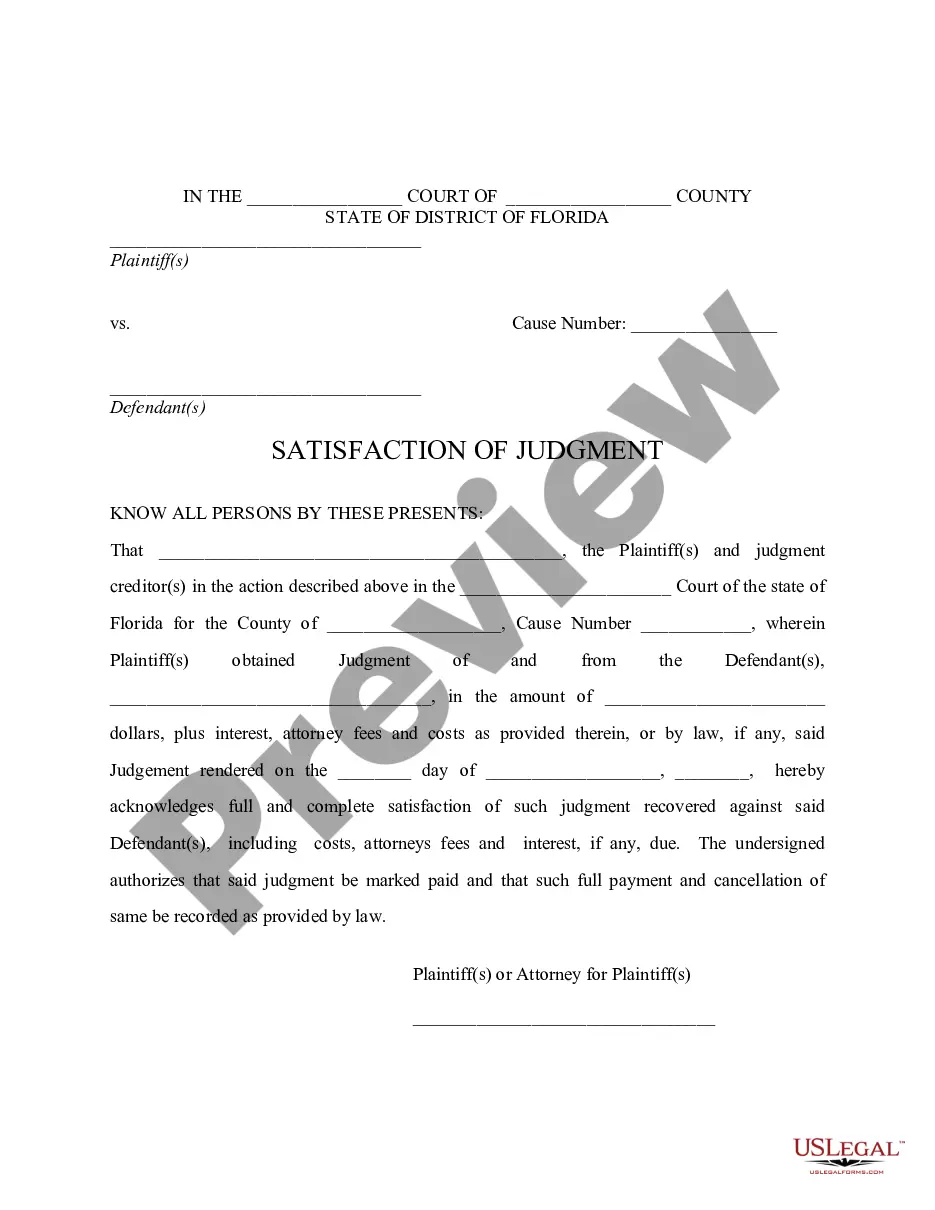

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Clark Nevada Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness Introduction: The Clark Nevada Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness is a legal document that allows an individual to assign their expected interest in an estate to repay outstanding debts. It provides a mechanism for individuals to proactively address their financial obligations by utilizing their anticipated inheritance. Types of Clark Nevada Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness: 1. Voluntary Assignment: A voluntary assignment occurs when an individual willingly assigns their expected interest in an estate to pay off their debts. This option allows individuals to take control of their financial situation before they formally acquire their inheritance. By voluntarily assigning a portion of their expected interest, individuals can ensure that their debts are settled promptly. 2. Court-Mandated Assignment: In some cases, a court may order the assignment of a portion of an individual's expected interest in an estate to repay their debts. This occurs when a person becomes legally obligated to settle outstanding obligations, typically due to a lawsuit or bankruptcy filing. The court mandates the assignment to ensure the timely resolution of the individual's debt. 3. Discretionary Assignment: A discretionary assignment of a portion of expected interest in an estate in order to pay indebtedness allows the assignor to determine the amount or percentage they wish to assign based on their financial situation and outstanding debts. This type of assignment provides flexibility to individuals, permitting them to retain a portion of their expected inheritance while partially settling their indebtedness. Key Components of Clark Nevada Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness: 1. Identification of Parties: The assignment should include the names, addresses, and contact information of both the assignor (the individual assigning their expected interest) and the assignee (the creditor or the party to whom the debt is owed). 2. Detailed Description of Expected Interest: The assignment must outline the anticipated interest in the estate that the assignor will be entitled to receive, including any specific assets or monetary value associated with the expected interest. 3. Assignment Percentage or Amount: The document should clearly specify the percentage or amount of the assignor's expected interest to be assigned to the assignee. This provides clarity on the extent of the assignor's obligation towards debt repayment. 4. Confirmation of Indebtedness: The assignment must acknowledge the existence and the amount of the debt owed to the assignee by the assignor. Including specific information about the debt, such as loan numbers or account details, helps to avoid ambiguity. 5. Rights and Liabilities: The assignment should address the rights and liabilities of both parties involved. It may include provisions regarding how the assignee can collect the assigned portion of the expected interest, any legal recourse in case of default, and the release of the assignor from further obligations upon successful assignment of the agreed-upon portion. Conclusion: The Clark Nevada Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness serves as a valuable tool in managing debts by utilizing an individual's anticipated inheritance. Whether it is a voluntary assignment, court-mandated assignment, or discretionary assignment, this legal document ensures the efficient and fair settlement of outstanding obligations.