Collin Texas Sample Letter for Delinquent Taxes

Description

How to fill out Sample Letter For Delinquent Taxes?

Drafting legal documents can be challenging. Additionally, if you opt to hire a legal expert to create a business contract, ownership transfer documents, prenuptial agreement, divorce filings, or the Collin Sample Letter for Delinquent Taxes, it could cost you a significant amount.

So, what is the most cost-effective method to save both time and finances while generating authentic documents that fully comply with your local and state laws? US Legal Forms is an ideal solution, whether you're looking for templates for personal or commercial purposes.

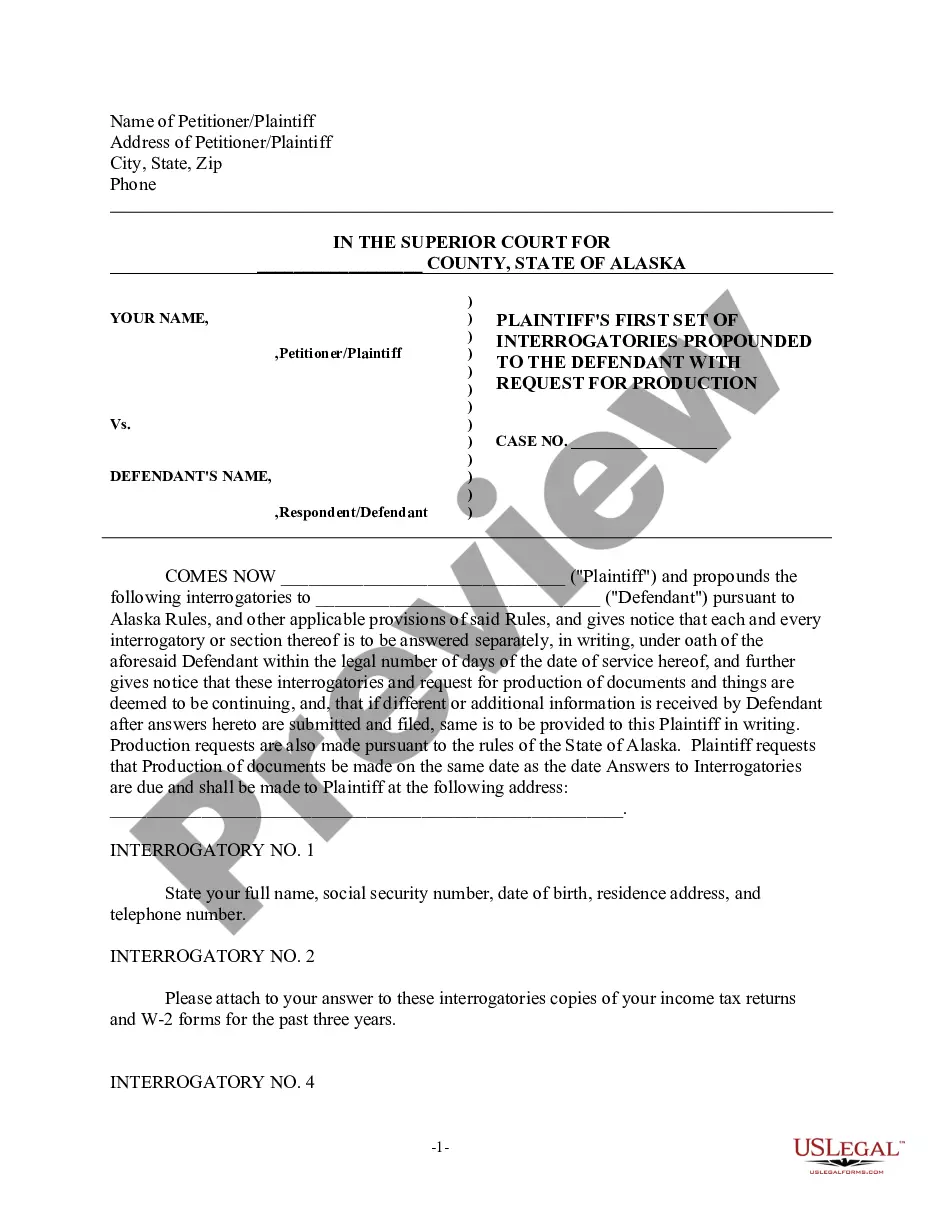

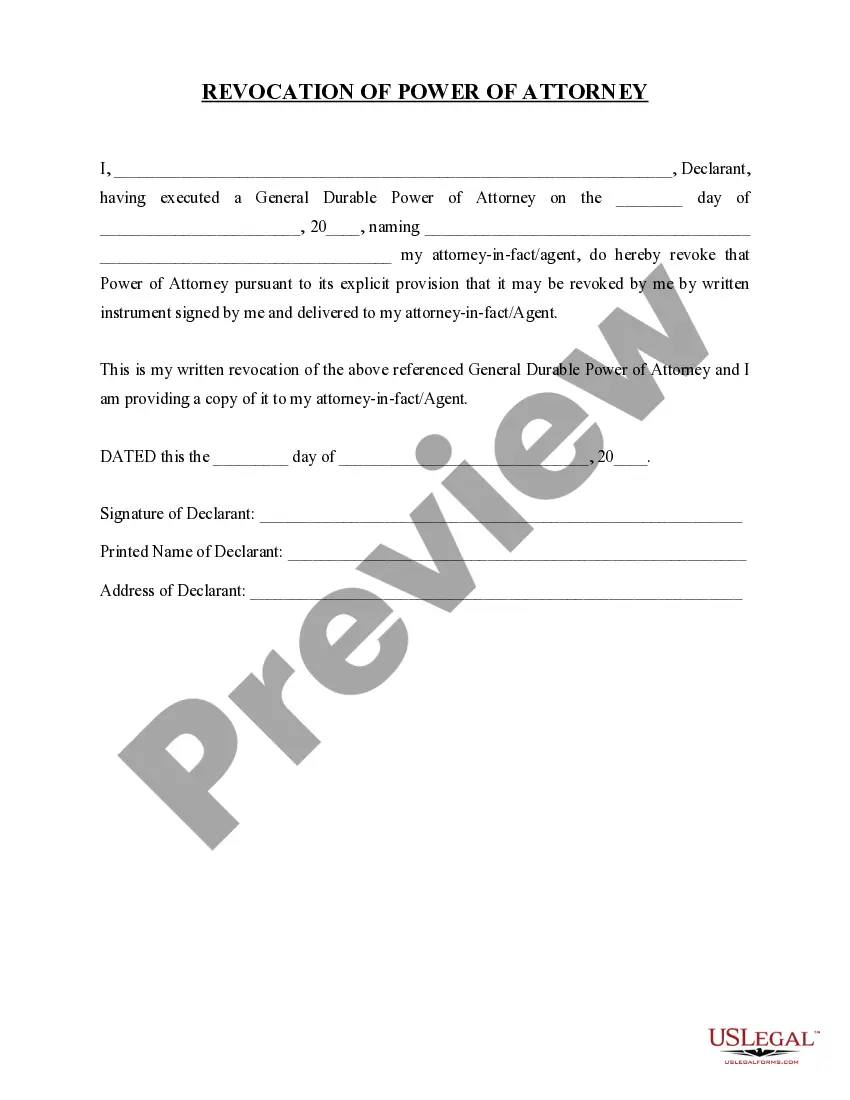

Don't fret if the form does not meet your needs - look for the appropriate one in the header. Click Buy Now after locating the desired sample and select the most suitable subscription. Log In or create an account to complete your subscription payment. Make a payment using a credit card or via PayPal. Select the file format for your Collin Sample Letter for Delinquent Taxes and save it. After completing this, you can either print it out and fill it in manually or upload the samples to an online editor for quicker and more efficient completion. US Legal Forms allows you to reuse all previously obtained documents multiple times - you can access your templates in the My documents section of your profile. Give it a try today!

- US Legal Forms boasts the most comprehensive online database of state-specific legal documents, offering users access to current and professionally validated forms for any situation, all consolidated in one place.

- Thus, if you're in search of the most recent version of the Collin Sample Letter for Delinquent Taxes, you can conveniently locate it on our platform.

- Accessing the documents requires minimal time.

- Those who already possess an account should verify their subscription is active, Log In, and select the sample using the Download button.

- If you haven't yet subscribed, here's how you can obtain the Collin Sample Letter for Delinquent Taxes.

- Browse the page to confirm that a sample is available for your area.

- Review the form description and utilize the Preview option, if available, to ascertain it's the template you require.

Form popularity

FAQ

If the lien is not satisfied within a reasonable amount of time, the lienholder has the right to foreclose on the property. The period in which this occurs can range from 60 days to more than 120 days. It all depends on the taxing authority and local market conditions.

Share on: In Texas, you cannot assume ownership of someone else's property by simply paying the balance of unpaid property taxes. However, you can purchase real estate, often at a discounted rate, at a tax foreclosure sale.

While Texas law provides a 10 percent annual cap on homestead valuation for the purpose of taxable value, there is no such cap on other property, including commercial, multifamily and industrial.

The protest must be mailed by May 15th to be timely or filed on the appraisal district's website by May 15th. Collin County Appraisal District's mailing address is: 250 El Dorado Parkway, McKinney, Texas, 75069.

In Texas, the redemption period is generally two years. This redemption period applies to residential homestead properties and land designated for agricultural use when the suit was filed. Other types of properties have a 180-day redemption period.

If taxes aren't paidor if a certificate of error isn't filedbefore the annual tax sale in the county, the tax lien can be sold at a public auction. Whoever buys the lien has a claim on the property, but doesn't technically own the property itself yet.

If you don't pay off the overdue amounts or have a valid defense against the foreclosure, the court will enter a judgment, and your property will be sold to a new owner at an auction. If the home doesn't sell at the tax sale, it will be "struck-off" to the county, which means the county gets the property.

Notice of protest The protest form can be submitted online using the Bexar Appraisal District's eFile system. Other options available include sending the form by email to protest@bcad.org, by fax to 210-242-2454 or mail: P.O. Box 830248, San Antonio, TX 78283.

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471. Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home.

Protests are to be sent to the chief appraiser at the Central Appraisal District of Collin County. You may discuss your objections about your property value, exemptions and special appraisal in a hearing with the Collin County Appraisal Review Board.