A mark is any word, name, symbol, or design that identifies a product or service. A trademark identifies a product (for example, Coca-Cola). A service mark identifies a service (for example, Holiday Inn). One can be an owner of a trademark or service mark, whether or not it is registered. This is common law protection. Registration is proof of ownership and makes ownership rights easier to enforce. The basic question in lawsuits over marks is whether or not the general public is likely to be confused as to the origin of the service or product.

A copyright is the exclusive right given by federal statute to the creator of a literary or an artistic work to use, reproduce, and display the work. The creator of the work has a limited monopoly on the work and can, with some exceptions, prohibit others from copying or displaying the work. Copyright law protects such works as writing, music, artwork, and computer programs. A copyright gives one the exclusive right to use or reproduce a literary, artistic, dramatic, audiovisual or musical work, or a computer program for the creator's life plus 50 years. A copyright is obtained simply by creating the work. It comes into existence automatically on the dated it is created.

Trade names are names associated with a business and its reputation. Business names are not by themselves a trademark. The name that a business uses to identify itself is called a "trade name."

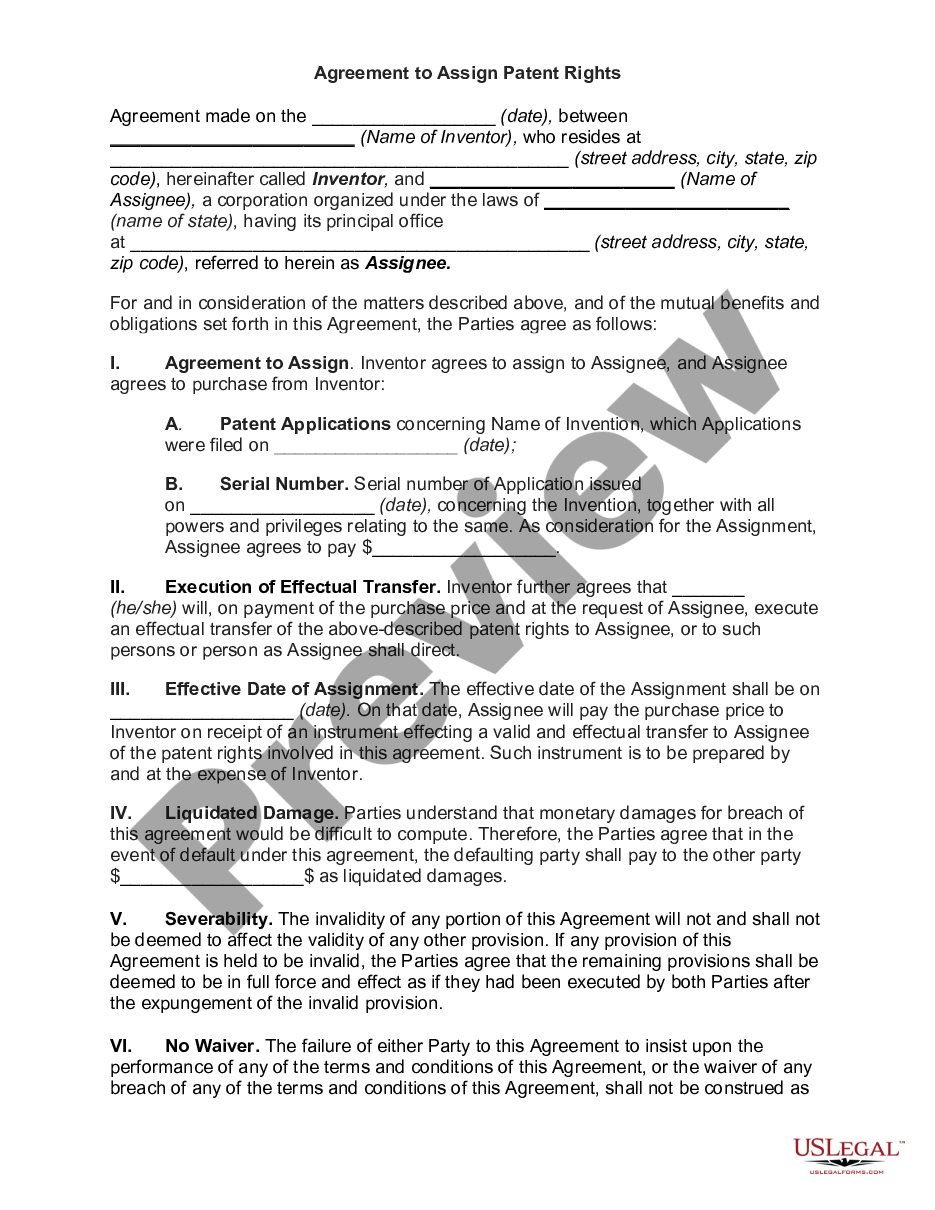

Intellectual property is a property right that can be protected under federal and state law, including copyrightable works, ideas, discoveries, and inventions. The term intellectual property relates to intangible property such as patents, trademarks, copyrights, and trade secrets.

A nonexclusive license is, in effect, an agreement by the licensor not to sue the licensee for infringement of the intellectual property rights being transferred. Such nonexclusive license is also normally not transferable by assignment to any other party by the licensee and, unless otherwise expressly provided for in the agreement.