The Franklin Ohio Adjustable Rate Rider — Variable Rate Note is an important document that homeowners in Franklin, Ohio need to understand when opting for an adjustable-rate mortgage. This rider provides specific details about the terms and conditions of the loan, particularly regarding the interest rate, payment adjustments, and potential risks involved. With various types available, it's crucial to select the most appropriate Franklin Ohio Adjustable Rate Rider — Variable Rate Note for your particular needs. One common type of Franklin Ohio Adjustable Rate Rider — Variable Rate Note is the 5/1 ARM (or 5/1 Adjustable Rate Mortgage). Under this option, the initial interest rate remains fixed for an initial period of five years. After that, the rate will adjust annually for the remaining term of the loan. This type of rider offers stability during the initial years but allows for the possibility of fluctuations in interest rates over time. Another well-known variant is the 7/1 ARM (or 7/1 Adjustable Rate Mortgage). Similar to the 5/1 ARM, the 7/1 ARM provides a fixed interest rate for the first seven years of the loan, followed by annual adjustments thereafter. This type is ideal for homeowners who plan to stay in their home for a moderate period and wish to take advantage of lower initial interest rates. The Franklin Ohio Adjustable Rate Rider — Variable Rate Note also includes provisions related to interest rate adjustments and payment calculations. These provisions typically outline the frequency of adjustments and the index used for determining rate changes. They also specify how the borrower will be notified about any rate adjustments and provide information about rate caps and payment limits to ensure that changes are manageable. It is crucial for anyone considering an adjustable-rate mortgage in Franklin, Ohio, to thoroughly review the Franklin Ohio Adjustable Rate Rider — Variable Rate Note. Understanding the terms and conditions of the loan, including potential risks and payment adjustments, is vital to making informed decisions and avoiding any financial surprises down the road. By selecting the appropriate Franklin Ohio Adjustable Rate Rider — Variable Rate Note for your needs, you can navigate the adjustable-rate mortgage process with confidence and make the most of your homeownership journey.

Franklin Ohio Adjustable Rate Rider - Variable Rate Note

Description

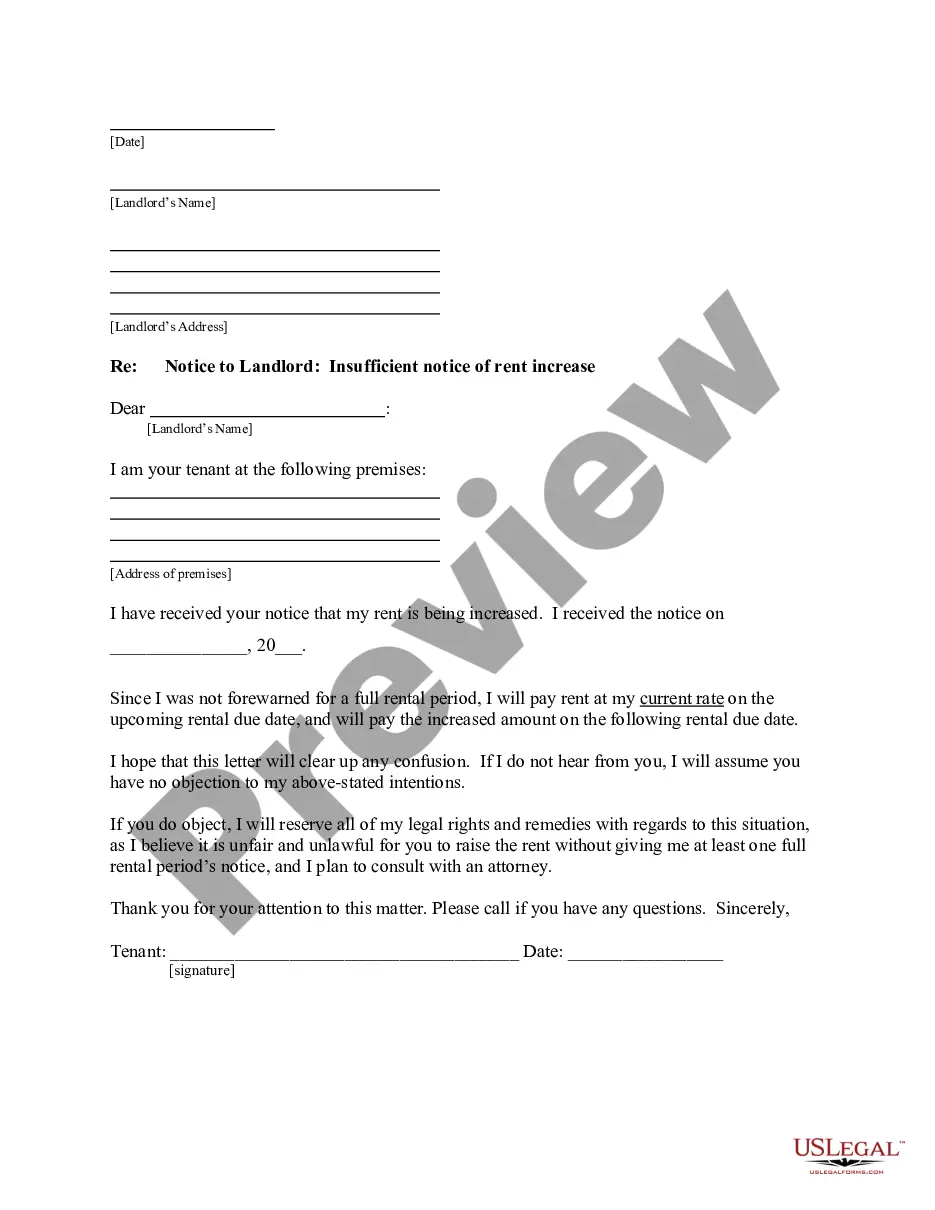

How to fill out Franklin Ohio Adjustable Rate Rider - Variable Rate Note?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Franklin Adjustable Rate Rider - Variable Rate Note, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any tasks associated with document execution simple.

Here's how to locate and download Franklin Adjustable Rate Rider - Variable Rate Note.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the similar forms or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and buy Franklin Adjustable Rate Rider - Variable Rate Note.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Franklin Adjustable Rate Rider - Variable Rate Note, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you have to cope with an extremely challenging situation, we recommend getting an attorney to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant paperwork effortlessly!

Form popularity

FAQ

Pros of an adjustable-rate mortgage It has lower rates and payments early in the loan term. Because lenders can consider the lower payment when qualifying borrowers, people can buy more expensive homes than they otherwise could. It allows borrowers to take advantage of falling rates without refinancing.

An adjustable-rate mortgage, or ARM, is a home loan with an interest rate that can change periodically. This means that the monthly payments can go up or down. Generally, the initial interest rate is lower than that of a comparable fixed-rate mortgage.

Adjustable-Rate Mortgage Benefits The bank (usually) rewards you with a lower initial rate because you're taking the risk that interest rates could rise in the future. 2feff Contrast the situation with a fixed-rate mortgage, where the bank takes that risk.

What is an Adjustable Rate Note? An adjustable rate note is a debt instrument with an interest rate that can fluctuate over time. Lenders typically use adjustable rates to compensate for risk and inflation, allowing borrowers to save money on their loan's interest payments.

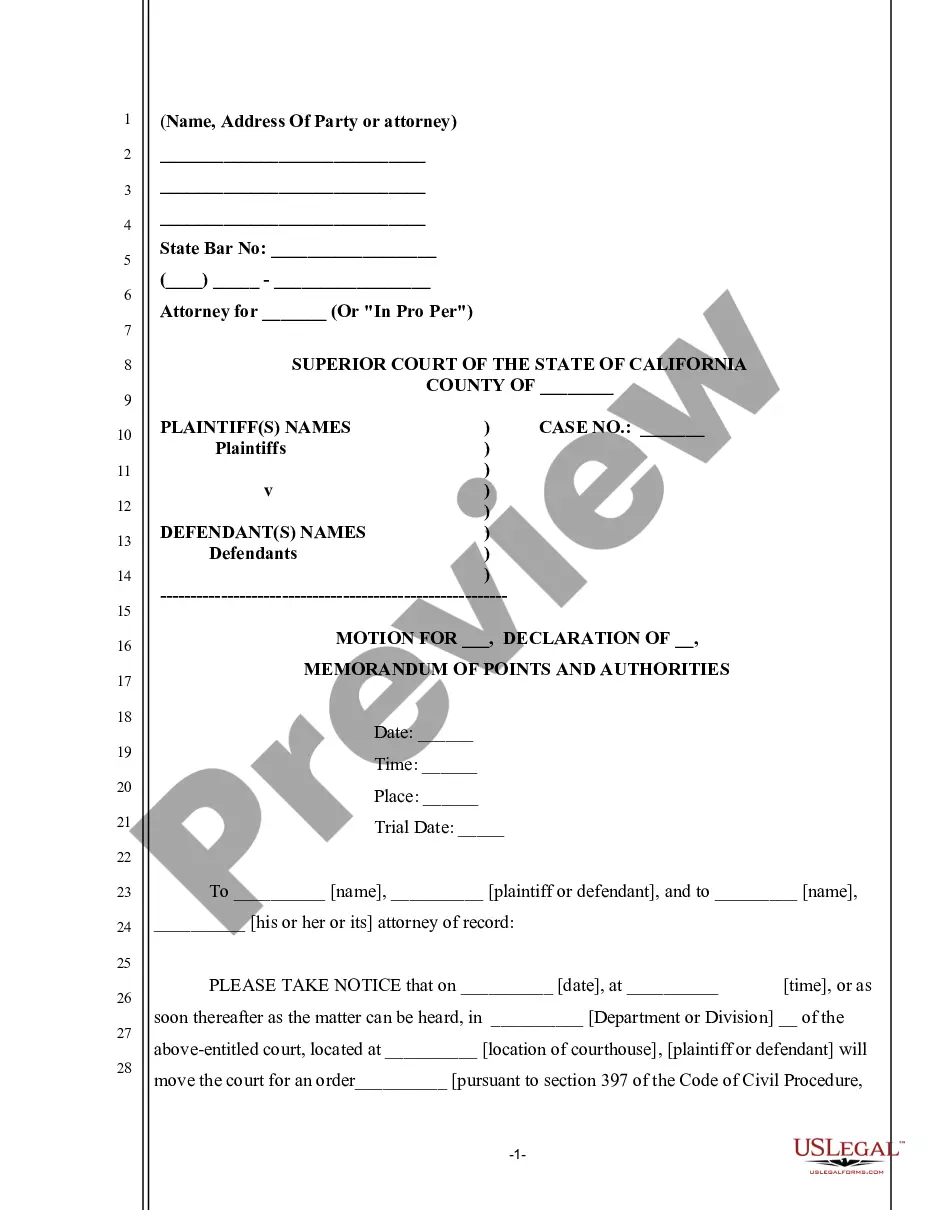

Why do I have mortgage rider? The mortgage rider includes special terms, conditions, and situations that affect the loan but are not present in the primary mortgage document. A mortgage rider is necessary when there are additional loan terms that are too complex to include into the primary mortgage papers.

Cons of Adjustable-Rate Mortgages You could be left with a much higher payment. You might buy more house than you can afford. Budget and financial planning is more difficult. You might end up owing more than your house is worth.

An adjustable-rate mortgage (ARM) is a home loan with a variable interest rate. With an ARM, the initial interest rate is fixed for a period of time. After that, the interest rate applied on the outstanding balance resets periodically, at yearly or even monthly intervals.

THE NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN THE INTEREST RATE AND THE MONTHLY PAYMENT. THE NOTE LIMITS THE AMOUNT THE BORROWER'S ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES THE BORROWER MUST PAY.

ARMs are easier to qualify for than fixed-rate loans, but you can get 30-year loan terms for both. An ARM might be better for you if you plan on staying in your home for a short period of time, interest rates are high or you want to use the savings in interest rate to pay down the principal on your loan.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date. Condominium riders specify the special terms of condominium ownership, such as the percentage of interest the borrower legally owns in the shared areas, or common elements.