Time share is a type of property right under which the purchaser of a time share has access to the 'share' they own in a property for a specific 'time'. Time-shares have been sold for cruises, recreational vehicles, campgrounds, and many other types of properties, but their most popular use is for shares in condominiums at timeshare resorts.

A Warranty Deed s provides the most protection against defects of title- covenants that the grantor has title to, and the power to convey, the property; that the buyer will not be disturbed in possession of the land; and that transfer is made without unknown adverse claims of third parties. A Special Warranty Deed only that the grantor held good title during his or her ownership of the property, not that there were no title defects when others owned it. If all liens and encumbrances are disclosed, the seller is not liable if a third person interferes with the buyer's ownership.

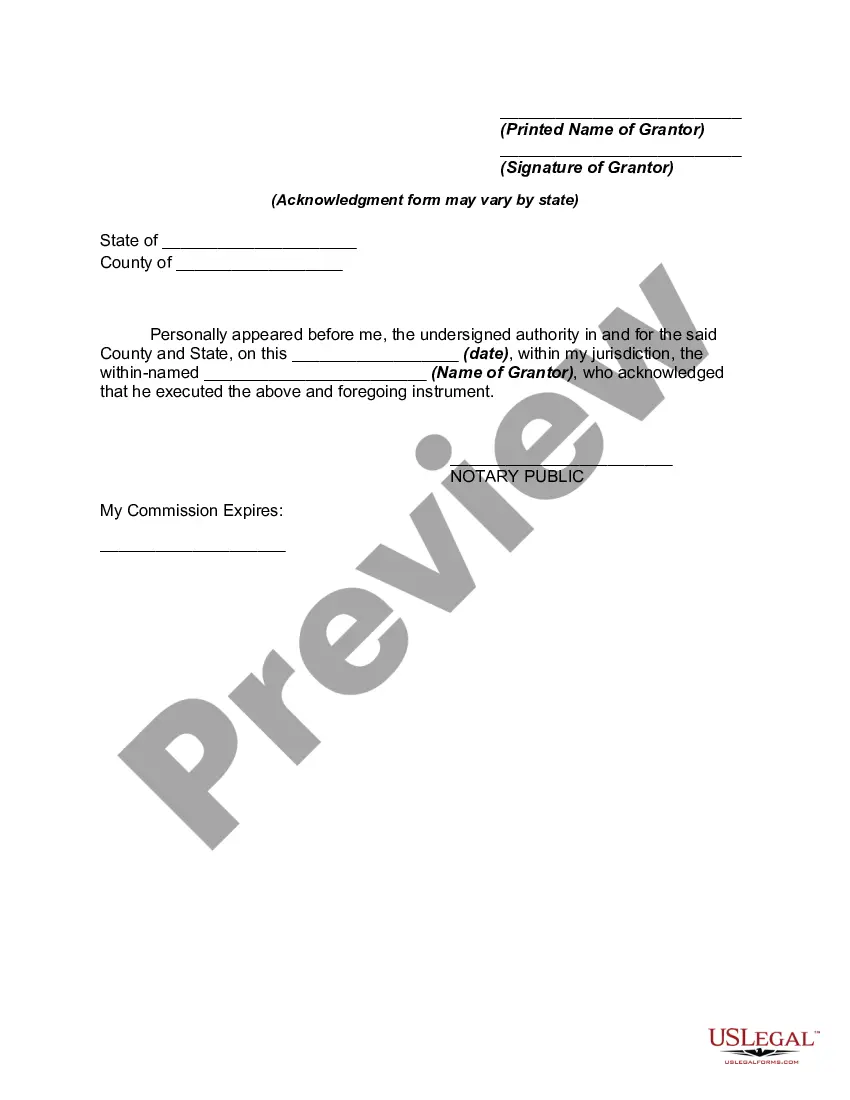

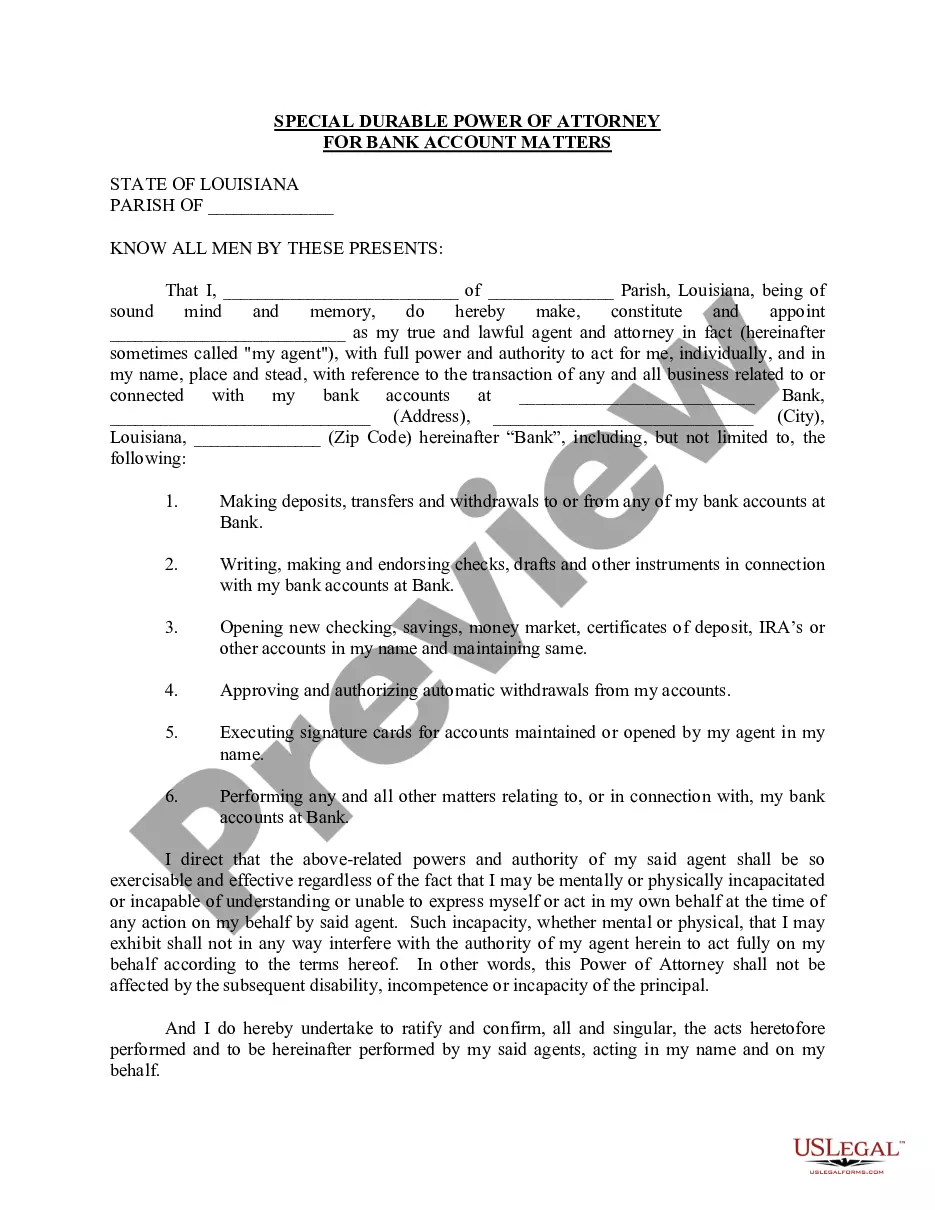

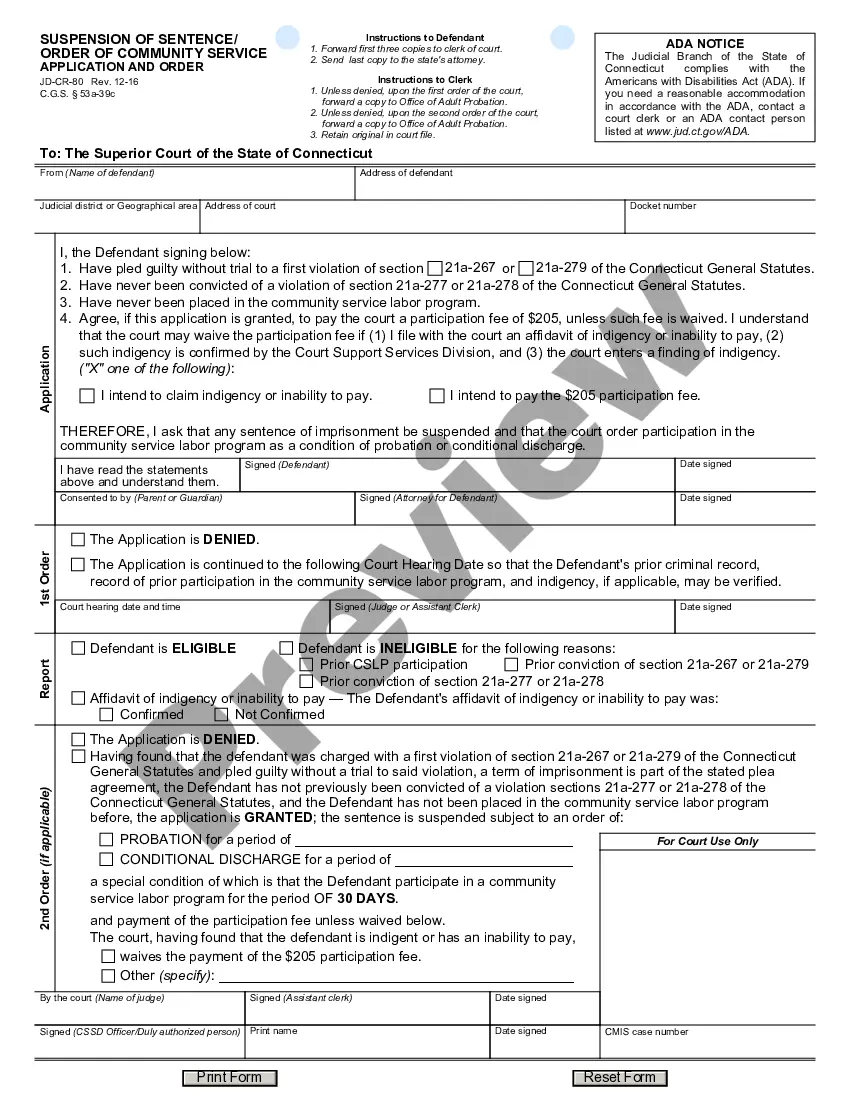

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.