Newark New Jersey Space, Net, Net, Net - Triple Net Lease

Description

Form popularity

FAQ

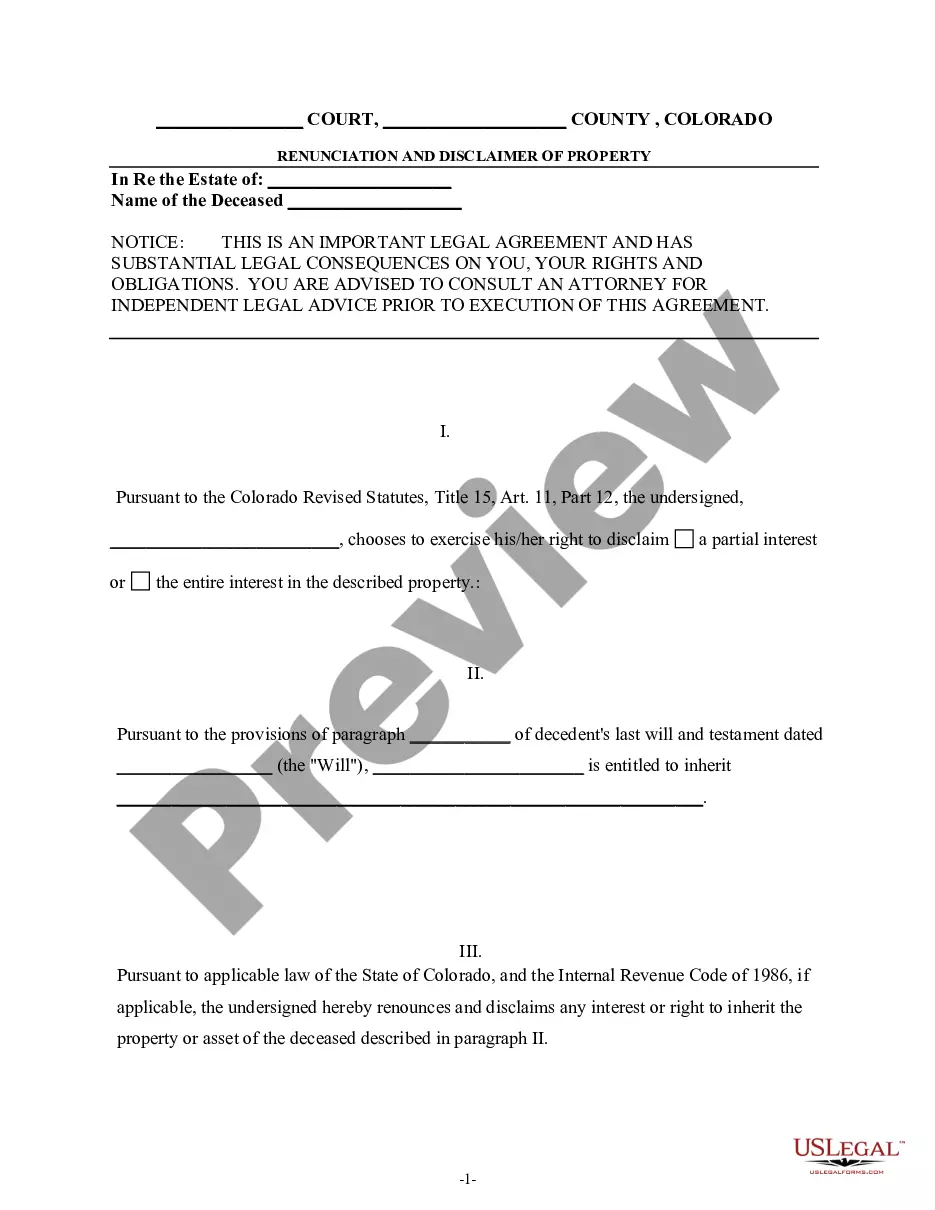

One significant downside of a triple net lease is the potential for unexpected costs to tenants. As property taxes and maintenance expenditures fluctuate, tenants might face increased financial burdens. Additionally, if the property requires repairs, the tenant bears that responsibility, leading to unplanned expenses. Thus, understanding these risks is crucial before entering a Newark New Jersey space with a triple net lease.

In real estate, a triple net lease refers to a lease agreement where the tenant takes on responsibility for property taxes, insurance, and maintenance costs. This structure often benefits landlords, allowing for a more stable income without direct property management involvement. For tenants, it provides opportunities in Newark New Jersey space to manage costs independently. Thus, understanding the structure and responsibilities can lead to better decision-making.

Engaging in a triple net lease in Newark New Jersey space has specific tax implications for both landlords and tenants. Typically, the landlord may benefit from a lower taxable income since they can deduct property expenses passed through to tenants. Meanwhile, tenants can often deduct their rental payments as business expenses, which may help reduce their taxable income. Therefore, understanding these tax benefits can enhance your investment strategy.

When reporting a triple net lease on your tax return, you typically treat the rental income and related expenses separately. You should report the income received from the Newark New Jersey Space, Net, Net, Net - Triple Net Lease on Schedule E of your Form 1040. Additionally, ensure you include any property taxes, insurance, or maintenance costs that you incurred. For more clarity and precision in tax reporting, consider using platforms like uslegalforms to guide you through the process.

To structure a triple net lease in Newark New Jersey, begin by outlining the terms and responsibilities of all parties involved. Clearly specify the tenant's obligations for taxes, insurance, and maintenance within the lease document. Utilizing platforms like US Legal Forms can simplify this process by providing templates that ensure all necessary details are included. This clarity helps protect both landlords and tenants.

Triple net leases in Newark New Jersey involve the tenant taking on responsibility for most property expenses. This includes property taxes, insurance, and maintenance costs. Landlords enjoy a stable income without the burden of managing day-to-day expenses. In this setup, the lease agreement clearly defines these responsibilities to avoid future disputes.

When comparing New York vs. Newark, it is important to consider the difference in population. Newark has a population of 307,220, while New York City has a population of a staggering 8.46 million people. Top Pros & Cons: Is NYC or Newark NJ Living Best for You? Harrington Moving & Storage ? Blog Harrington Moving & Storage ? Blog

Newark (/?nju??rk/ NEW-?rk, locally: [n??k]) is the most populous city in the U.S. state of New Jersey, the seat of Essex County, and a principal city of the New York metropolitan area. As of the 2020 census, the city's population was 311,549. Newark, New Jersey - Wikipedia Wikipedia ? wiki ? Newark,_New_Jersey Wikipedia ? wiki ? Newark,_New_Jersey

Newark, New Jersey Country United States State New Jersey County Essex Founded Religious colony (1663)36 more rows

A large part of Northern New Jersey, including Newark, is part of the NYC Metropolitan Area. Also, all three major New York City Airports are managed by The Port Authority of New York and New Jersey. Why is Newark Airport described as New York's airport if it's in ... Quora ? Why-is-Newark-Airport-descri... Quora ? Why-is-Newark-Airport-descri...