Fairfax Virginia Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Drafting legal documents is essential in the modern era. However, it’s not always necessary to seek expert assistance to create some of these from scratch, including Fairfax Assignment of LLC Company Interest to Living Trust, by using a service like US Legal Forms.

US Legal Forms offers more than 85,000 templates to choose from across various types, ranging from living wills to real estate documents to divorce filings. All forms are categorized by their applicable state, simplifying the search process.

You can also find informational resources and guides on the site to make any tasks related to document execution straightforward.

If you are already a subscriber to US Legal Forms, you can find the required Fairfax Assignment of LLC Company Interest to Living Trust, Log In to your account, and download it. Obviously, our platform can’t completely replace a legal expert. If you are faced with a very complex situation, we recommend consulting an attorney to review your document before signing and submitting it.

With over 25 years in the industry, US Legal Forms has established itself as a reliable provider of various legal documents for millions of users. Join them today and conveniently obtain your state-compliant documents!

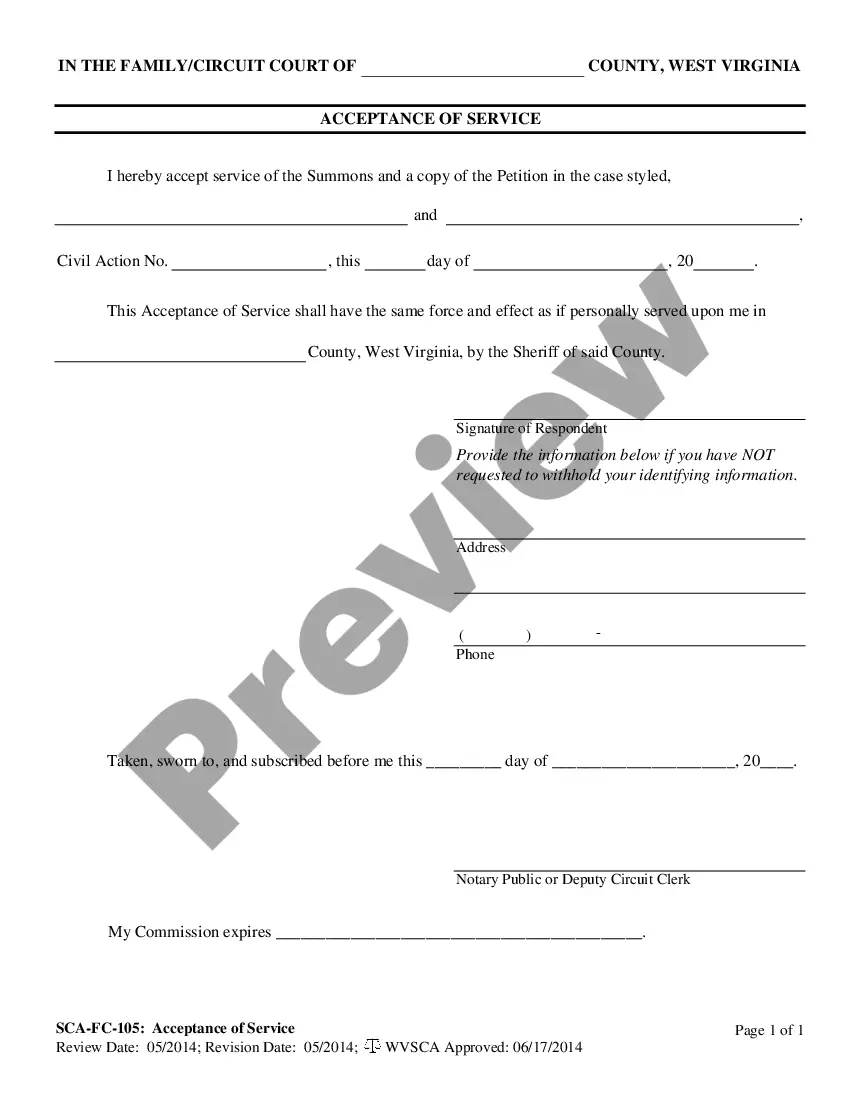

- Examine the document's preview and summary (if available) for an overview of what you’ll receive after acquiring the form.

- Confirm that the template you select is tailored to your state/county/region since state regulations can influence the legitimacy of some documents.

- Review similar forms or restart the search to find the correct document.

- Click Buy now and create your account. If you already have one, opt to Log In.

- Select the pricing plan, then a suitable payment method, and purchase Fairfax Assignment of LLC Company Interest to Living Trust.

- Choose to save the document template in any available file format.

- Go to the My documents section to re-download the document.

Form popularity

FAQ

An assignment of membership interest is a legal document that allows members of a Limited Liability Company (or LLC) to reassign their interest in the company to a different party. LLC laws are different from state to state, so what's required in an assignment of membership agreement changes.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

Assignment of interest in LLCs happens when a member communicates to other members his/her intention to transfer part or all of his ownership rights in the LLC to another entity. The assignment is usually done as a means for members to provide collateral for personal loans, settle debts, or leave the LLC.

The answer is that the LLC is designed to protect your personal assets from lawsuits, while the Living Trust preserves your estate from probate costs and inheritance taxes when you die, and prevents court control of your assets if you become incapacitated.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

For an LLC interest to be properly transferred to a revocable trust, the LLC must change the owner of record to the trust (specifically, to the trustee, as trustee of the trust).

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

How to Put an LLC in a Trust - YouTube YouTube Start of suggested clip End of suggested clip And you can make the change there if not you can amend your articles of organization or yourMoreAnd you can make the change there if not you can amend your articles of organization or your Articles of Incorporation. Or whatever it is out of the state and add the name of the trust.