Contra Costa California Disclaimer of Inheritance Rights for Stepchildren

Description

How to fill out Contra Costa California Disclaimer Of Inheritance Rights For Stepchildren?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Contra Costa Disclaimer of Inheritance Rights for Stepchildren, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Contra Costa Disclaimer of Inheritance Rights for Stepchildren from the My Forms tab.

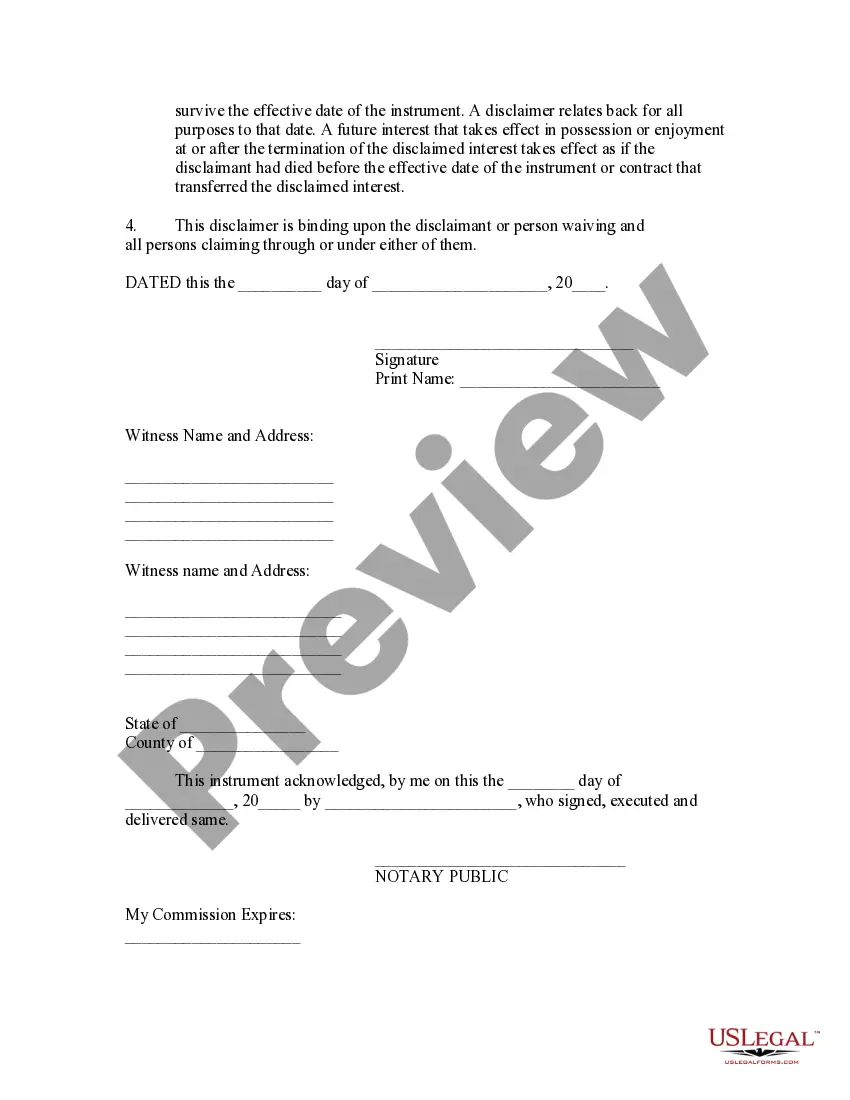

For new users, it's necessary to make some more steps to get the Contra Costa Disclaimer of Inheritance Rights for Stepchildren:

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Only a spouse, a blood relative, or an adopted child can inherit automatically from someone who died without leaving a will. Bear in mind also that a will that leaves assets to 'my children' or to 'my brothers and sisters' does not include stepchildren and stepsiblings.

In fact, California law states that stepchildren do not inherit until all of the relatives directly related to the stepparent or relatives descended from the stepparent's grandparents receive property. This can even apply if your stepparent inherited your biological parent's assets upon their passing.

Using a Marital Bypass Trust prevents your assets from ending up in the hands of the your stepchildren, your new spouse's, or perhaps even another person if your new spouse remarries.

Only a spouse, a blood relative, or an adopted child can inherit automatically from someone who died without leaving a will. Bear in mind also that a will that leaves assets to 'my children' or to 'my brothers and sisters' does not include stepchildren and stepsiblings.

When are stepbrothers and stepsisters awarded an inheritance? Step-siblings never inherit, unless they were adopted by the decedent's parent, in which case they are considered equal to natural siblings and receive their share of the decedent's estate along and equally with those natural siblings.

Stepchildren do not have inheritance rights unless you have legally adopted them. If you want your stepchildren to inherit from you, you must specifically name them as beneficiaries using at least one estate planning tool, such as a will, trust, or beneficiary designation.

In California, for example, state intestacy law allows a step child to inherit from a step parent, if it can be proved 1) the relationship with the step child began while the step child was a minor and continued until the present, and 2) there is clear and convincing evidence the step parent would have adopted the