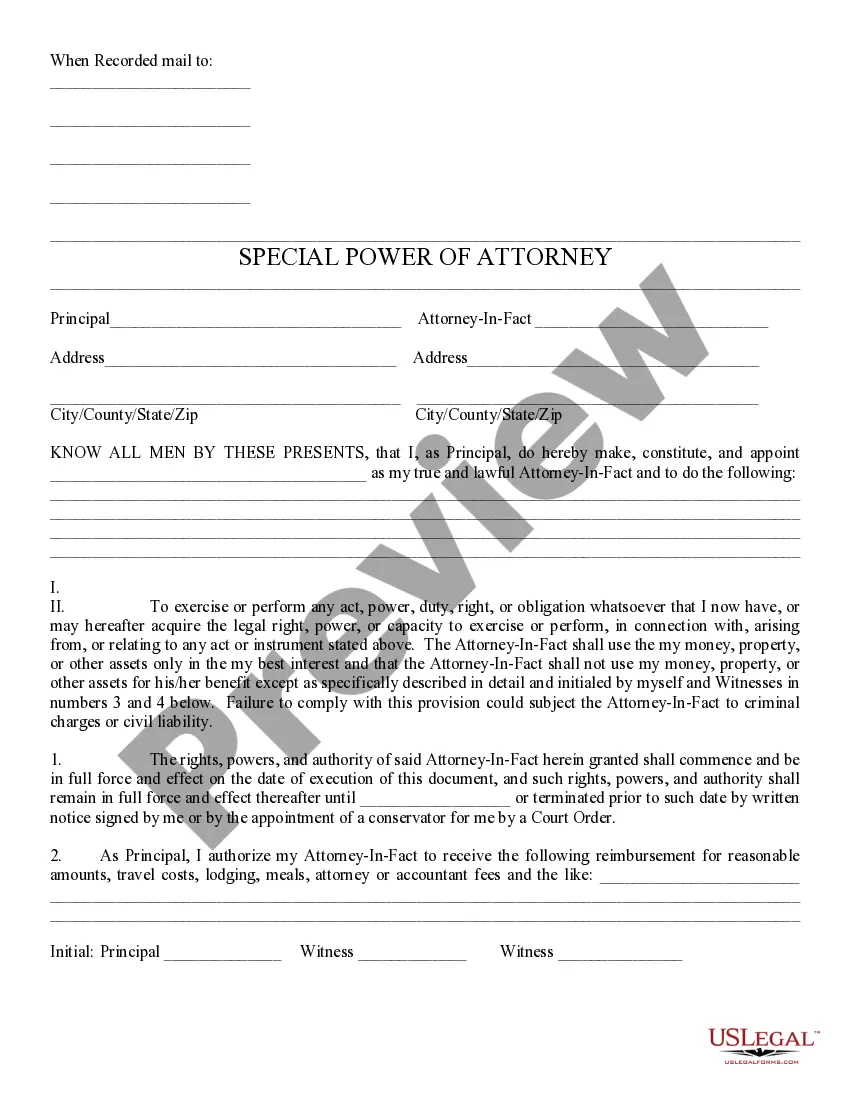

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fulton Georgia Petition to Determine Distribution Rights of the Assets of a Decedent

Description

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

Are you searching to swiftly create a legally-enforceable Fulton Petition to Determine Distribution Rights of the Assets of a Decedent or potentially any other document to oversee your personal or business matters.

You can choose one of two alternatives: reach out to a legal expert to draft a legitimate document on your behalf or construct it entirely by yourself.

To begin, thoroughly confirm if the Fulton Petition to Determine Distribution Rights of the Assets of a Decedent adheres to your state's or county's laws.

If the form includes a description, ensure to verify its intended use.

- The good news is, there's an additional option - US Legal Forms.

- It will assist you in obtaining well-written legal documents without incurring exorbitant fees for legal services.

- US Legal Forms presents a vast anthology of over 85,000 state-specific document templates, including Fulton Petition to Determine Distribution Rights of the Assets of a Decedent and form bundles.

- We offer papers for a variety of life situations: from divorce documents to real estate contracts.

- Having been in operation for more than 25 years, we have developed an impeccable reputation among our clientele.

- Here’s how you can become one of our satisfied clients and receive the required document without any hassle.

Form popularity

FAQ

When Georgia courts select an executor or administrator to handle the estate, Georgia law immediately puts a six-month hold on all lender claims. That hold is the same for all creditors other than those who hold a home mortgage, vehicle loans, or security interests on the estate.

The asset distribution to the descendants of a deceased owner of an estate is determined during the estate planning process. In this process, the owner of the estate identifies all their heirs who are due to receive a portion of the inheritance. The owner lists all the assets that he/she owns.

On average, the time to settle an estate in Georgia is 12 to 18 months.

The final distribution of probate is the transfer of title and assets to the heirs and beneficiaries named in the decedent's estate. This takes place after the probate has been fully administered and the judge signs off that the estate is settled and can be distributed.

Because no notice is required, Georgia law gives interested parties four years rom the date the will is admitted to probate in common form to file an objection. Exception: A person who is a minor at the time the will is probated has four years after they reach age 18 to object.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

If you're a Beneficiary, it's important to remember that there can be an innocent explanation for an Executor delaying the distribution of an Estate, so you should talk to the Executor first to raise any concerns you have, and you might find that the issues are resolved straight away.

Under Georgia law, there is no time limit on settling an estate. After your loved one passes away, there is no set number of days or months to open an estate. The usual time frame is from two weeks to as long as six months.