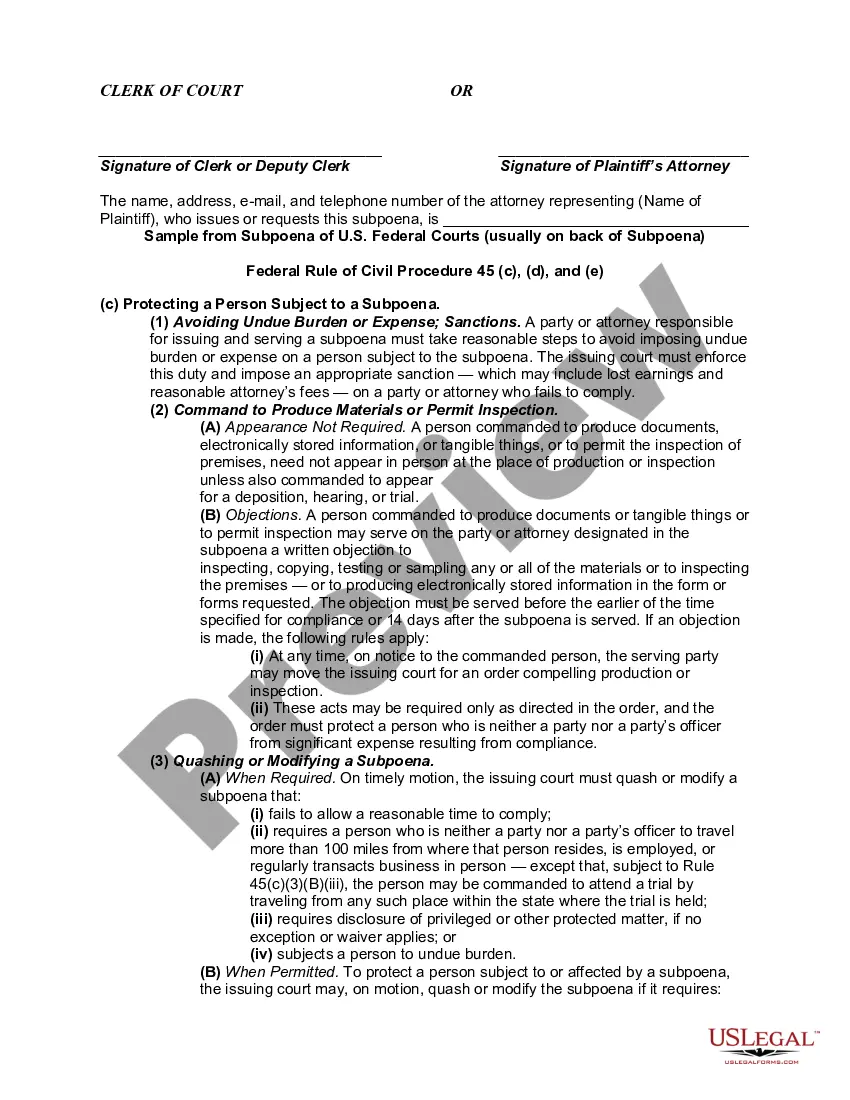

A subpoena is an order directed to an individual commanding him to appear in court on a certain day to testify or produce documents in a pending lawsuit. The power to subpoena a person is granted officers of the court, such as clerks of courts, attorneys and judges. A person may be subpoenaed to appear in court or any designated location to provide testimony for trial or deposition or produce documents or other evidence.

A subpoena which requests items be brought with the person is called a "subpoena duces tecum". A subpoena is an order directed to an individual commanding him to appear in court on a certain day to testify or produce documents in a pending lawsuit. The power to subpoena a person is granted officers of the court, such as clerks of courts, attorneys and judges. A person may be subpoenaed to appear in court or any designated location to provide testimony for trial or deposition or produce documents or other evidence.

Identity theft is governed by federal and state criminal statutes. State laws vary, but typically define the crime to include an intent to use another's identity to commit, aid, or abet any unlawful activity. A person commits the crime of identity theft if, without the authorization, consent, or permission of the victim, and with the intent to defraud for his or her own benefit or the benefit of a third person, he or she does any of the following:

1. Obtains, records, or accesses identifying information that would assist in accessing financial resources, obtaining identification documents, or obtaining benefits of the victim.

2. Obtains goods or services through the use of identifying information of the victim.

3. Obtains identification documents in the victim's name.