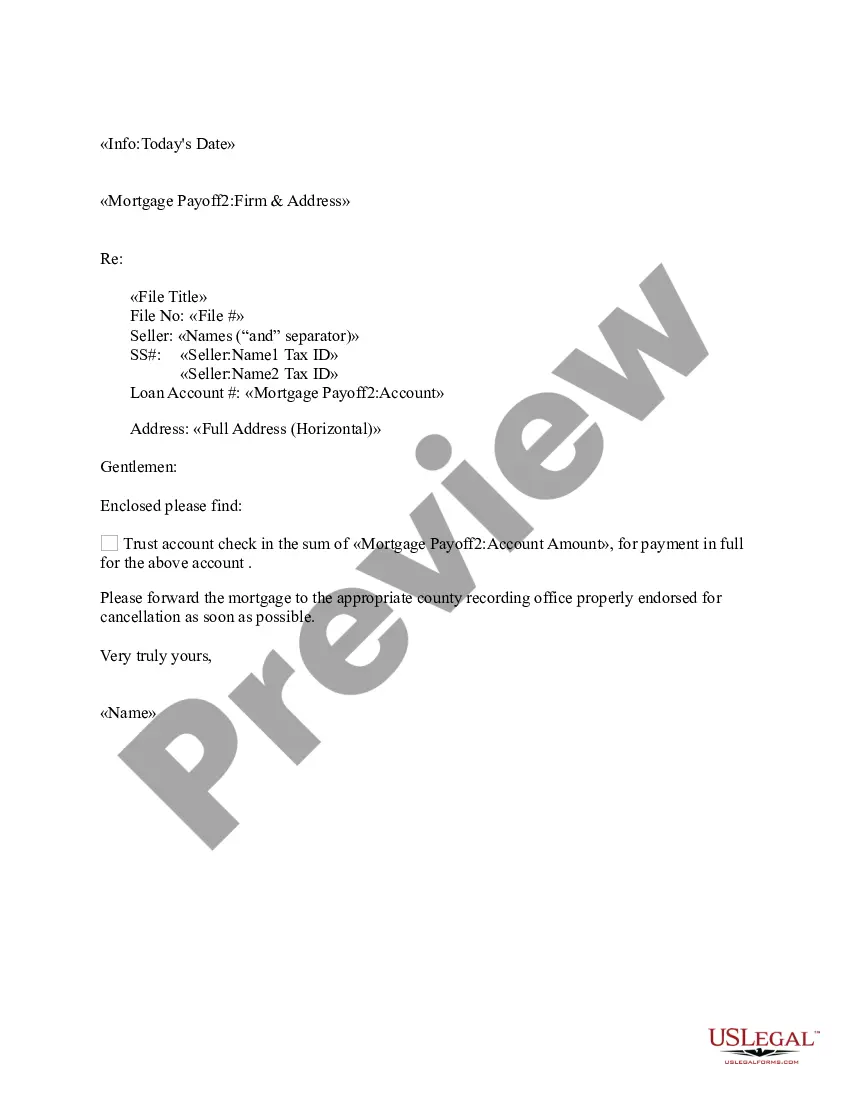

Palm Beach Florida Sample Letter Requesting Payoff Balance of Mortgage

Description

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

Laws and regulations in each area vary across the nation.

If you're not a legal professional, it's simple to become confused by the different rules when it comes to creating legal documents.

To prevent costly legal fees when drafting the Palm Beach Sample Letter Requesting Payoff Balance of Mortgage, you require a verified template applicable to your locality.

That's the easiest and most cost-effective method to acquire current templates for any legal needs. Find them all with just a few clicks and maintain your documentation organized with the US Legal Forms!

- That's when utilizing the US Legal Forms platform proves to be advantageous.

- US Legal Forms is a reliable online library that hosts over 85,000 state-specific legal templates.

- It's an ideal option for both professionals and individuals seeking do-it-yourself templates for various life and business circumstances.

- All documents can be utilized multiple times: once you select a sample, it stays available in your profile for future reference.

- Therefore, when you hold an account with an active subscription, you can effortlessly Log In and re-download the Palm Beach Sample Letter Requesting Payoff Balance of Mortgage from the My documents section.

- For newcomers, you need to follow a few additional steps to acquire the Palm Beach Sample Letter Requesting Payoff Balance of Mortgage.

- Review the page content to ensure you have found the correct sample.

- Use the Preview feature or read the form description, if available.

Form popularity

FAQ

You request a payoff statement from your lender when you want to know exactly how much it costs to pay off your house. You need this information before you sell your home, refinance the mortgage or you otherwise decide to get rid of the debt.

A "payoff demand letter" or request for payoff demand statement is generally a document provided to detail the amounts necessary for the final satisfaction of a loan.

Under federal law, the servicer is generally required to send you a payoff statement within seven business days of your request, subject to a few exceptions.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

You might want to pay off your mortgage early because2026 You have a high mortgage interest rate. If you're paying more than the current rate and can't refinance, a mortgage payoff may make more sense. You have adequate emergency savings and insurance.

Once you have your payoff amount, you should think about getting it done as soon as possible. A lender may give you a solid payoff number and due date (often seven to ten days).

A homeowner that wants to get rid of a current loan in favor of a new loan may also look forward to replacing a present mortgage debt. Both scenarios require the homeowner to pay off existing mortgage indebtedness. Homeowners must formally "request payoff" from their lenders for the exact amount owed.

5 ways to pay off your mortgage early Make extra payments. There are two ways you can make extra mortgage payments to accelerate the payoff process:Refinance your mortgage.Recast your mortgage.Make lump-sum payments toward your principal.Get a loan modification.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.