Austin Texas Triple Net Lease for Sale

Description

Form popularity

FAQ

One disadvantage of an Austin Texas Triple Net Lease for Sale is that tenants take on multiple financial responsibilities. This includes property taxes, insurance, and maintenance costs, which can be substantial. If the property requires unexpected repairs, these costs can strain budgets. Therefore, it's crucial to understand the lease structure and potential liabilities before signing.

The risks associated with an Austin Texas Triple Net Lease for Sale include potential financial unpredictability due to variable expenses. Tenants may face increases in insurance rates, property taxes, or maintenance costs over time. Additionally, long-term commitments can be challenging if business needs change. It's important to weigh these factors carefully.

When considering an Austin Texas Triple Net Lease for Sale, it's vital to conduct comprehensive due diligence. This includes reviewing the lease terms, understanding property costs, and assessing market trends. Prospective tenants should inspect the property and evaluate its condition. Resources like uslegalforms can assist in navigating this process smoothly.

Investing in an Austin Texas Triple Net Lease for Sale carries specific risks, such as fluctuating operational costs. Unexpected expenses can arise from property maintenance or rising tax rates. Tenants must carefully evaluate the property's condition and the local market. It's essential for potential investors to do thorough research before committing.

In an Austin Texas Triple Net Lease for Sale, tenants are responsible for property taxes as part of their lease agreement. This setup allows landlords to minimize their financial obligations. Consequently, tenants should factor these taxes into their overall expense budget. Understanding this aspect is essential for anyone considering an NNN lease.

An Austin Texas Triple Net Lease for Sale can be beneficial for tenants who prefer predictable operational costs. With a triple net lease, tenants cover property taxes, insurance, and maintenance, which means landlords handle fewer responsibilities. This arrangement often results in lower base rent compared to gross leases. For tenants seeking stable expenses, an NNN lease can be a smart choice.

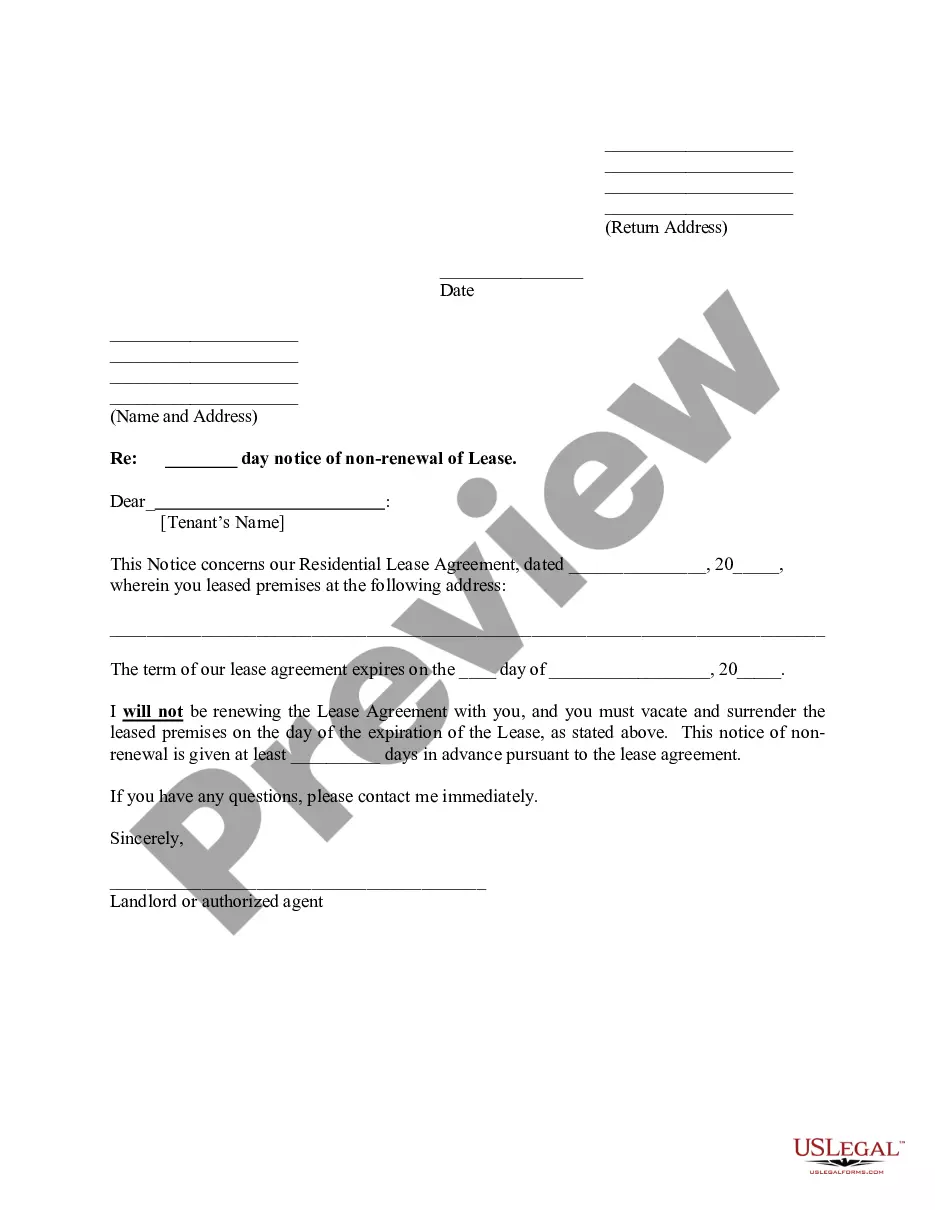

Structuring a triple net lease involves clear communication between the landlord and tenant regarding responsibilities. In an Austin Texas Triple Net Lease for Sale, it is essential to outline the specific expenses that the tenant will cover, including taxes, insurance, and maintenance fees. Creating a detailed lease agreement ensures that both parties understand their obligations and rights. Utilizing platforms like US Legal Forms can simplify this process, allowing you to generate comprehensive lease agreements tailored to your needs.

Triple net leases, often referred to as NNN leases, structure the responsibilities between landlords and tenants. In an Austin Texas Triple Net Lease for Sale, the tenant typically pays the property taxes, insurance, and maintenance costs in addition to the base rent. This structure allows landlords to enjoy a more stable income stream while reducing their involvement in day-to-day property management. Therefore, understanding the intricacies of these leases can greatly benefit both landlords and tenants.

While an Austin Texas Triple Net Lease for Sale offers benefits, it's important to be aware of potential downsides as well. For instance, if a tenant struggles financially, you may face unexpected costs from property maintenance and repairs. Additionally, long-term leases can limit your flexibility in managing investment properties. Understanding these risks helps you make informed decisions.

Investors looking for a low-maintenance income stream often gain the most from NNN leases. Additionally, businesses with stable financial performance benefit as they can invest more resources into operations rather than property upkeep. The structure of an Austin Texas Triple Net Lease for Sale creates a win-win situation for both landlords and tenants. Each party can focus on their core activities while enjoying financial advantages.