Montgomery Maryland Sample Letter to Beneficiaries regarding Trust Money

Description

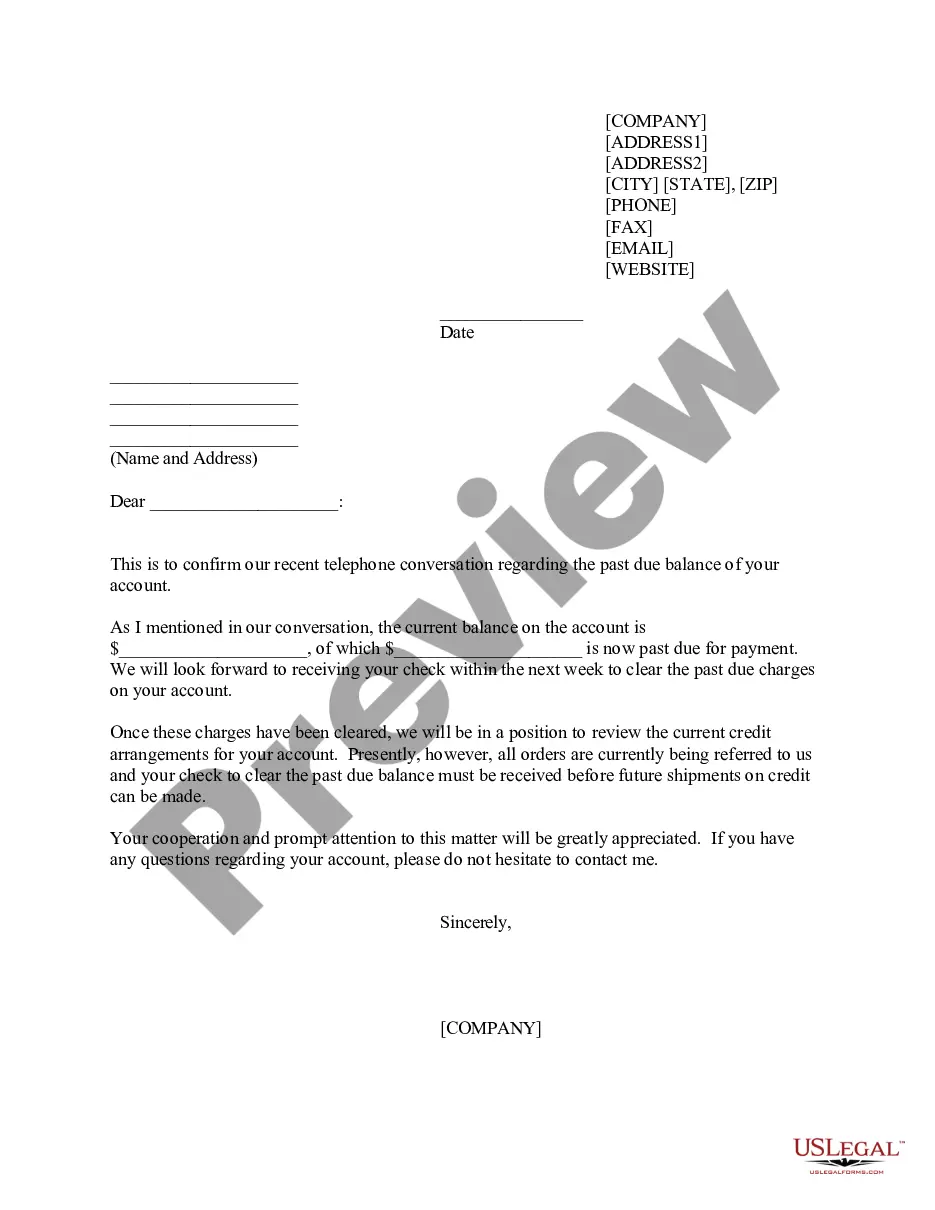

How to fill out Sample Letter To Beneficiaries Regarding Trust Money?

Creating documentation for the enterprise or individual requirements is consistently a significant duty.

When formulating a contract, a public service appeal, or a power of attorney, it is imperative to consider all federal and state statutes of the relevant jurisdiction.

Nonetheless, small counties and even towns also possess legislative processes that must be taken into account.

Exemplifying the US Legal Forms library is the need that all the documents you've ever retrieved remain accessible - you can reach them in your profile within the My documents section at any time. Join the platform and effortlessly acquire verified legal templates for any circumstance with just a few clicks!

- All these factors render it laborious and time-consuming to produce Montgomery Sample Letter to Beneficiaries regarding Trust Money without professional guidance.

- It's feasible to avoid unnecessary expenses on lawyers drafting your paperwork and generate a legally binding Montgomery Sample Letter to Beneficiaries regarding Trust Money independently by utilizing the US Legal Forms online repository.

- It is the finest online compilation of state-specific legal templates that are expertly validated, ensuring you can trust their legitimacy when selecting a specimen for your county.

- Previously enrolled users only need to Log In to their accounts to retrieve the required form.

- If you still lack a subscription, follow the step-by-step instructions below to acquire the Montgomery Sample Letter to Beneficiaries regarding Trust Money.

- Browse the page you've opened and confirm if it contains the document you require.

- To do this, utilize the form description and preview if these features are present.

Form popularity

FAQ

Several states require you to send a notice to all trust beneficiaries within a certain time after you take over as successor trustee of the trust. Most states give you 30 or 60 days to send this initial notice.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

Generally speaking, a trustee cannot withhold money from a beneficiary unless they are acting in accordance with the trust. If the trust does not indicate any conditions for dispersing funds, the trustee cannot make them up or follow their own desires.

In most cases, a trust deed generally offers two processes for the removal of a beneficiary. Most commonly, the beneficiary can sign a document to renunciate all interests as a beneficiary. Otherwise, the trustee may have discretionary power to revoke the beneficiary.

The letter to your heirs and beneficiaries may contain information about valuable possessions as well as sentimental pieces. Specify which beneficiaries are to receive less valuable possessions. Include important contact information in the letter to your heirs and beneficiaries.

A beneficiary should be addressed in a letter in the same manner as any other professional person. The letter should be addressed to the beneficiary, using her title and full name. Begin the salutation with the word dear and then state all relevant issues in a concise and clear manner.

Revocable Trust Rights as a Trustor Write the name of the trustee, his address, city, state, and zip code about one-quarter inch below the date. Reference the name of your trust, and your trust account number if applicable. Write a salutation followed by a colon, for example, "Dear Mr.

Notice to beneficiaries and heirs: If the trust becomes irrevocable when the settlor dies, the trustee has 60 days after becoming trustee or 60 days after the settlor's death, whichever happens later, to give written notice to all beneficiaries of the trust and to each heir of the decedent.

The trust itself must report income to the IRS and pay capital gains taxes on earnings. It must distribute income earned on trust assets to beneficiaries annually. If you receive assets from a simple trust, it is considered taxable income and you must report it as such and pay the appropriate taxes.

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.