Riverside California Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

A document process always accompanies any legal activity you undertake.

Starting a business, applying for or accepting a job offer, transferring assets, and many other life circumstances require you to prepare official paperwork that differs from state to state.

This is why having everything gathered in one location is incredibly useful.

US Legal Forms is the largest online repository of up-to-date federal and state-specific legal templates.

This is the easiest and most reliable method to acquire legal documents. All the samples in our library are professionally created and confirmed for compliance with local laws and regulations. Prepare your documentation and manage your legal affairs efficiently with US Legal Forms!

- On this platform, you can quickly locate and obtain a document for any personal or business purpose used in your area, including the Riverside Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

- Finding samples on the platform is exceptionally simple.

- If you already possess a subscription to our service, Log In to your account, search for the sample using the search box, and click Download to save it on your device.

- Following this, the Riverside Articles of Incorporation, Not for Profit Organization, with Tax Provisions will be available for future use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this easy guideline to obtain the Riverside Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

- Ensure you have accessed the correct page with your local form.

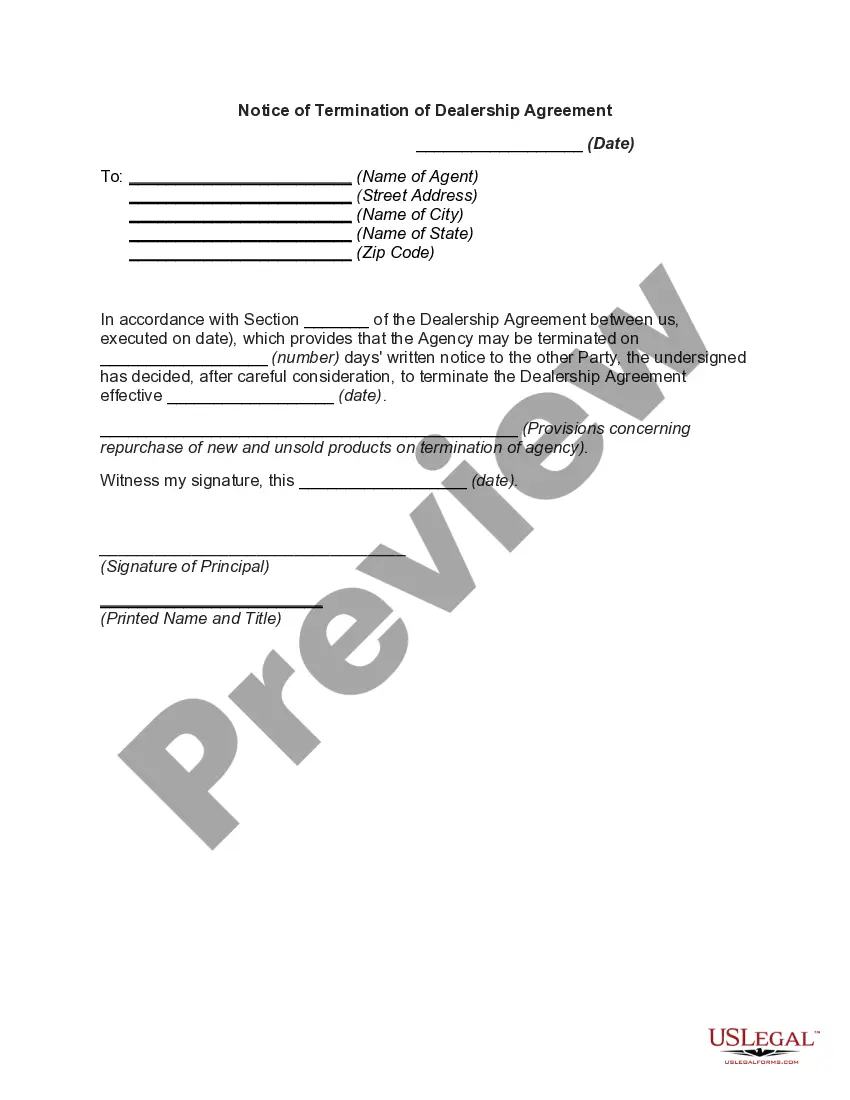

- Utilize the Preview mode (if available) and scroll through the template.

- Review the description (if any) to verify the template suits your requirements.

- Search for an alternative document using the search tab if the sample does not meet your needs.

- Click Buy Now once you find the necessary template.

Form popularity

FAQ

Yes, 501(c)(3) organizations are incorporated entities. This incorporation is crucial for their legal standing in Riverside, California, and allows them to operate as recognized not for profit organizations with tax provisions. Being incorporated also provides liability protection for the directors and officers, enhancing trust among donors and stakeholders.

Indeed, a 501(c)(3) organization needs articles of incorporation to establish itself legally. In Riverside, California, these articles are crucial for ensuring compliance with state laws governing not for profit organizations with tax provisions. Without them, your organization may face legal challenges and may not qualify for tax-exempt status.

Yes, a 501(c)(3) organization must have articles of incorporation as part of its legal foundation. These articles outline the purpose and structure of your organization in Riverside, California, while also incorporating tax provisions necessary for obtaining tax-exempt status. This documentation ensures your organization meets state requirements and is eligible for various funding opportunities.

You can obtain a copy of your 501(c)(3) tax-exempt form through the IRS website or by submitting a request to the IRS directly. First, ensure you have your organization’s details on hand to facilitate the retrieval process. Additionally, consider using platforms like USLegalForms to streamline the documentation needed for your Riverside, California, not for profit organization.

Articles of association serve as the framework for how a non-profit organization operates, including rules about governance, membership, and decision-making processes. In Riverside, California, these documents need to align with the articles of incorporation to ensure consistency in your not for profit organization with tax provisions. Properly drafted articles enhance credibility and legal standing.

The article for a non-profit organization typically details the organization’s purpose, structure, and governance. In Riverside, California, these articles should reflect the vision and mission of the organization, while also addressing specific tax provisions. This document lays the groundwork for your non-profit’s legal foundation and can greatly influence tax-exempt eligibility.

Articles of Incorporation: Your Primary Corporate Document The primary corporate document for every nonprofit corporation is its articles of incorporation. A corporation comes into existence on the date its articles of incorporation are filed with the state corporate filing office.

However, the basic structure of a nonprofit is generally the same everywhere. The structure is divided into three functional areasgovernance, programs and administration and then further subdivided within each area, depending on the purpose and goals of the nonprofit.

Filing the Nonprofit Articles of Incorporation is one of the main steps in starting your nonprofit 501c3 organization. It is the first document of your required organizational documents, and one that almost 90% of applicants don't get it right the first time.

The most common type of business structure for a nonprofit is a corporation, which is formed and regulated under state law. Therefore, if a nonprofit incorporates, it must abide by the state requirements of a corporation.