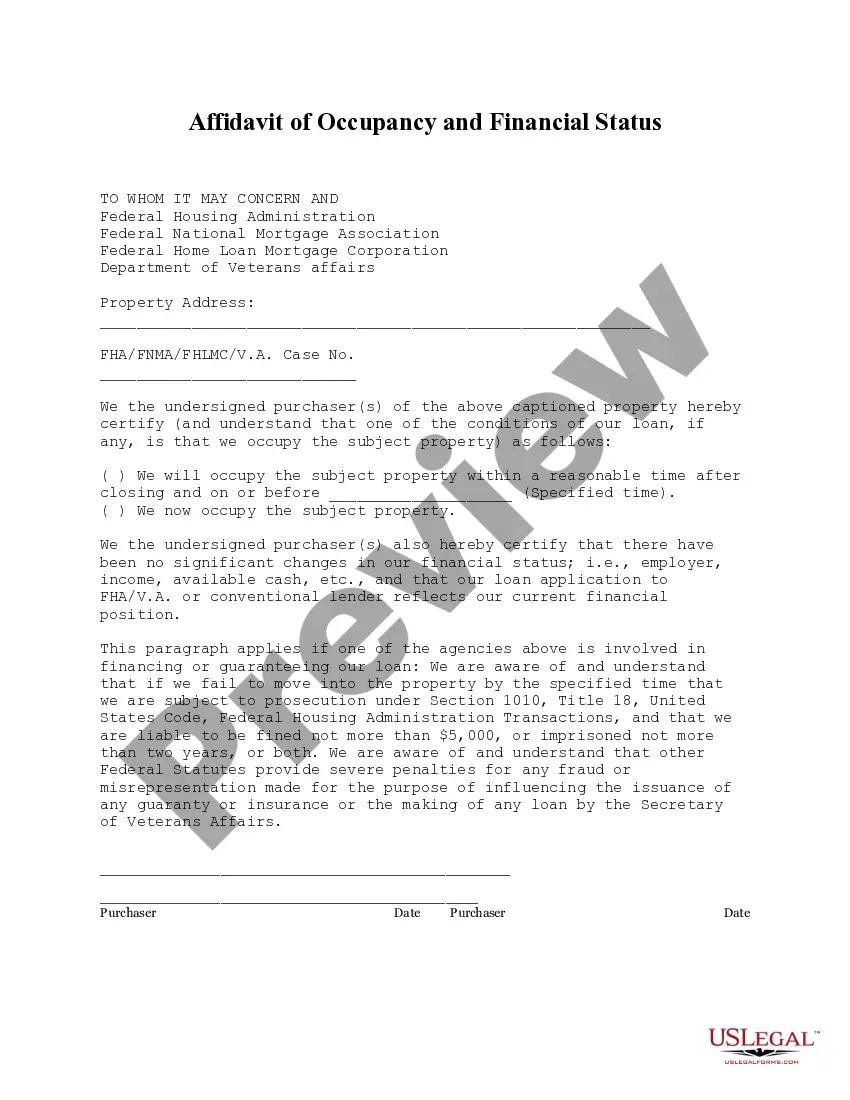

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.