Colorado Springs Colorado Request for Refund of Duplicate Payment

Description

Form popularity

FAQ

To claim the Colorado Tabor refund, you must first confirm your eligibility based on your income and residency requirements. You typically need to complete the necessary forms and submit them along with your tax return. If you encounter any issues, such as a duplicate payment, the US Legal platform can help you navigate the Colorado Springs Colorado Request for Refund of Duplicate Payment easily.

The $800 Colorado tax refund is a one-time payment provided by the state to eligible residents, aimed at alleviating personal tax burdens. This refund is often issued automatically when you file your tax return, so you do not need to take additional steps. For those interested in understanding eligibility or needing to address duplicate payments, the US Legal platform offers resources that can assist with the Colorado Springs Colorado Request for Refund of Duplicate Payment.

To request a refund from income tax, you need to file your tax return and ensure that you have included all relevant information accurately. If you believe you have made a duplicate payment, be sure to highlight this in your submission. You can streamline this process using the US Legal platform, which provides forms and guidance specifically for Colorado Springs Colorado Request for Refund of Duplicate Payment.

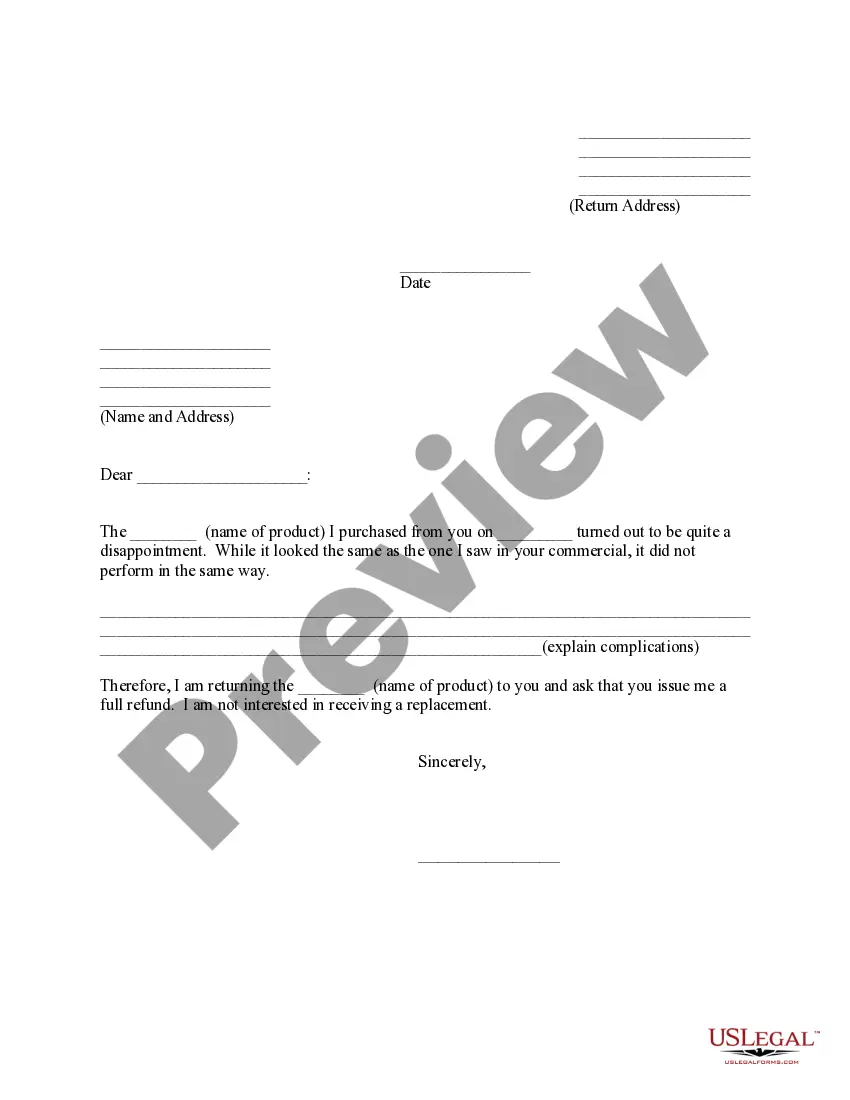

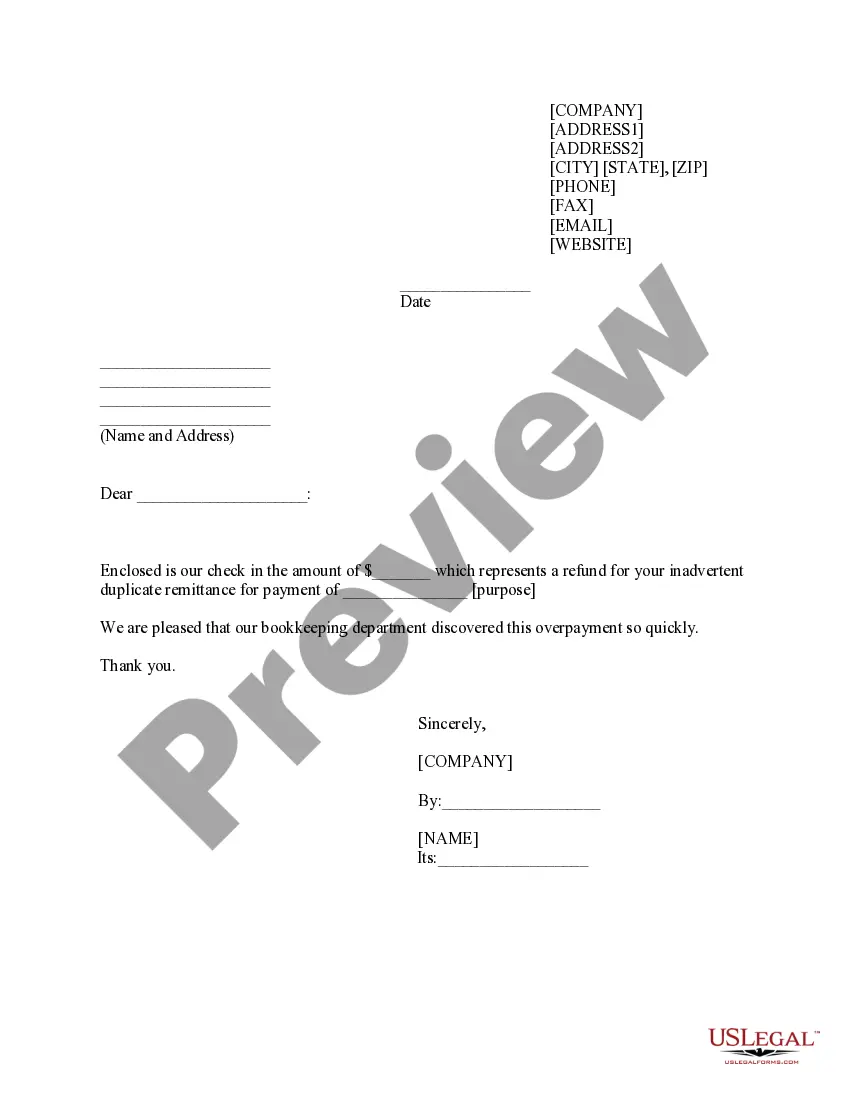

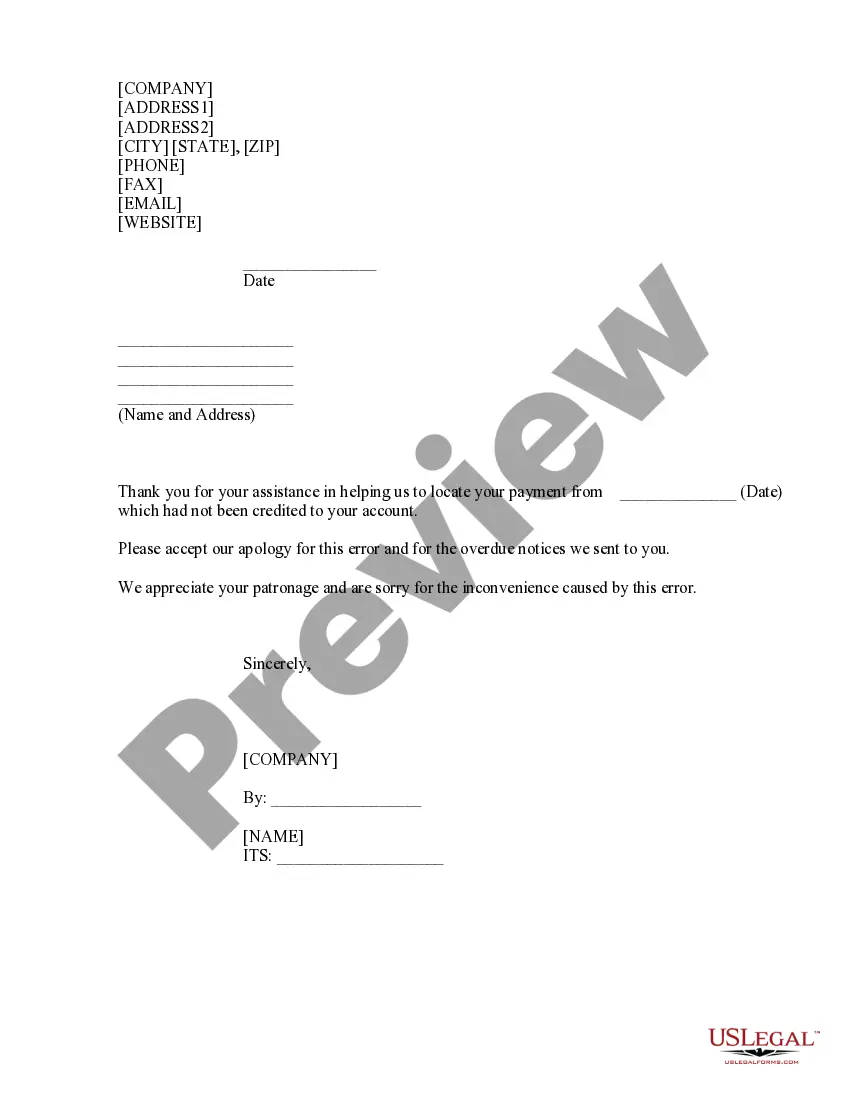

To request a refund for a duplicate payment in Colorado Springs, Colorado, you should first gather all relevant documents related to the payment. Next, visit the official website for Colorado Springs or contact their customer service. They will provide you with the necessary forms to complete your Colorado Springs Colorado Request for Refund of Duplicate Payment. Additionally, using the US Legal Forms platform can simplify the process by offering templates and guidance to ensure your request is submitted correctly.

The $800 refund in Colorado refers to a specific tax refund program aimed at providing relief to qualified taxpayers. This amount may vary based on your tax situation and is part of the state’s efforts to return surplus funds to residents. To determine your eligibility and request this refund, you can visit the Colorado Department of Revenue website or use USLegalForms for assistance with your Colorado Springs Colorado Request for Refund of Duplicate Payment. This could provide you with a straightforward way to access your funds.

To request your tax refund, you should fill out the appropriate form, which is typically available on the state’s revenue website. You can also utilize services like USLegalForms to streamline your application process. After completing the form, submit it according to the guidelines provided, whether online or via mail. This ensures that your Colorado Springs Colorado Request for Refund of Duplicate Payment is processed efficiently.

If you need to reissue your Colorado tax refund, you can call the Colorado Department of Revenue at 303-238-7378 for assistance. It’s important to have your personal information and any relevant documents on hand when you call. The representatives can guide you through the process and help resolve any issues regarding your Colorado Springs Colorado Request for Refund of Duplicate Payment. Make sure to ask specific questions to get the clarity you need.

To request a refund in Colorado, you need to complete the appropriate forms, which can be found on the Colorado Department of Revenue website. You may also use the USLegalForms platform to simplify the process, ensuring you have all necessary documents ready for submission. After filling out your request, submit it either electronically or by mail, depending on your preference. Keep track of your submission to ensure timely processing.

The time it takes to receive your Colorado refund can vary based on several factors, including the method of filing and processing times. Generally, if you filed electronically, you might see your refund within 21 days. However, for a Colorado Springs Colorado Request for Refund of Duplicate Payment, it may take longer, especially if additional verification is needed. Always check the Colorado Department of Revenue website for the most current processing times.

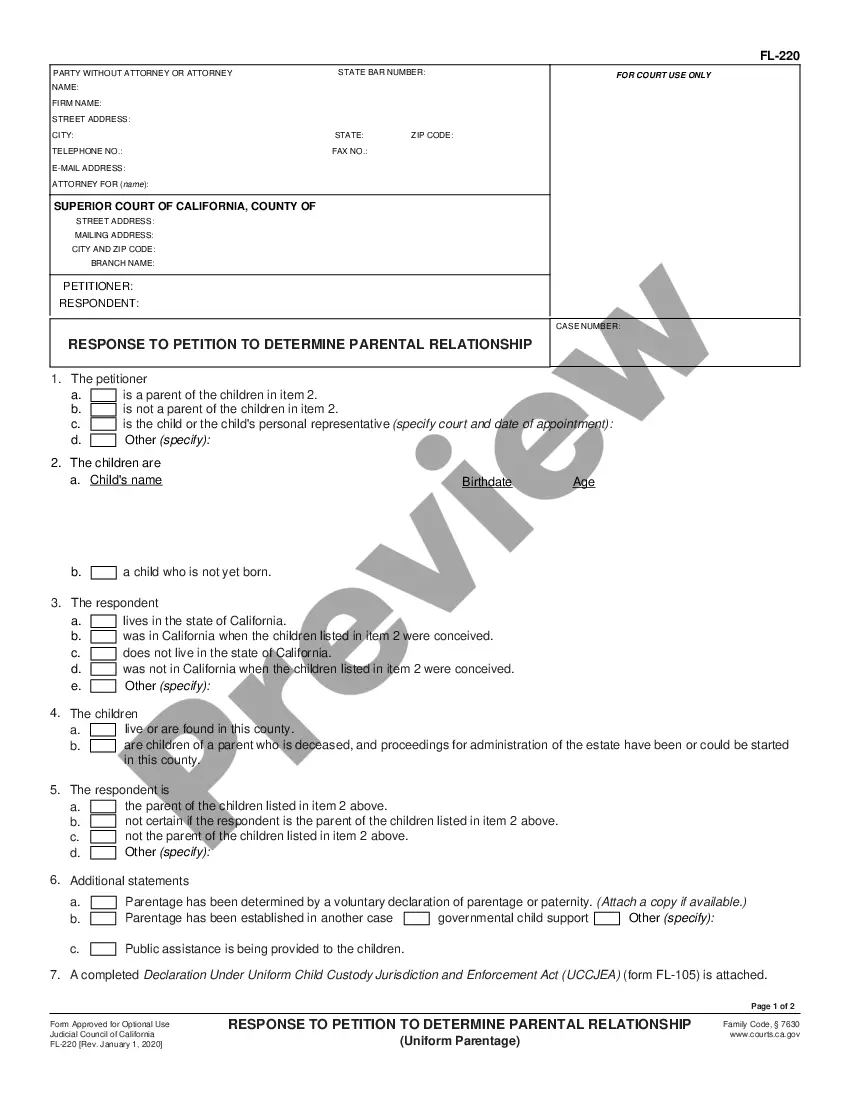

Dr. 4709 Colorado Department of Revenue refers to the form used by taxpayers in Colorado Springs who seek a refund for a duplicate payment. This form is essential for ensuring that your request for a refund of duplicate payment is processed correctly. By submitting Dr. 4709, you provide the necessary details to the Colorado Department of Revenue to facilitate your Colorado Springs Colorado Request for Refund of Duplicate Payment. Using platforms like UsLegalForms can simplify this process, offering easy access to the form and guidance on submission.