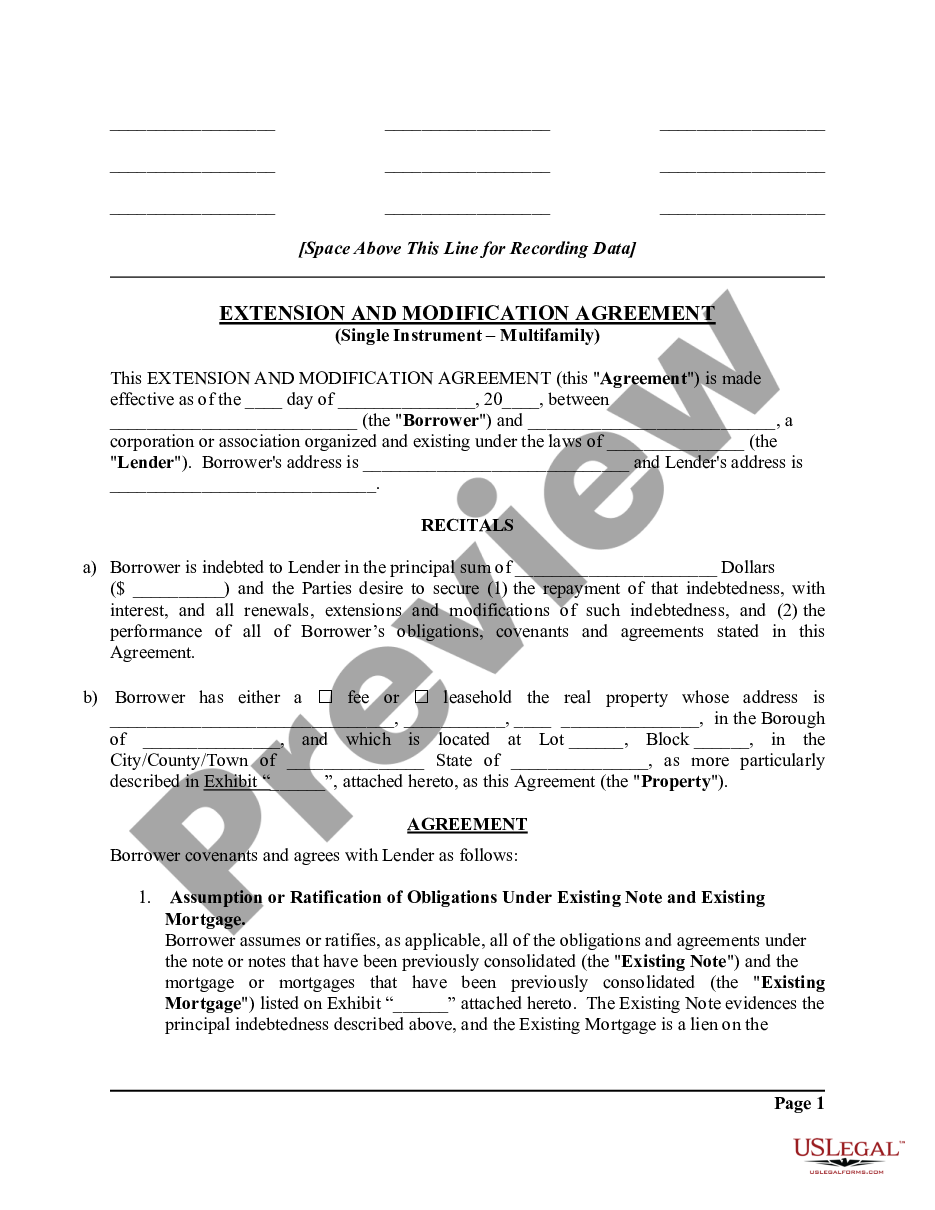

Nassau New York Document Review Record Sheet

Description

How to fill out Document Review Record Sheet?

Are you searching to swiftly produce a legally-enforceable Nassau Document Review Record Sheet or perhaps any other document to manage your personal or business matters.

You can choose from two options: engage a specialist to draft a legal document for you or compose it entirely on your own.

To begin, verify if the Nassau Document Review Record Sheet aligns with your state's or county's guidelines.

If there is a description of the document, be sure to confirm its intended purpose.

- Fortunately, there's another alternative - US Legal Forms.

- It will assist you in acquiring expertly crafted legal documents without incurring exorbitant charges for legal assistance.

- US Legal Forms provides an extensive assortment of over 85,000 state-compliant document templates, including the Nassau Document Review Record Sheet and package forms.

- We offer templates for a wide range of purposes: from divorce documentation to real estate papers.

- With more than 25 years of experience, we have established a solid reputation among our clients.

- Here’s how you can join their ranks and obtain the required document without unnecessary complications.

Form popularity

FAQ

The tax grievance process is a lengthy and complicated one; Heller notes that it can take anywhere from 12 to 18 months, from beginning to end, so if you make a habit of grieving your taxes every single year, you'll often find it becomes a cumulative process, with each year's grievance overlapping with the next one.

The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF). Read the instructions on the form and send in the appropriate fee.

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

A title search can take anywhere from a few hours up to five days to complete. There are several factors that can affect the time frame, including: The number and availability of documents that need to be reviewed. The age and transaction history of the property.

1. File for an Exemption Contact your local town assessor's office and inquire on what exemptions you may qualify for. STAR (Basic & Enhanced) Veteran. Senior Citizen & Low Income. Home Improvement. Disability & Low Income. Agricultural Commitment. Religious & Non-Profit. First-Time Homeowners.

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

You can request a certified or uncertified copy of property records online or in person. Certified copies cost $4 per page. Uncertified copies printed at a City Register Office cost $1 per page. There is no charge for ACRIS copies printed from a personal computer.

If you believe the assessment is inaccurate, you may appeal by filing an application for correction with the Assessment Review Commission by March 1, 2022. You can appeal online from this site from January 3, 2022 to March 1, 2022. File online.

Properties outside New York City and Nassau County Use Form RP-524, Complaint on Real Property Assessment to grieve your assessment. The form can be completed by yourself or your representative or attorney. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town.

Use Form RP-524, Complaint on Real Property Assessment to grieve your assessment. The form can be completed by yourself or your representative or attorney. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town.