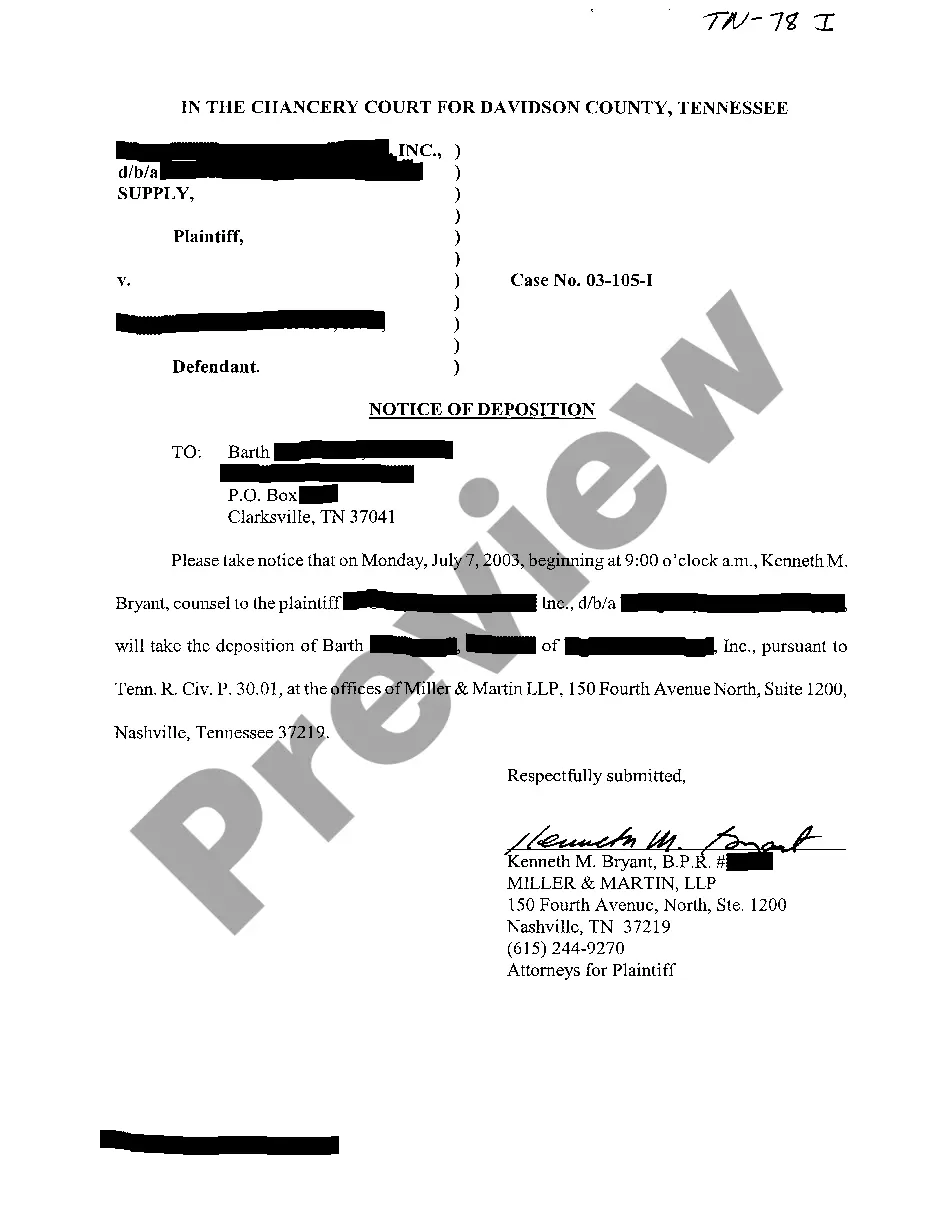

Suffolk New York Notice by Lessee to Lessor of Exercise of Option to Purchase

Description

How to fill out Notice By Lessee To Lessor Of Exercise Of Option To Purchase?

Creating documents for business or personal purposes is consistently a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it’s crucial to consider all federal and state statutes pertinent to the specific area.

Nonetheless, smaller counties and even towns also possess legislative regulations that you must take into account.

Join the platform and effortlessly obtain authenticated legal templates for any circumstance with just a few clicks!

- All these aspects make it stressful and time-consuming to draft Suffolk Notice by Lessee to Lessor of Exercise of Option to Purchase without professional guidance.

- It’s simple to save money on lawyers drafting your paperwork and create a legally valid Suffolk Notice by Lessee to Lessor of Exercise of Option to Purchase independently, using the US Legal Forms web library.

- It is the largest online repository of state-specific legal templates that are professionally examined, so you can be assured of their validity when selecting a sample for your county.

- Previously registered users only need to Log In to their accounts to acquire the necessary form.

- If you don’t have a subscription yet, follow the step-by-step guide below to procure the Suffolk Notice by Lessee to Lessor of Exercise of Option to Purchase.

- Browse the page you’ve opened and confirm if it contains the sample you need.

- To ensure this, utilize the form description and preview if these features are available.

Form popularity

FAQ

When and how is an Option exercised? That the tenant must give written notice to the landlord of their intention to exercise the Option; That the notice must be given during a particular period (usually between 6 months and 3 months prior to the end of the initial lease term); and.

To make money with a lease option the investor must find a renter to pay more than the amount the investor agreed to with the property owner. For example, if the investor agreed to pay $1500 each month but finds a tenant to pay $1800 each month, the investor makes a monthly income of $300 for the property.

Option to renew your lease? Use it before you lose it! Give the landlord formal written notice, which should be a clear and unequivocal exercise of the option.Serve the notice on the landlord within the required time.Serve the notice on the landlord in accordance with the terms of the lease.

A lease option is an agreement that gives a renter a choice to purchase the rented property during or at the end of the rental period. It also precludes the owner from offering the property for sale to anyone else. When the term expires, the renter must either exercise the option or forfeit it.

Option clauses, also known as renewal terms, are provisions in a commercial lease agreement that allow a tenant to extend the term of the lease for an additional term after the initial term has expired.

A Notice Clause in a lease sets out how notices are served from the landlord to the tenant and vice versa. That's not really a surprise. However, we frequently find that clients tend to take the Notice Clause for granted and don't really read it and sometimes don't understand it.

The main advantage of leasing a business facility is that your initial outlay of cash to gain the use of an asset is generally less for leasing than it is for purchasing.

This is a great question - I can confirm unequivocally that cooling off periods do NOT apply to rental property contracts. Most people will be familiar with the concept of a cooling off period you've probably been made aware of it when signing a new mobile phone contract or something similar.

optiontobuy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.